Oneowner Se7 Leather Third Row Tow Package 4x4 Dealer Inspected Warranty Auto on 2040-cars

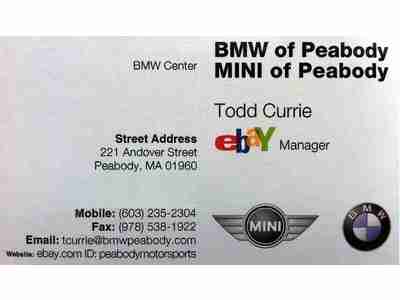

Peabody, Massachusetts, United States

Vehicle Title:Clear

Engine:4.6L 4554CC 278Cu. In. V8 GAS OHV Naturally Aspirated

For Sale By:Dealer

Body Type:Sport Utility

Fuel Type:GAS

Make: Land Rover

Warranty: Vehicle has an existing warranty

Model: Discovery

Trim: SE Sport Utility 4-Door

Options: Sunroof

Power Options: Power Locks

Drive Type: 4WD

Mileage: 74,865

Vehicle Inspection: Inspected (include details in your description)

Sub Model: 4dr Wgn SE

Exterior Color: Green

Number of Cylinders: 8

Interior Color: Tan

Land Rover Discovery for Sale

2004 land rover discovery 4x4 black on black 2 moonroofs runs great clean no res

2004 land rover discovery 4x4 black on black 2 moonroofs runs great clean no res Land rover discovery sd 4x4 remote start runs and drives great(US $4,100.00)

Land rover discovery sd 4x4 remote start runs and drives great(US $4,100.00) Se 4x4 1 owner cold climate htd sts sunroofs 6cd service history(US $10,900.00)

Se 4x4 1 owner cold climate htd sts sunroofs 6cd service history(US $10,900.00) 2003 land rover discovery se7 awd one owner low miles dvd grill guard no reserve

2003 land rover discovery se7 awd one owner low miles dvd grill guard no reserve 2003 land rover discovery se sport utility 4-door 4.6l(US $6,500.00)

2003 land rover discovery se sport utility 4-door 4.6l(US $6,500.00) 2003 land rover discovery s sport utility 4-door 4.6l(US $6,950.00)

2003 land rover discovery s sport utility 4-door 4.6l(US $6,950.00)

Auto Services in Massachusetts

Tiny & Sons Glass ★★★★★

Tint King Inc. ★★★★★

The Weymouth Auto Mall ★★★★★

R & R Garage ★★★★★

Quirk Chrysler Jeep ★★★★★

Post Road Used Auto Parts ★★★★★

Auto blog

U.S. issues new tariff threat, this time against British-built cars

Mon, Jan 27 2020WASHINGTON — Britain is the United States' closest ally but their long friendship may be sorely tested as the two countries try to forge a new trade agreement after Britain's exit from the European Union. U.S. Treasury Secretary Steven Mnuchin said on Saturday in London that he was optimistic that a bilateral deal with Britain could be reached as soon as this year. But Mnuchin gave up no ground after a second meeting with his UK counterpart, Sajid Javid. Javid has insisted that Britain will proceed with a unilateral digital services tax, despite a U.S. threat to levy retaliatory tariffs on British-made autos. Mnuchin told reporters after Saturday's meeting that such taxes would discriminate against big U.S. tech companies like Alphabet Inc's Google, Apple, Facebook and Amazon. The UK Treasury declined to comment on the private meeting. The divide highlights the challenges ahead as the Trump administration seeks a new bilateral agreement with Britain, part of a broader push to rebalance relations with nearly all its major trading partners. The stakes are high — British Prime Minister Boris Johnson has pegged the trade deal with United States as a way to ease the pain of breaking with Europe, Britain's largest trade partner. U.S. President Donald Trump, has promised a "massive" trade deal to support Brexit, the product of a populist movement similar to his "America First" agenda. The goodwill and special relationship the two countries have enjoyed for decades may not count for much, experts say. "Trump is not going to be doing Johnson any favors," said Amanda Sloat, a senior fellow with the Brookings Institution in Washington. "He's not going to give him a trade deal without major concessions." Even before the digital tax issue arose, the Trump administration threatened to tax foreign car imports, which could hit British-made Jaguar, Land Rover, Mini, and Honda Civic hatchback cars. Stiff U.S. trade demands include increased access for U.S. farm goods, concessions that will be difficult for Britain's entrenched natural food culture to swallow. The United States also wants Britain to change the way its National Health Service prices drugs and allow in more U.S. pharmaceuticals, which could prove politically unpopular for Johnson's government. Washington's demand that London block Chinese telecoms equipment maker Huawei Technologies Co Ltd for national security reasons could also cloud talks.

Could Jaguar become an EV-only brand?

Fri, Oct 12 2018Just yesterday we wrote about the Heisenbergian uncertainty surrounding the future of the Jaguar F-Type. A new report in Autocar prompts us to consider extending that ambiguity to the entire Jaguar brand. The UK magazine reports the automaker's product planners have devised a ten-year plan to switch to a pure EV lineup of cars and crossovers. According to Autocar's sources this is a planning exercise and doesn't have the green light, but it's "fairly advanced" and has adherents inside the company. The first shot fired would be an all-electric XJ replacement. That sedan, a "no-holds-barred luxury car" to challenge the Tesla Model S and Porsche Taycan, would provide emissions-free motoring before the Mercedes-Benz S-Class and BMW 7 Series come with their EV propositions. Around 2023, an EV crossover a touch larger than the full-sized Audi E-tron would replace both the XF and XE sedans. Two years later, a new mid-sized I-Pace would debut as both the F-Pace and E-Pace fade out. And two years after that, around 2027, the J-Pace luxury crossover would sigh its last ICE gasp. And what about the F-Type? The report says "with no replacement for F-Type in the works," an electric sports car "is also a possibility." There's no mention of the XK revival. Right now, Jaguar sells seven models - four sedans and three crossovers. As the Autocar article's written, come 2027 Jaguar would have an electric XJ sedan, a full-sized EV crossover, the I-Pace, and perhaps an electric sports car. That's a brave new world - one we're not sure Jaguar dealers could survive in. Problem is that Jaguar and its dealers are having plenty of problems now. Chinese-market volatility, the cloud around diesels, and Brexit uncertainty have contributed to a sales slump so dire that Jaguar's Castle Bromwich plant is going to a three-day week for the rest of the year. The sales flu has spread to Land Rover, too, the brand's Solihull plant closing for two weeks to realign dealer inventory. Considering all that, and with no easy relief in sight, the product planners are apparently debating whether a new, traditional three-model sedan range is worth the investment. The upside of going all-electric is said to be higher sales, with internal estimates supposing 300,000 units annually. Last year Jaguar sold 178,500 units. The marque could rake in larger profit margins on those sales, too, thanks to premium buyers being ready to shell out big ducats for EVs.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.