2006 Land Rover Lr3 Se 7 Seaters Only 57k on 2040-cars

Philadelphia, Pennsylvania, United States

Body Type:SUV

Vehicle Title:Clear

Engine:4.4L 4394CC V8 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Land Rover

Model: LR3

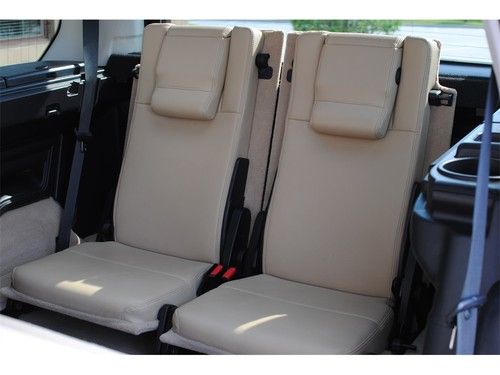

Trim: SE Sport Utility 4-Door

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Drive Type: 4WD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 57,700

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Blue

Interior Color: Tan

Land Rover LR3 for Sale

2006 land rover lr3 hse sport utility 4-door 4.4l(US $22,500.00)

2006 land rover lr3 hse sport utility 4-door 4.4l(US $22,500.00) We finance '06 land rover suv awd triple sunroof leather premium sound

We finance '06 land rover suv awd triple sunroof leather premium sound 2005 land rover lr3 se sport utility 4-door 4.4l 107k miles

2005 land rover lr3 se sport utility 4-door 4.4l 107k miles 06 land rover lr3 hse-7 navigation, rear dvd, 1 owner, 3rd row xenons excellent(US $16,995.00)

06 land rover lr3 hse-7 navigation, rear dvd, 1 owner, 3rd row xenons excellent(US $16,995.00) 2007 land rover lr3 se, clean history, super clean!!! must see!!!

2007 land rover lr3 se, clean history, super clean!!! must see!!! 1973 land rover series 3, aluminum body, 4x4, off road, desert rally, safari(US $5,795.00)

1973 land rover series 3, aluminum body, 4x4, off road, desert rally, safari(US $5,795.00)

Auto Services in Pennsylvania

Zirkle`s Garage ★★★★★

Young`s Auto Transit ★★★★★

Wolbert Auto Body and Repair ★★★★★

Wilkie Lexus ★★★★★

Vo Automotive ★★★★★

Vince`s Auto Service ★★★★★

Auto blog

Cargo ship carrying 1,200 Jaguars and Land Rovers deliberately run aground [w/video]

Mon, Jan 5 2015A cargo ship carrying a load of new cars out of Southampton has run aground in the English Channel in between England and the Isle of Wight. The vessel apparently suffered some sort of failure just 45 minutes after leaving port that caused it to list heavily to the starboard side before the crew deliberately beached it on Bramble Bank to prevent the ship from capsizing altogether. The vessel, called the Hoegh Osaka, is a 590-foot car carrier weighing some 57,000 tons and registered in Singapore. Although several automakers (including Honda and Bentley) were reportedly looking into whether they had cars on board, the vessel is said to have been filled to approximately one-third its capacity, with 1,400 vehicles on board – including 1,200 Jaguar and Land Rover vehicles, 65 Mini models and one Rolls-Royce Wraith. 70 to 80 pieces of construction equipment were also said to be on board. The Hoegh Osaka was en route from the southern British port of Southampton to Bremerhaven, Germany. Fortunately, no major injuries have been reported. The crew was mostly airlifted by helicopter off of the beached ship, with two crew members evacuated by lifeboat. One crew member reportedly jumped over 25 feet off the ship into the water before being immediately retrieved by rescue workers. According to the Daily Mail, two crew members were treated for non-life-threatening injuries, including a broken leg. It may take several days, if not longer, to extract the vessel from the sand bank and ascertain the damage to the ship and its cargo. An early attempt to free the ship with tugboats failed, meaning that the Maritime and Coastguard Agency may have to wait until more favorable high tides to try again before towing the ship back into the port. Bramble Bank, where the vessel was run aground, is a well-known obstacle to maritime navigators. The Queen Elizabeth 2 ran aground there in November 2008 with 1,700 passengers on board, but was quickly freed by four tugboats and was able to continue on its way. Two local yacht clubs also play a cricket match there every year at low tide. The vessel's operator, Hoegh Autoliners, praised the skill and quick thinking of the crew in acting to prevent the ship's capsizing by running her aground on the soft, sandy shoal. Watch the clip below for aerial footage of the beached ship, courtesy of the BBC. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Jaguar teases four-door EV grand tourer; electric Range Rover orders open this year

Wed, Apr 19 2023Jaguar just revealed a few vital details about a new EV it says will be revealed by the end of 2023, and Land Rover shared a little update about its upcoming electric Range Rover, too. Starting with the Jag, JLR — the new, official name for Jaguar Land Rover — announced that its next electric vehicle will be a four-door GT car. The image above is the teaser the company provided. Power output will be greater than any previous Jaguar, with the current record holder being the XE SV Project 8 at just over 590 horsepower. Range is claimed to be about 430 miles on a full charge (Jaguar doesn't specify the test cycle type), but that number could be different (and likely lower) here in the United States once EPA testing takes place. Jaguar says the grand tourer will debut its new in-house EV platform that is officially named JEA, which is unrelated to the electric XJ that was scrapped a couple years ago. And lastly, Jaguar says the vehicle will start at GBP100,000 in Great Britain. Pricing for the United States wasnÂ’t estimated, but a direct conversion at todayÂ’s rates puts it at about $124,000. Considering the price point, power level and range, this Jaguar is shaping up to be a potential Porsche Taycan competitor. The single teaser image at the top of this post suggests the same, as the photo shows a car with a fast-sloping roofline and wide, bulging fenders. ItÂ’s an exciting teaser, as it pretty much confirms that Jaguar will be coming in hot with a spicy-looking electric four-door. The last detail about this Jag confirmed today is its production site, as Jaguar says it will build the vehicle at its Solihull plant in the West Midlands, England. As for the Range Rover news, weÂ’ve known an electric Range Rover was on its way, now we know that the vehicle will launch in 2025. JLR says it will begin accepting orders for the electric Range Rover later this year, but didnÂ’t set an official date. The electric Range Rover will be built at JLRÂ’s Halewood plant in Merseyside, England. Those are all the details we know about today, but expect more teasers and information leading up to the reveal of these new EVs later in 2023. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Jaguar Land Rover develops 'transparent' A-pillar and ghost car [w/video]

Mon, Dec 15 2014Jaguar and Land Rover are known for making highly covetable luxury, performance and off-road vehicles, but the British automakers are on a bit of a technology bent lately. Keen to show that it can not only keep up but lead the way when it comes to safety and convenience features, JLR has come out with two more systems to show the way forward. JLR's new 360 Virtual Urban Windscreen system, showcased on an XJ sedan, adopts two novel approaches to getting around town. First up is the Transparent Pillar system, which uses a combination of cameras and display screens embedded in the A, B and C-pillars to make them virtually disappear. Instead of acting as blind spots limiting the driver's visibility, the system uses the roof pillars to display what's going on around the car. If there's an obstacle hidden by the A-pillars, the system shows you the potential hazard as if the pillars weren't there, and brings the obstacle to the driver's attention. If the driver turns his or her head to see a vehicle passing alongside, it projects the vehicle on the inside of the B- or C-pillar. The second technology integrated in the next-generation head-up display is the Follow-Me Ghost Car Navigation system, which takes a page out of the video-game playbook by projecting a "ghost car" on the windscreen that the driver can then "follow" instead of listening to turn-by-turn directions or looking at a map in the dashboard display. The system is similar to what Jaguar recently showcased on an F-Type for track use, but applied for more practical use on city streets and highways. The release of these systems also follows the integrated smart navigation and infotainment system displayed on the Range Rover Sport and the Transparent Bonnet showcased on the Discovery Vision concept. Though these new technologies might not be quite ready for production applications, their impressive sum total goes to show that Jaguar Land Rover is ahead of the curve when it comes to reducing driver distraction and increasing the driver's visibility. Scope out the latest systems in the press release and video below for a closer look of what the future holds for British-style luxury motoring. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.