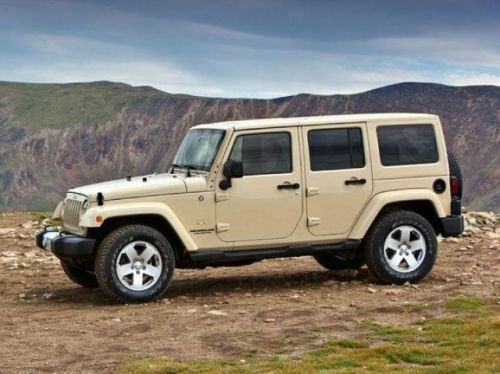

2011 Jeep Wrangler Unlimited Sahara on 2040-cars

4505 W. 96th St, Indianapolis, Indiana, United States

Engine:3.8L V6 12V MPFI OHV

Transmission:4-Speed Automatic

VIN (Vehicle Identification Number): 1J4BA5H1XBL588453

Stock Num: 432182A

Make: Jeep

Model: Wrangler Unlimited Sahara

Year: 2011

Exterior Color: Black

Options: Drive Type: 4WD

Number of Doors: 4 Doors

Mileage: 34760

CERTIFIED(7YR-100000 MILE WARRANTY), 1OWNER, CLEAN CARFAX, HARDTOP SAHARA, LEATHER, NAVIGATION, SOUND BAR, 4WD, POWER WINDOWS, POWER LOCKS, CRUISE CONTROL, A/C AND PLENTY MORE EXTRAS TO LIST............. COME IN AND INSPECT................ Please call 877-513-1180 to schedule an appointment or PRINT THIS AD and bring it in with you.

Jeep Wrangler for Sale

2011 jeep wrangler unlimited 70th anniversary(US $30,900.00)

2011 jeep wrangler unlimited 70th anniversary(US $30,900.00) 2014 jeep wrangler unlimited sport(US $31,088.00)

2014 jeep wrangler unlimited sport(US $31,088.00) 2014 jeep wrangler sahara(US $31,609.00)

2014 jeep wrangler sahara(US $31,609.00) 2014 jeep wrangler unlimited sport(US $31,781.00)

2014 jeep wrangler unlimited sport(US $31,781.00) 2012 jeep wrangler unlimited sahara(US $32,000.00)

2012 jeep wrangler unlimited sahara(US $32,000.00) 2014 jeep wrangler unlimited sahara(US $33,909.00)

2014 jeep wrangler unlimited sahara(US $33,909.00)

Auto Services in Indiana

Williams Auto Parts Inc ★★★★★

Wes`s Wheels & Tires ★★★★★

Tsi Auto Repair & Service ★★★★★

Town & Country Ford Inc ★★★★★

Tachyon Performance ★★★★★

Stroud Auto ★★★★★

Auto blog

8 fastest depreciating cars in America

Tue, Feb 27 2018Getting a new car is an amazing experience. The fresh new scent, the barely touched interior, the double digit miles on your odometer, and... the depreciation once it leaves the car dealers lot? Maybe not that last one. To save you from the hurt of a quickly depreciating new car, we collected 8 of the fastest depreciating cars in America. And here's a surprise, one of them is a Toyota. Learn more at Autoblog.com Cadillac Infiniti Jeep Kia Lincoln Toyota Autoblog Minute Videos Original Video jeep compass cadillac xts infiniti q50 camry q50

Best pickup trucks for 2023

Wed, Mar 29 2023In 2023, it seems like there’s a pickup truck for everyone. This wasnÂ’t always the case, as it wasnÂ’t until fairly recently that the midsize truck segment started becoming competitive again, and even more recently that weÂ’ve got choices for economical compact trucks or cleaner electric pickups. As the diversity of choices continues to grow, so does the potential customer base for vehicles with an open bed. Whether youÂ’re looking for something luxurious to drive in style, an absolute workhorse to tow the heaviest of loads, something small and practical, or a dune-blasting monster, youÂ’ve got options. Whatever it is you need it to do, here are what we think are the best pickup trucks for 2023. Before we start really categorizing these trucks, let's go over the scores our editors have given the best-selling pickup trucks in America. Best Full-Size Pickup Trucks for 2023: 2023 Ram 1500: 9.0 2023 Ford F-150: 8.5 2023 GMC Sierra: 8.0 2023 Chevrolet Silverado: 7.5 2023 Toyota Tundra: 7.0 2023 Nissan Titan: 5.5 Best Midsize Pickup Trucks for 2023: 2023 Ford Ranger: 8.0 2023 Honda Ridgeline: 8.0 2023 Jeep Gladiator: 8.0 2023 Nissan Frontier: 7.5 2023 Toyota Tacoma: 7.0 It's worth noting that the Chevrolet Colorado and GMC Canyon were redesigned for 2023, and we like them quite a bit. We haven't yet been able to pass them around to all of our editors in order to give them official rankings, but we're certain they'll come out at or near the top. Now, remember what we said at the outset about there being a pickup truck for every buyer? Let's break it down. Â Best luxury truck: Ram 1500 Limited With an exceptionally comfortable interior with high-quality materials, excellent fit and finish, plenty of space, useful technology and a wealth of convenience features, this is the cabin in which weÂ’d want to spend the most time. We especially like touches like the ventilated reclining back seat, clever storage and 12-inch vertically oriented touchscreen. All the American trucks can be ultra-luxurious, though. What really seals the deal for Ram is its choice of either coil spring or air spring rear suspension that provide unmatched ride quality, no matter which you choose. The 1500 Limited will truly keep you feeling kingly on those long hauls. Read our review of the Ram 1500. Â Best truck for cowboys: Ford F-150 King Ranch (Honorable mention: Ram 1500 Limited Longhorn) Need a truck to match those new cowboy boots and shiny belt buckle?

Autoblog Podcast #370

Tue, Mar 4 2014Episode #370 of the Autoblog podcast is here, and this week, Dan Roth, Michael Harley and Craig Fitzgerald of BangShift and Boldride talk about the 2015 Jeep Renegade, the Consumer Reports list of Cars to Avoid, and the Geneva Motor Show, which opened today. We start with what's in the garage and finish up with some of your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Check out the new rundown below with times for topics, and you can follow along after the jump with our Q&A. Thanks for listening! Autoblog Podcast #370: Topics: 2015 Jeep Renegade Worst Cars of 2014 Geneva Motor Show preview In the Autoblog Garage: 2014 Volkswagen Jetta SE 2014 SRT Viper 2015 Subaru WRX Hosts: Dan Roth, Michael Harley Guests: Craig Fitzgerald Runtime: 01:28:37 Rundown: Intro and Garage - 00:00 Jeep Renegade - 27:28 Cars to Avoid - 41:46 Geneva Motor Show - 59:54 Q&A - 01:11:04 Get the podcast: [UStream] Listen live on Mondays at 10 PM Eastern at UStream [iTunes] Subscribe to the Autoblog Podcast in iTunes [RSS] Add the Autoblog Podcast feed to your RSS aggregator [MP3] Download the MP3 directly Feedback: Email: Podcast at Autoblog dot com Review the show in iTunes Podcasts Geneva Motor Show Jeep Subaru Volkswagen Concept Cars worst cars