1976 Jeep Wagoneer Base Sport Utility 4-door 6.6l on 2040-cars

Princeton, Wisconsin, United States

Body Type:Sport Utility

Engine:6.6L 401Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Make: Jeep

Model: Wagoneer

Trim: Base Sport Utility 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 4WD

Options: 4-Wheel Drive

Mileage: 43,025

Power Options: Cruise Control

Sub Model: qaudra trac

Exterior Color: Blue

Disability Equipped: No

Interior Color: Blue

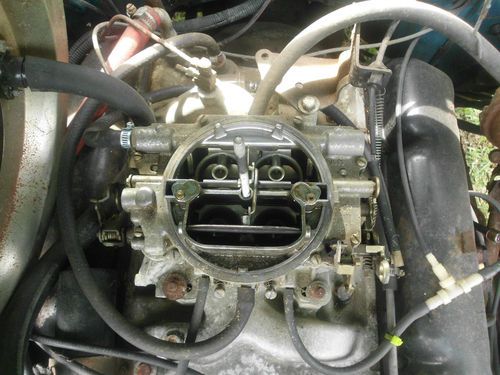

i have up for a sale a 1976 jeep wagoneer all original body and trim. the jeep has the AMC 401 engine with a edelbrock highrise manifold and a edelbrock 4 barrel carb the engine is a rebuild. miles are unknown on new engine but we do know that it was parked shortly after new motor was put in. it has the qaudra-track 4x4. it has the 4low under the seat and a even lower 4 wheel drive in the glove box. this jeep runs great and sounds really good. has aftermarket true dual exhaust. it does have some rust as seen in the pics under the doors and the back wheel wells. it has all the glass and trim. all the chrome is in good shape. drives good has new brake line from front to rear. tranny shifts good. tires are bald but do hold air fine. HERE IS A LINK TO YOU TUBE TO SEE IT RUN AND DRIVE. http://youtu.be/iqOve45O8fA

Jeep Wagoneer for Sale

1991 jeep grand wagoneer final edition, 4x4, woodie, must see

1991 jeep grand wagoneer final edition, 4x4, woodie, must see 1988 jeep grand wagoneer

1988 jeep grand wagoneer 1984 jeep grand wagoneer (woody) 360 engine ,everything works 4 w/d

1984 jeep grand wagoneer (woody) 360 engine ,everything works 4 w/d 1990 jeep grand wagoneer base sport utility 4-door 5.9l(US $24,999.00)

1990 jeep grand wagoneer base sport utility 4-door 5.9l(US $24,999.00) Superman man of steel movie car screen used documented no reserve smallville nr

Superman man of steel movie car screen used documented no reserve smallville nr Superman man of steel movie car screen used documented no reserve smallville nr

Superman man of steel movie car screen used documented no reserve smallville nr

Auto Services in Wisconsin

WE Recycle Auto Parts ★★★★★

Vande Hey Brantmeier Central Garage ★★★★★

Two Guys Automotive ★★★★★

Tool Shed Inc ★★★★★

Tilsner Collision Center ★★★★★

Suamico Garage ★★★★★

Auto blog

Next Jeep Wrangler spotted with 8-speed and EcoDiesel

Tue, Jun 21 2016Although it may not look like it, there are big changes coming to the next-generation Wrangler. The 2018 model will use aluminum for weight savings, spawn a pickup version, and offer new engines. This latest set of spy images brings confirmation of two new powertrain items. The spy photos below show a Wrangler mule with the current interior and an eight-speed automatic shifter fitted in place of the old five-speed unit. (There's a comparison photo in the gallery.) The shifter design matches that of the refreshed Dodge Charger and Challenger; the final Jeep version is likely to differ, but this clearly indicates what kind of transmission is underneath. Chrysler builds eight-speed automatics from a ZF design and also uses some transmissions built by ZF. View 4 Photos While it's not visible in the photos, the unmistakable sound of a diesel was heard coming from this Jeep. The EcoDiesel V6 is expected to be available alongside a new turbocharged four-cylinder engine that is rumored to have the code name "Hurricane." The turbo four may completely replace the current gas V6 or be offered in addition. There's a good chance the eight-speed will also be paired with the Hurricane engine, since improved fuel economy is a goal for the new model across the board. We don't yet know whether a manual transmission will be offered again, but it's a pretty good bet for one of the gas engines since many diehard off-roaders prefer the ultimate control. Related Video: Featured Gallery 2018 Jeep Wrangler Detailed Spy Photos View 18 Photos Spy Photos Jeep SUV Off-Road Vehicles jeep wrangler unlimited

Jeep bringing two special-edition Renegades to the LA Auto Show

Thu, Nov 10 2016Few manufacturers do limited edition runs like Jeep, which has released everything from a 75th Anniversary Edition Wrangler to a Batman v. Superman: Dawn of Justice Renegade. The automaker is revealing two new versions of the Renegade next week at the 2016 Los Angeles Auto Show: a 2017 Jeep Renegade Deserthawk and a 2017 Jeep Renegade Altitude. The off-road ready Deserthawk starts at $28,140 and builds on the bones of the already capable Renegade Trailhawk. The extra $1,495 nets you an exclusive Mojave Sand paint option, hood, and rear panel decals. It also comes equipped with rock rails and the towing package. Inside, the Deserthawk comes with black leather seats, Light Frost stitching and accents, all-weather floor mats, and a cargo tray mat. As it's based on the Trailhawk, the Deserthawk comes with four-wheel drive, a 2.4-liter four-cylinder engine, and a nine-speed automatic transmission. The Renegade Altitude, like the other Jeep Altitude models, essentially means black on black on black. It comes with 18-inch gloss black wheels with gloss black accents on the front and rear badges, grille rings and tail lamp rings. The black theme continues inside with black cloth seats and black gloss trim. The Altitude also features what Jeep calls Metal Diamond door handles and shift knob. Standard features include a backup camera and a keyless ignition. All that black gloss will set you back at least $22,390. Look for the Renegade pair to arrive in dealers soon. The Altitude will be available later in November while the Deserthawk hits showrooms in January. Related Video: LA Auto Show Jeep Crossover Off-Road Vehicles jeep renegade

Chrysler recalling 31k SUVs and vans

Fri, 06 Jun 2014Chrysler is issuing recalls covering roughly 31,700 vehicles worldwide due to two separate problems. In both cases the company believes that most of the affected vehicles are either still on, or in transit to, dealer lots.

One recall covers roughly 10,700 Dodge Durango, Jeep Cherokee, Grand Cherokee and Grand Cherokee SRT models from the 2014 model year built between January 16 and April 17, 2014. The SUVs need a software update for the cruise control. It's possible that when the cruise is on and the driver presses on the throttle, the acceleration could last a second after the pedal is released or two seconds for the SRT. Afterward, they return to the speed originally set by the driver.

Chrysler says it isn't aware of any accidents, injuries or even reported incidents of this happening in the real world. Also, in all cases, if the driver presses on the brake, the cruise shuts off. The automaker believes that there are about 6,100 affected SUVs in the US, 950 in Canada, 425 in Mexico and 3,200 outside of North America. The software upgrade will be ready shortly, the company says.