Priced To Sell 1 Owner Laredo X Leather Nav Backup Camera Sunroof We Finance on 2040-cars

Johnstown, Pennsylvania, United States

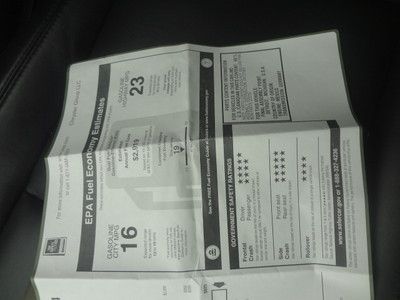

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Body Type:SUV

Warranty: Vehicle has an existing warranty

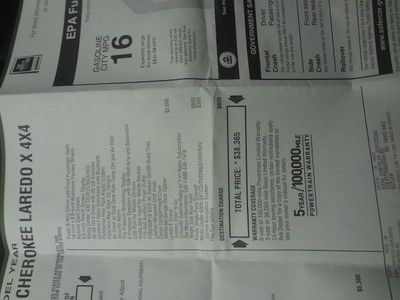

Model: Grand Cherokee

Mileage: 21,940

Options: Leather Seats

Sub Model: 4WD Laredo X

Safety Features: Side Airbags

Exterior Color: White

Power Options: Power Windows

Interior Color: Black

Number of Cylinders: 6

Vehicle Inspection: Inspected (include details in your description)

Jeep Grand Cherokee for Sale

New suv srt 4wheeldrive awd auto california demo v8 470hp 18mpg alloy wheels

New suv srt 4wheeldrive awd auto california demo v8 470hp 18mpg alloy wheels Navigation, leather, pentastar engine, clean autocheck history, backup camera 11

Navigation, leather, pentastar engine, clean autocheck history, backup camera 11 Jeep grand cherokee laredo limited ed.(US $4,600.00)

Jeep grand cherokee laredo limited ed.(US $4,600.00) 2013 jeep grand cherokee limited 4x4 navigation venilated seats keyless sat radi(US $39,900.00)

2013 jeep grand cherokee limited 4x4 navigation venilated seats keyless sat radi(US $39,900.00) 2001 jeep grand cherokee limited black on black leather sunroof no reserve !

2001 jeep grand cherokee limited black on black leather sunroof no reserve ! (US $26,000.00)

(US $26,000.00)

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Van Gorden`s Tire & Lube ★★★★★

Valley Seat Cover Center ★★★★★

Tony`s Transmission ★★★★★

Tire Ranch Auto Service Center ★★★★★

Thomas Automotive ★★★★★

Auto blog

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.

Jeep teases Trailcat and other Easter Safari concepts

Thu, Mar 3 2016Update: It's confirmed. The Trailcat is a Hellcat-powered Wrangler concept. Stay tuned for more details. Ahead of the 50th annual Easter Jeep Safari in Moab, Utah, the company is teasing two of the seven concepts it'll be taking along. There are virtually no solid details about these two Jeeps, save that they exist. But just reading the word scrawled across the Jeep Wrangler Trailcat concept's hood gets the blood pumping. We've been hearing about Hellcat-powered Jeeps for a while now. The Grand Cherokee Trackhawk has been the subject of a steady drum-roll of rumors and reputed confirmations, and even a spy video. But that's the Grand Cherokee. But a Wrangler? The aftermarket has been fooling with it. A company called Hauk will stuff one in a Wrangler for you, and surely other companies will follow. For Jeep itself to stuff one into a concept vehicle seems like a great way to fire up the diehard Wrangler folks. The other concept is called the Jeep Crew Chief, and it looks like an update of the Jeep Chief concept from last year. That incredible, retro design recalled the SJ-generation Jeep Cherokee of the 1970s and '80s. Last year's Chief was based on a Wrangler Unlimited, with the rear doors slightly disguised to emulate its two-doored forbearer. Based on the "Crew" part of the name, we can surmise it might be a crew-cab pickup conversion with the wonderful Chief front end. Expect it to be a hit, as well. Related Video: Jeep Truck SUV Off-Road Vehicles easter jeep safari

Stellantis reports surprising 2020 results, is 'off to a flying start'

Wed, Mar 3 2021MILAN — Low global car inventories and cost cuts should boost Stellantis's profit margins this year, though a shortage of semiconductors and investments in electric vehicles could weigh on results, the newly-formed automaker said on Wednesday. The forecast came as Stellantis, created by the January merger of Peugeot-maker PSA and Fiat Chrysler (FCA), reported better-than-expected results for 2020 that sent its shares up around 3% in morning trading. "Stellantis gets off to a flying start and is fully focused on achieving the full promised synergies (from the merger)," Chief Executive Carlos Tavares said in a statement. Stellantis is the world's fourth largest carmaker, with 14 brands including Fiat, Peugeot, Opel, Jeep, Ram and Maserati. It said 2021 results should be helped by three new high-margin Jeep vehicles in North America and a strong pricing environment there. The U.S. market has driven profits for years at FCA and starts off as the strongest part of Stellantis. The group's guidance assumes no more significant lockdowns caused by the global COVID-19 pandemic, which shuttered auto plants around the world last spring. Stellantis should also get a lift as its starts to implement a plan aimed at delivering over 5 billion euros a year in savings, without closing any plants. Tavares has also pledged not to cut jobs. But a pandemic-related global shortage of semiconductors, used for everything from maximizing engine fuel economy to driver-assistance features, could hurt business. Auto industry executives have said the shortage should ease by the second half of 2021. Stellantis said its "electrification offensive" could also weigh on results this year. Automakers are racing to develop electric vehicles to meet tighter CO2 emissions targets in Europe and this week Volvo joined a growing number of carmakers aiming for a fully-electric line-up by 2030. Stellantis plans to have fully-electric or hybrid versions of all of its vehicles available in Europe by 2025, broadly in line with plans at top rivals such as Volkswagen and Renault-Nissan, although Stellantis has further to go to meet that goal. The carmaker is targeting an adjusted operating profit margin of 5.5%-7.5% this year. That compares with a 5.3% aggregated margin last year: 4.3% at FCA and 7.1% at PSA excluding a controlling stake in parts maker Faurecia, which is set to be spun-off from Stellantis shortly.