1988 Jaguar Xjs He on 2040-cars

Long Beach, California, United States

Engine:5.3L Gas V12

Vehicle Title:Clean

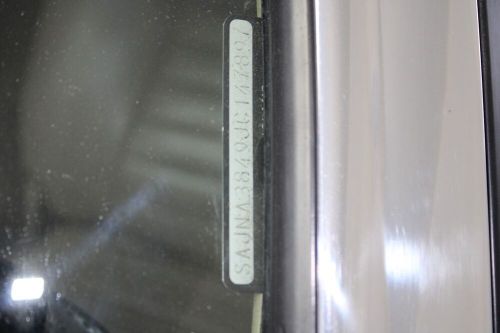

VIN (Vehicle Identification Number): SAJNA3849JC147897

Mileage: 87853

Number of Seats: 2

Trim: HE

Fuel: gasoline

Drive Type: RWD

Model: XJS

Number of Cylinders: 12

Make: Jaguar

Jaguar XJS for Sale

1991 jaguar xjs(US $10,000.00)

1991 jaguar xjs(US $10,000.00) 1992 jaguar xjs(US $15,000.00)

1992 jaguar xjs(US $15,000.00) 1990 jaguar xjs convertible(US $19,000.00)

1990 jaguar xjs convertible(US $19,000.00) 1992 jaguar xjs v12 convertible(US $13,900.00)

1992 jaguar xjs v12 convertible(US $13,900.00) 1990 jaguar xjs(US $20,500.00)

1990 jaguar xjs(US $20,500.00) 1996 jaguar xjs(US $27,000.00)

1996 jaguar xjs(US $27,000.00)

Auto Services in California

Woody`s Auto Body and Paint ★★★★★

Westside Auto Repair ★★★★★

West Coast Auto Body ★★★★★

Webb`s Auto & Truck ★★★★★

VRC Auto Repair ★★★★★

Visions Automotive Glass ★★★★★

Auto blog

South African company builds the world's first armored Jaguar I-Pace

Mon, Nov 28 2022When you think of armored cars, the presidential “Beast” limo and large SUVs likely come to mind. What you might not consider is that as the auto industry transforms itself to produce electric vehicles, weÂ’ll start seeing more armored EVs. A South African company has a leg up in this area with the release of the first armored Jaguar I-Pace. Armormax has offices around the globe, but its home base in South Africa is responsible for developing the armored SUV. Jaguar South Africa worked with the company to produce the I-Pace, and the work to add protection does not void or change the warranty. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Armoring a vehicle tends to add a ton of weight, but Armormax says the I-Pace takes advantage of its in-house materials. The company claims its protection material is the lightest in the world and notes the use of high-grade ballistic glass. The I-Pace offers a B4 ballistic protection rating, which covers handguns up to a .44 Magnum and shotguns. Armormax added run-flat tires and an external intercom system. We donÂ’t know if Armormax will offer the I-Pace outside of South Africa, but it likely wonÂ’t be cheap if it does. The U.S. I-Pace starts at more than $71,000, and thatÂ’s before buyers add any of ArmormaxÂ’s impressive upgrades. The company offers gas masks, ballistic riot shields, bomb blankets, and more. If Bond-villain features are your thing, Armormax will sell you smoke screen systems, electric-shock door handles, and a road tack dispensing system.

Jaguar XJ could move to all-electric platform late this year

Mon, Jan 22 2018The Jaguar XJ is getting a little long in the tooth. The current generation of Jaguar's flagship sedan debuted back in 2009, making it one of the oldest vehicles still on the market. This week, Autocar reported that a new XJ could debut late this year and would move to an all-electric platform. That would place the XJ straight against cars like the Tesla Model S and upcoming Porsche Mission E, presumably sharing parts with the upcoming I-Pace electric crossover. While a couple of refreshes have kept the Jaguar competitive, the Mercedes-Benz S-Class and BMW 7 Series and Audi A8 have gone through full redesigns since the XJ debuted. (Two for the Audi). Compared to the Germans, the Jaguar looks and feels dated, especially when it comes to technology, active safety and alternative powertrains. In the U.S., the XJ is only available with either a supercharged gasoline V6 or V8. The competition from Germany, Japan and the U.S. all offer some form of electrification. Moving to an all-electric powertrain would be a huge shift for Jaguar and is sure to spark some debate among enthusiasts. The British automaker has previously stated it plans to electrify all new vehicles after 2020. Look for electrified variants of current models to be available, too. The new XJ is rumored to be co-developed with a new model called the Road Rover, a sort of high-riding sedan or wagon in the vein of the Audi allroad or Volvo V90 Cross Country. Like the XJ, the Road Rover would use a battery electric powertrain. Look for more news on both models later this year. Related Video:

Jaguar F-Pace 300 Sport, 400 Sport create new trims below SVR

Mon, Apr 18 2022Jaguar has introduced two new F-Pace trims in the UK, one of which we expect to make it our way. Dubbed the F-Pace 300 Sport and F-Pace 400 Sport, they also welcome Amazon Alexa integration to the whole F-Pace range. Both Sport trims come standard with gloss black roof rails, privacy glass, and the Black Pack that dresses the badges, bumpers and intakes, sills and greenhouse trim in gloss black. A set of 21-inch wheels is also standard, the Style 5105 design also in gloss black. A 22-inch Style 1020 forged wheel in either gloss black or with satin black inserts or gloss silver with contrasting inserts. Inside, the Sports get Ebony Suedecloth headliners lording over Windsor leather slimline performance seats and Satin Charcoal Ash veneers, plus premium cabin lighting with 30 available colors. The F-Pace 300 Sport is powered by the automaker's Ingenium 3.0-liter six-cylinder diesel mild hybrid with 296 horsepower (300 PS) and 479 pound-feet of torque. This is the one we don't expect to make land in the U.S. The F-Pace 400 Sport would be the one for us, assuming it leaps the Atlantic. The F-Pace Sport models follow the creation of the E-Pace Sport last year, and that trim on the smaller crossover didn't come to America, hence the uncertainty. Back to the matter: The F-Pace Sport 400 is powered by the Ingenium 3.0-liter straight-six gasoline mild hybrid with 395 hp (400 PS) and 406 lb-ft. Prices in the UK start at GBP62,250 ($80,900 U.S.) for the D300 AWD Auto 300 Sport, and GBP68,520 ($89,050 U.S.) for the P400 AWD Auto 400 Sport. The duo add Alexa voice control to their infotainment suites, the ability to request anything online or change the temperature in your second bedroom at home now officially an F-Pace thing. Jaguar says it will add Alexa integration to every F-Pace globally that's fitted with Pivi Pro Infotaiment via an over-the-air update. Wireless Android Auto and Apple CarPlay are now also standard. Â Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.