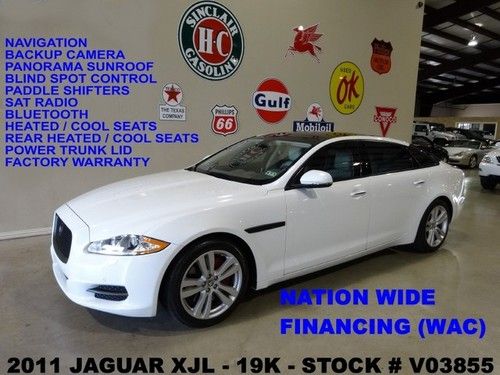

2011 Xjl,pano Roof,nav,back-up,htd/cool Lth,b & W Sys,19in Whls,19k,we Finance! on 2040-cars

Carrollton, Texas, United States

For Sale By:Dealer

Engine:5.0L 5000CC V8 GAS DOHC Naturally Aspirated

Body Type:Sedan

Fuel Type:GAS

Transmission:Automatic

Warranty: Vehicle has an existing warranty

Make: Jaguar

Model: XJ

Trim: L Sedan 4-Door

Disability Equipped: No

Doors: 4

Drive Type: RWD

Drive Train: Rear Wheel Drive

Mileage: 19,601

Number of Doors: 4

Sub Model: L

Exterior Color: White

Number of Cylinders: 8

Interior Color: Tan

Jaguar XJ for Sale

Navigation leather backup camera parking sensors bluetooth sunroof ( hr1 )

Navigation leather backup camera parking sensors bluetooth sunroof ( hr1 ) 1977 jaguar xj6l - regency red with biscuit interior

1977 jaguar xj6l - regency red with biscuit interior 04 silver jag xj-8 4.2l v8 sedan *leather & wood steering wheel *low miles *fl

04 silver jag xj-8 4.2l v8 sedan *leather & wood steering wheel *low miles *fl 2012 jaguar xjl, 16k miles, perfect colors, this is one exquisite cat(US $63,888.00)

2012 jaguar xjl, 16k miles, perfect colors, this is one exquisite cat(US $63,888.00) 1995 jaguar xjs rare coupe wine/cream beauty 28k

1995 jaguar xjs rare coupe wine/cream beauty 28k 2011 xjl used 5l v8 32v automatic rwd sedan premium(US $44,992.00)

2011 xjl used 5l v8 32v automatic rwd sedan premium(US $44,992.00)

Auto Services in Texas

Yang`s Auto Repair ★★★★★

Wilson Mobile Mechanic Service ★★★★★

Wichita Falls Ford ★★★★★

WHO BUYS JUNK CARS IN TEXOMALAND ★★★★★

Wash Me Down Mobile Detailing ★★★★★

Vara Chevrolet ★★★★★

Auto blog

Jaguar reveals upcoming XE's InControl infotainment system [w/video]

Tue, 19 Aug 2014Jaguar has been keeping busy lately, rolling out both the new Lightweight E-Type and F-Type Project 7 at Pebble Beach this past weekend. But the more important project for the British automaker is the upcoming new XE.

Coventry has been releasing a steady stream of information and teasers on its new 3 Series challenger, and has now revealed details of the new infotainment system that will debut in the XE. Called InControl, the system centers around an eight-inch touchscreen and integrates with smartphones (running both iOS and Android) through the InControl Remote and InControl Apps. The system will allow drivers to pre-set the climate control for each day of the week, lock and unlock the doors and start the engine remotely.

It'll also include an on-board wifi hotspot to connect multiple devices and a laser-based head-up display that you can scope out in the graphic above as well as the video and press release below in advance of the XE's upcoming debut in London on September 8.

Chinese patent filing shows what could be next Royal Limo from Jaguar

Fri, 10 May 2013Someone filed a patent application in China for the Jaguar XJ limousine seen above, but no one's sure who filed it or what the car is for. One camp thinks it's a State limo for UK royals like the Bentley State Limousine, another camp thinks it's the work of aftermarket coachbuilders.

One thing's for sure: Assuming it ever gets made, anyone who buys it wants an XJ in name only; the modifications have removed almost all of the grace of the standard sedan. Estimated to be more than three feet longer than an XJ, the stretched rear doors are backed by an even more stretched rear section that, in losing the trademark XJ C-pillar (the D-pillar on this car), adds all sorts of ungainliness to its backside. What's more, the roof rises from front to rear, we can only assume to make room for people with large hats. Or the NBA player that the Chinese call "Sweet Melon."

Head over to AutoSohu for more photos from the application, if you're sure that's what you really want.

NHTSA, IIHS, and 20 automakers to make auto braking standard by 2022

Thu, Mar 17 2016The National Highway Traffic Safety Administration, the Insurance Institute for Highway Safety and virtually every automaker in the US domestic market have announced a pact to make automatic emergency braking standard by 2022. Here's the full rundown of companies involved: BMW, Fiat Chrysler Automobiles, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen, and Volvo (not to mention the brands that fall under each automaker's respective umbrella). Like we reported yesterday, AEB will be as ubiquitous in the future as traction and stability control are today. But the thing to note here is that this is not a governmental mandate. It's truly an agreement between automakers and the government, a fact that NHTSA claims will lead to widespread adoption three years sooner than a formal rule. That fact in itself should prevent up to 28,000 crashes and 12,000 injuries. The agreement will come into effect in two waves. For the majority of vehicles on the road – those with gross vehicle weights below 8,500 pounds – AEB will need to be standard equipment by September 1, 2022. Vehicles between 8,501 and 10,000 pounds will have an extra three years to offer AEB. "It's an exciting time for vehicle safety. By proactively making emergency braking systems standard equipment on their vehicles, these 20 automakers will help prevent thousands of crashes and save lives," said Secretary of Transportation Anthony Foxx said in an official statement. "It's a win for safety and a win for consumers." Read on for the official press release from NHTSA. Related Video: U.S. DOT and IIHS announce historic commitment of 20 automakers to make automatic emergency braking standard on new vehicles McLEAN, Va. – The U.S. Department of Transportation's National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety announced today a historic commitment by 20 automakers representing more than 99 percent of the U.S. auto market to make automatic emergency braking a standard feature on virtually all new cars no later than NHTSA's 2022 reporting year, which begins Sept 1, 2022. Automakers making the commitment are Audi, BMW, FCA US LLC, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Maserati, Mazda, Mercedes-Benz, Mitsubishi Motors, Nissan, Porsche, Subaru, Tesla Motors Inc., Toyota, Volkswagen and Volvo Car USA.