2010 Jaguar Xf 4dr Sdn Premium Luxury Heated Mirrors Power Passenger Seat on 2040-cars

Sarasota, Florida, United States

Transmission:Automatic

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:GAS

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Seats, Power Windows

Make: Jaguar

Vehicle Inspection: Vehicle has been Inspected

Model: XF

CapType: <NONE>

Trim: Premium Sedan 4-Door

FuelType: Gasoline

Listing Type: Certified Pre-Owned

Drive Type: RWD

Certification: Manufacturer

Mileage: 26,012

Sub Model: PRM SOUND

BodyType: Sedan

Exterior Color: Silver

Cylinders: 8 - Cyl.

Interior Color: Gray

DriveTrain: REAR WHEEL DRIVE

Number of Doors: 4

Warranty: Unspecified

Number of Cylinders: 8

Options: CD Player, Leather Seats, Sunroof

Safety Features: Anti-Lock Brakes, Passenger Airbag

Jaguar XF for Sale

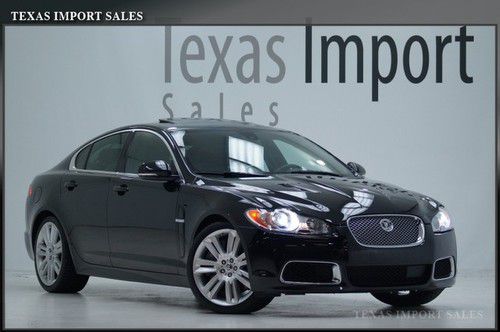

2010 jaguar xf premium 19" wheels navigation rear camera soft leather call shaun(US $24,975.00)

2010 jaguar xf premium 19" wheels navigation rear camera soft leather call shaun(US $24,975.00) 12 xfr 7k miles,510hp,black/london tan,1.99% financing(US $65,950.00)

12 xfr 7k miles,510hp,black/london tan,1.99% financing(US $65,950.00) 10 xfr 11k miles,navigation,bowers/wilkins,1.99% financing(US $49,950.00)

10 xfr 11k miles,navigation,bowers/wilkins,1.99% financing(US $49,950.00) 10 xfr 18k miles,adaptive cruise,blk/blk,1.99% financing(US $49,450.00)

10 xfr 18k miles,adaptive cruise,blk/blk,1.99% financing(US $49,450.00)

Auto Services in Florida

Yokley`s Acdelco Car Care Ctr ★★★★★

Wing Motors Inc ★★★★★

Whitt Rentals ★★★★★

Weston Towing Co ★★★★★

VIP Car Wash ★★★★★

Vargas Tire Super Center ★★★★★

Auto blog

Jaguar Land Rover posts profitable quarter amidst big yearly losses

Mon, May 20 2019Jaguar has posted its first profit in quite some time, as the financial quarter ending on March 31 brought in a net income of $151.6 million. However, that is the light in the end of the tunnel, as full year results through March showed a $4.58 billion loss (GBP3.6 billion). The losses are again attributable to declining sales in China, with a whiff of the still-lingering Brexit process. While JLR's annual U.S. sales were up 8.1 percent, and U.K. sales improved by 8.4%, overall sales came down 5.8% to 578,915 vehicles. For April, Chinese sales nearly halved as they dropped by 46 percent. Earlier this year, JLR's woes caused its owner Tata Motors to post the biggest ever quarterly loss in Indian corporate history, at nearly $4 billion. JLR's CEO Ralf Speth stated that the company is "reducing complexity" and transforming its business by cost savings and cash flow improvements, citing the fourth-quarter profits as an example of the ongoing turnaround. Speth said JLR has already managed to deliver $1.59 billion (GBP1.25 billion) of efficiencies and savings. JLR says its turnaround program, dubbed Charge, will drive it to at least $3.18 billion (GBP2.5 billion) of investment, working capital and profit improvements by March 2020, and that it currently has $4.84 billion (GBP3.8 billion) of cash. Speth continued that JLR will "go forward as a transformed company that's leaner and fitter," and that the sustained investment in new products and technologies will drive future demand. There has been earlier speculation of Tata Motors selling JLR to the PSA Group, but as Autocar reports, Tata's financial chief again refuted these rumors. JLR also announced today that its CFO of 11 years, Ken Gregor is stepping down after 22 years with the company, and that he will be succeeded by JLR's Chief Transformation Officer, Adrian Mardell.

Jaguar Land Rover hands Tata the biggest loss in Indian corporate history

Fri, Feb 8 2019BENGALURU/NEW DELHI — Jaguar Land Rover's owner Tata Motors Ltd stunned markets by posting the biggest-ever quarterly loss in Indian corporate history of about $4 billion on slumping China sales, sending its shares crashing as much as 30 percent. Tata Motors also warned that the Jaguar Land Rover (JLR) unit, which brings in most of its revenue, would swing to an operating loss for the year versus an earlier projection it would break even, given weak sales at the luxury British carmaker. JLR's China retail sales were cut almost in half in the December quarter as overall demand in the world's biggest auto market contracted last year for the first time since the 1990s. The firm has also been buffeted by Brexit woes and weaker business for diesel cars that account for bulk of its sales in Europe. Tata Motors turned in a third-quarter loss of 269.93 billion rupees ($3.8 billion) on Thursday, more than half its current market capitalization of $6.1 billion, mostly due to a massive impairment at JLR. Analysts were expecting a profit. "We are now taking clear and decisive actions in JLR to step up its competitiveness, reduce costs and improve cash flows and make the business fit for the future," Chief Financial Officer PB Balaji told reporters on a conference call on Thursday. JLR has taken steps to address the slide in China sales by changing its strategy to focus on profits for dealers instead of sales and incentivising retail sales over wholesale, he said. "We are encouraged by continued demand for the refreshed Range Rover and Range Rover Sport," JLR Chief Commercial Officer Felix Brautigam said in a statement. "With deliveries of the new Evoque due to start later this quarter, we look forward to building momentum." But analysts expect JLR to struggle to generate profit with China's economy projected to slow further this year after growth eased to its weakest pace in almost three decades in 2018. JLR's overall retail sales in January plunged 11 percent. The dour numbers prompted Tata investors to make a beeline for the exits as markets opened on Friday, with shares of the company skidding to their lowest in nine years at one point. The stock was down about 20 percent by 0720 GMT near 150 rupees, on track for its sharpest drop since 2003. At least four brokerages cut their price target for Tata Motors shares after its quarterly loss. Analysts at Jefferies pegged the stock at 250 rupees, versus an earlier target of 300 rupees, citing weak performance at JLR.

Geneva 2019, Jaguar I-Pace and Toyota Supra | Autoblog Podcast #572

Thu, Mar 7 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore welcomes the newest Autoblog staffers, West Coast Editor James Riswick and Assistant Editor Zac Palmer. First, the trio talk about the cars they've been driving: the 2019 Jaguar I-Pace and the 2019 Lexus LX 570. After that, they recap the exciting 2019 Geneva Motor Show, and all its highlights, disappointments and oddities. Then they answer some listener mail about the new Toyota Supra before closing the podcast with the Spend My Money segment. Autoblog Podcast #572 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Introducing Zac Palmer and James Riswick Driving the Jaguar I-Pace Driving the Lexus LX 570 2019 Geneva Motor Show recap Mail Bag: Is the Toyota Supra a hit or a miss? Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: