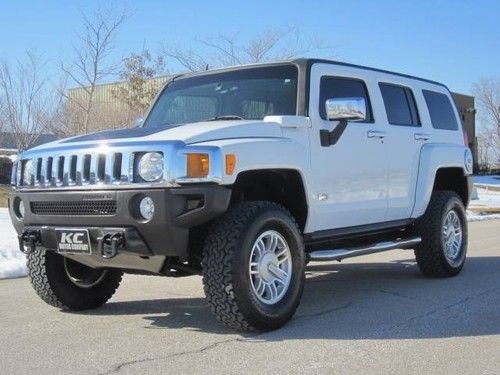

2006 Hummer H3 4x4, Cloth, Sunroof, 131k Miles on 2040-cars

Katy, Texas, United States

Vehicle Title:Clear

Engine:3.5L 3460CC 211Cu. In. l5 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sport Utility

Fuel Type:GAS

Interior Color: Tan

Make: Hummer

Model: H3

Warranty: No

Trim: Base Sport Utility 4-Door

Drive Type: 4WD

Mileage: 131,105

Number of Cylinders: 5

Sub Model: 4X4 CLOTH, SUNROOF

Exterior Color: Gray

Hummer H3 for Sale

We finance, we ship, adventure 3.7l, adventure package locking differential

We finance, we ship, adventure 3.7l, adventure package locking differential Rare! 2008 hummer h3 v8 alpha 7,000 miles! off road pkg like new!(US $75,000.00)

Rare! 2008 hummer h3 v8 alpha 7,000 miles! off road pkg like new!(US $75,000.00) Hummer h3 sunroof navigation heated leather seats loaded autocheck no reserve

Hummer h3 sunroof navigation heated leather seats loaded autocheck no reserve H3 4x4 leather heated power sunroof nerf bars trailer tow clean carfax alloys

H3 4x4 leather heated power sunroof nerf bars trailer tow clean carfax alloys Perfect condition hummer h3 lux in army green(US $19,000.00)

Perfect condition hummer h3 lux in army green(US $19,000.00) Ultra silver metallic, sunroof, cloth, 77k miles, clean, spacious, we finance!

Ultra silver metallic, sunroof, cloth, 77k miles, clean, spacious, we finance!

Auto Services in Texas

Wynn`s Automotive Service ★★★★★

Westside Trim & Glass ★★★★★

Wash Me Car Salon ★★★★★

Vernon & Fletcher Automotive ★★★★★

Vehicle Inspections By Mogo ★★★★★

Two Brothers Auto Body ★★★★★

Auto blog

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

GMC and EarthCruiser to collaborate on Hummer EV Pickup overlander project

Thu, Mar 30 2023GMC just announced a collaboration with overlanding vehicle builder EarthCruiser, and the end result is going to provide us with a co-developed Hummer EV Pickup. The photo you’re looking at above is the first teaser for whatÂ’s to come of the partnership. The Hummer team will be working with EarthCruiserÂ’s research and design division to develop an overland upfit solution for EVs that it says will initially be integrated into the Hummer EV Pickup. In case you werenÂ’t familiar with EarthCruiser, theyÂ’re the people that have made utterly wild overlanding vehicles like the Terranova, FX and EXP. Needless to say, EarthCruiser makes some pretty rad stuff, and none of it is cheap. GMC says this collaboration will look to use EarthCruiserÂ’s expertise gained from developing its vehicles to create an overlanding solution for the Hummer. We should expect to see EarthCruiserÂ’s engineering technologies integrated into the vehicle, which will allow the Hummer to go even further off-road and provide the ability for owners to live with their trucks in the wilderness. The one snag with overlanding in EVs is the typically long journeys away from civilization. As an example, the EarthCruiser XP and EXP feature 60-gallon fuel tanks to ensure you can get to where you need to go and power the living situation for a long time once youÂ’re there. WeÂ’ll be interested to hear what GMC and EarthCruiser have to say about the challenges presented by overlanding in an EV. Already visible in the teaser image is what looks like a solar panel-filled roof and rear side pods for supplies. The concept truck will be presented in late summer 2023, and while no date for a production vehicle was provided, itÂ’s likely that the final truck will come soon after. Related video:

Humvee maker AM General reportedly for sale, with interest from FCA, GM

Wed, Oct 3 2018WASHINGTON — AM General has put itself up for sale and has hired investment bank Macquarie Group Ltd to seek potential bidders in a deal that could value the builder of Humvee military vehicles at more than $2 billion, people familiar with the matter said this week. Potential bidders include competitors in the military ground vehicle market, such as General Dynamics, Oshkosh Corp and BAE Systems, according to two people familiar with the matter. Automakers like Fiat Chrysler and General Motors may also be potential buyers. GM licensed Hummer from AM General in 1998 to build civilian SUVs. None of the companies would comment or reply to a request for comment. The South Bend, Indiana-based AM General is currently owned by private equity firms. A possible sale of AM General follows a rash of deals over the past 18 months among defense contractors. But relatively fewer makers of defense equipment have gone on the auction block. Last year, United Technologies acquired Rockwell Collins for $30 billion, and in March, TransDigm Group continued its acquisition spree with a $525 million deal for Extant Components Group. AM General could fetch about 10 times its annual earnings of $160 million, one of the people said. The company's favorable tax treatment because of its current status as an limited liability corporation, would allow a buyer to reduce the company's taxable earnings for 15 years. That coupled with recent contract awards could push the ultimate value of the company to over $2 billion in a sale. The sale, should it happen, comes as the U.S. Army is gearing up for a broad effort to modernize its forces, including seeking prototypes of its Next-Generation Combat Vehicle in fiscal year 2022. Last month, AM General was awarded an Army contract for as many as 2,800 new M997A3 High Mobility Multipurpose Wheeled Vehicle (HMMWV) ambulances. The contract could be worth as much as $800 million if all options were exercised, AM General said at the time. Last year, the Pentagon awarded AM General a $550 million contract to deliver HMMWVs for use as protected weapons carriers, cargo transporters and ambulances to Afghanistan, Iraq, Ukraine, Jordan, Slovenia, Bahrain, Columbia, Bosnia and Kenya as a part of a larger Foreign Military Sales agreement. The sale of AM General offers an opportunity to purchase a prime contractor that delivers a finished product to the Pentagon, and not just an add-on system or service.