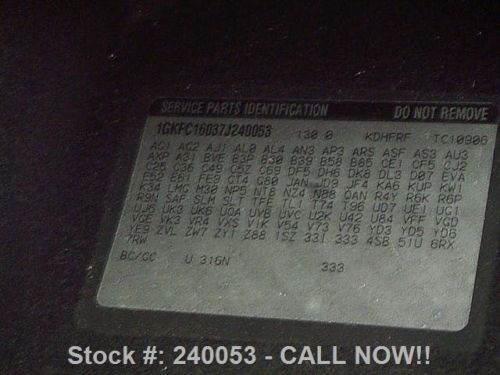

2007 Gmc Yukon Regency Sunroof Nav Dvd Rear Cam 81k Mi Texas Direct Auto on 2040-cars

Stafford, Texas, United States

GMC Yukon for Sale

2015 navigation sunroof 20s chrome rear dvd v8 ecotec lifetime warranty(US $70,254.00)

2015 navigation sunroof 20s chrome rear dvd v8 ecotec lifetime warranty(US $70,254.00) 2007 gmc yukon xl 1500 denali sport utility 4-door 6.2l(US $26,500.00)

2007 gmc yukon xl 1500 denali sport utility 4-door 6.2l(US $26,500.00) 2005 gmc yukon 4dr, dark blue, 4wd , police government seizure - no reserve

2005 gmc yukon 4dr, dark blue, 4wd , police government seizure - no reserve 2004 gmc yukon xl 1500 denali sport utility 4-door 6.0l(US $8,000.00)

2004 gmc yukon xl 1500 denali sport utility 4-door 6.0l(US $8,000.00) 2014 gmc yukon xl slt 8pass heated leather rear cam 22k texas direct auto(US $35,780.00)

2014 gmc yukon xl slt 8pass heated leather rear cam 22k texas direct auto(US $35,780.00) 2014 gmc yukon xl slt htd leather rear cam 8-pass 27k texas direct auto(US $35,780.00)

2014 gmc yukon xl slt htd leather rear cam 8-pass 27k texas direct auto(US $35,780.00)

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Next Chevy Silverado could get this built-in tailgate step

Thu, Feb 2 2017General Motors just received patent approval for a tailgate step in a pickup bed. And given the timing, don't be surprised if you see this on the upcoming 2019 Silverado pickup (not the mention its GMC Sierra twin), expected to arrive in late 2018. According to the patent, granted in December of last year, the whole mechanism is housed in the tailgate assemble. The magic happens when a portion of the top half of the tailgate swings down and a step folds out. There's also a handle that locks into position to help climb up into the bed. As trucks get bigger and taller over the years, it gets harder and harder to access the cargo bed. Ford's solution with the 2009 F-150 was a step that slides out from the end of the tailgate. Back then, Chevy made an ill-advised ad highlighting the feature for Ford. And while Howie Long mocked the F-150's "man step" Ford saw almost a third of its trucks with the option in the first year. The GM design seems to improve on Ford's idea as it appears to be wider and has a back to the lower step. That is, you don't have to worry about stepping through the ladder-rung design as on the F-150. Ford's tailgate step later spread to the F Super Duty, and other cargo access assists have proliferated through the truck world. On the most recent redesign, the Chevrolet Silverado took a trick from the Avalanche and added cutouts to the corners of the rear bumper that act as a foothold. Ford also offers a deployable side step, Chevrolet has running boards that scoot rearward with a kick of the boot, and Ram offers fixed wheel-to-wheel side rails. Nissan is in on the game too, with an optional folding step that tucks under the rear bumper. We don't expect Chevrolet to comment on when or if we'll see this feature in the showrooms. But given that engineers are already hard at work on the next Silverado and the timing of this patent lines right up with the new truck's development cycle, we'll be disappointed if this patent stays in the file cabinet. Related Video:

Weekly Recap: Hyundai scores NFL sponsorship after GM exits

Sat, Jul 4 2015Hyundai replaced General Motors as the official automotive sponsor of the NFL with a four-season deal that was announced this week. Hyundai gets exclusive sponsorship rights for mainstream and luxury cars, though not for pickups – as it doesn't have one in its current portfolio. "There may be another automotive truck sponsor, but not one that competes with our vehicle lineup," a Hyundai spokesman said in an email. That leaves the door open for another truckmaker to enter the fray. GM used the NFL to promote its GMC division, which makes pickups and sport-utility vehicles. The Detroit automaker decided to quit the sponsorship, which it had held since 2001, a GM spokesman said. Financials were not released, but ESPN said the sponsorship will cost Hyundai $50 million a year, double what GM paid. It gives Hyundai access to NFL trademarks for use in its marketing and advertising, and Hyundai will provide promotional vehicles to the league for the Super Bowl and other events. Hyundai celebrated the agreement by lighting up its Fountain Valley, CA, headquarters this week with a football field and the NFL logo. Hyundai's sister company, Kia, is the official automotive sponsor of the NBA. "We are huge football fans at Hyundai and feel there is no better venue to reach consumers, increase consideration, and tell the Hyundai brand story," Hyundai Motor America CEO Dave Zuchowski said in a statement. Hyundai will officially kick off its sponsorship when the NFL season begins on Sept. 10 with a primetime game featuring the Pittsburgh Steelers and the Super Bowl champion New England Patriots. OTHER NEWS & NOTES Toyota Mirai rated at 67 mpge, 312-mile range The Environmental Protection Agency gave the Toyota Mirai hydrogen fuel cell electric car a 67-miles-per-gallon-equivalent rating. The figure is for city, highway, and combined driving. The EPA also said the Mirai will have a 312-mile range. The sedan will arrive in dealerships in California this fall and will cost $57,500, though incentives can drop the price significantly. The Mirai will also be offered as a $499-per-month lease. Both come with three years or $15,000 worth of free fuel. Toyota plans to expand sales to the Northeast United States later. Toyota's top female exec resigns in wake of arrest Meanwhile, in other Toyota news, the automaker's communications chief and top female executive, Julie Hamp, resigned.

Maserati Quattroporte Trofeo, GMC Yukon XL, Tesla earnings, Maine Mitsubishi Delicas | Autoblog Podcast #689

Fri, Jul 30 2021In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. They discuss recently driven cars: the GMC Yukon XL diesel, Maserati Quattroporte Trofeo and Acura TLX Type-S. After that comes recent Tesla news along with cancelled Mitsubishi Delica registrations in the state of Maine. Finally, the editors help a reader spend their money on an affordable crossover. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #689 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown What we're driving: 2021 GMC Yukon XL diesel 2021 Maserati Quattroporte Trofeo 2022 Acura TLX Type-S News: Tesla earnings and delays Mitsubishi Delica registrations in Maine Spend my money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: