2002 Gmc Sonoma Sls Standard Cab Pickup on 2040-cars

Springville, Indiana, United States

Body Type:Standard Cab Pickup

Vehicle Title:Clear

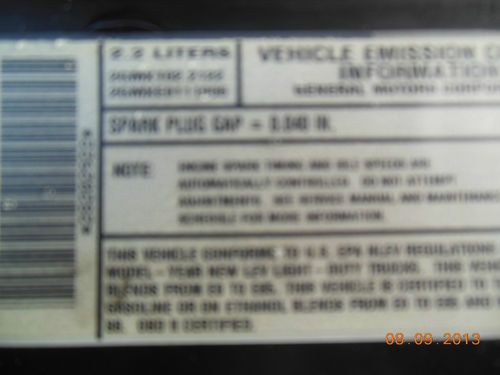

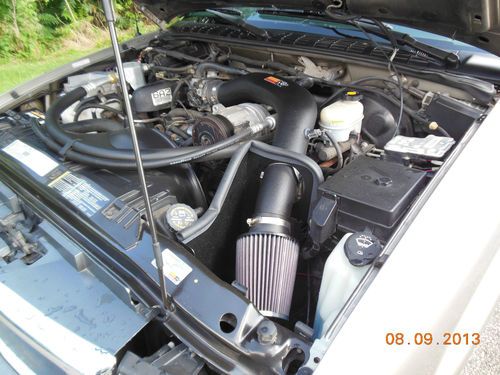

Engine:2.2L 2190CC 134Cu. In. l4 FLEX OHV Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: GMC

Model: Sonoma

Trim: SLS Standard Cab Pickup 2-Door

Options: CD Player

Safety Features: Driver Airbag, Passenger Airbag

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control

Mileage: 64,552

Exterior Color: Silver

Interior Color: Gray

Disability Equipped: No

Number of Cylinders: 4

Warranty: Vehicle does NOT have an existing warranty

VERY NICE TRUCK SOLD NEW AT LOCAL GMC DEALER AND WELL MAINTAINED SINCE NEW WITH 64552 ORIGINAL MILES. 2.2L 4 CYLINDER AUTOMATIC WITH CRUISE CONTROL, ICE COLD AIR CONDITIONING, AM/FM STEREO WITH CD PLAYER. NICE ORIGINAL PEWTER SILVER METALLIC PAINT WITH A COUPLE OF VERY SMALL DINGS. ONE IN THE PASSENDER SIDE BEDSIDE AND ONE IN THE DRIVERS DOOR. BOTH COULD BE TAKEN OUT EASILY WITH PAINTLESS DENT REMOVAL. ORIGINAL INTERIOR LOOKS LIKE NEW. BED HAS A DEALER INSTALLED SPRAYED BEDLINER. TRUCK HAS AMERICAN RACING WHEELS WITH P215/70 BF GOODRICH TIRES WITH VERY LITTLE MILES ON THEM. HAS NEW CATBACK DUEL EXHAUST WITH CHROME TIPS, AND A NEW K&N COLD AIR INTAKE FILTER KIT. THIS TRUCK RUNS AND DRIVES LIKE NEW WITH NO KNOWN ISSUES AT ALL. IF YOU`RE LOOKING FOR A NICE ECONOMICAL AND DEPENDABLE SMALL TRUCK THIS IS IT. TRUCK FOR SALE LOCALLY AND RESERVE THE RIGHT TO END AUCTION EARLY. TRUCK MUST BE PICKED UP OR SHIPPED WITHIN 30 DAYS OR STORAGE FEE WILL START TO ACCRUE.

GMC Sonoma for Sale

1998 gmc sonoma sls extended cab pickup 3-door 4.3l

1998 gmc sonoma sls extended cab pickup 3-door 4.3l 1991 gmc sonoma base extended cab pickup 2-door 4.3l

1991 gmc sonoma base extended cab pickup 2-door 4.3l 1992 gmc sonoma sl ext cab(US $6,900.00)

1992 gmc sonoma sl ext cab(US $6,900.00) 2001 gmc sonoma "sls" like new, minor damage. rebuildable salvage."no reserve"

2001 gmc sonoma "sls" like new, minor damage. rebuildable salvage."no reserve" 1996 gmc sonoma sle extended cab pickup 2-door 4.3l(US $1,800.00)

1996 gmc sonoma sle extended cab pickup 2-door 4.3l(US $1,800.00) 2003 gmc / chevy sonoma sl standard cab pickup 2-door 2.2l - estate sale 2 owner

2003 gmc / chevy sonoma sl standard cab pickup 2-door 2.2l - estate sale 2 owner

Auto Services in Indiana

West Side Auto Collision ★★★★★

V R Auto Repairs ★★★★★

Tri State Battery Supply ★★★★★

Tony Kinser Body Shop ★★★★★

Stanfa Tire & Auto ★★★★★

Speed Shop Motorsports ★★★★★

Auto blog

GMC shows how the 2022 Hummer could have looked even more futuristic

Fri, Oct 23 2020Excitement filled the room when GMC asked its designers to resurrect the Hummer in April 2019, but a tinge of uneasiness permeated the department after executives locked in an early 2020 unveiling date. Luckily, stylists knew what they wanted early on in the development phase, and preliminary design sketches give us a fascinating look at how they shaped the electric off-roader that ended up making its global debut online in October 2020. Hummer, the brand, unceremoniously shut down in 2010 after General Motors failed to sell it to the Chinese, but its design DNA was so strong that stylists were able to pick up where their predecessors left off. All of the sketches published on Instagram by the official General Motors Design account show a boxy truck with a tall front end, a short windshield, and a generous amount of ground clearance. These styling cues trace their roots to the AM General Humvee that entered production in 1984 and made its combat debut when the United States invaded Panama in 1989. Even the wildest drawings still depict a pickup that's immediately recognizable as a Hummer. Most of the early design sketches wear some variation of the seven-slot grille that characterized Hummer's production models; it's a styling cue that hints at a heritage shared with Jeep under the American Motors Corporation (AMC) umbrella. Oddly, none wear the round headlights seen on the H2, the H3, and the HX concept that nearly became the H4. Was GMC afraid that its Hummer would end up looking too much like a Jeep? And, at least one sketch shows a fold-down windshield, a feature that will not make it to the assembly line. Sketches never reach production without modifications made in the name of packaging and safety concerns, and the Hummer is no exception, but stylists did a good job of reinventing the brand's design language without copying or erasing the past. If the company had stuck around long enough to make a second- and a third-generation H2, odds are it would look a lot like the GMC-branded model that will enter production in a year. GMC remains on track to start 2022 Hummer deliveries in late 2021, though it told Green Car Reports that it still hasn't built a fully functional prototype yet. When it arrives, this outdoorsy pickup will land in a burgeoning segment of the truck market that numerous models (including the Rivian R1T and Ford's electric F-150) will also call home.

REWIND: Watch the GMC Hummer EV live reveal right here

Tue, Oct 20 2020It has been a long wait to see the GMC Hummer electric pickup truck, which was teased way back at the Super Bowl in February of this year. And that wait ends tonight at 8 p.m. eastern time when GM pulls the covers off the truck. You can see the whole reveal right here, or during the World Series on Fox or "The Voice" on NBC. For everything we know about the truck, go to our reveal post here. The truck should be impressive. GMC has previously announced it will have up to 1,000 horsepower, and it will have a variety of fun features such as removable roof panels and four-wheel steering that can move the truck sort of sideways with "Crab Mode." The GMC Hummer will also be available in pickup and SUV forms. So be sure to tune in tonight for one of the biggest (figuratively and literally) vehicle reveals of the year. And keep an eye on Autoblog for all the latest on the Hummer and other vehicles.

GM's Super Bowl ad puts Will Ferrell and EVs in Netflix shows

Tue, Feb 7 2023GM is kicking off the automotive Super Bowl commercial season with EVs and Will Ferrell. The ad highlights GM's new relationship with Netflix in which the automaker's many upcoming electric cars and trucks will appear. More specifically, the ad has Will Ferrell appearing in settings from major Netflix TV movies and shows such as "Army of the Dead" and "Squid Game," talking about how there's no reason not to have EVs there. And then he also appears with EVs in shows where they don't make sense, such as "Bridgerton" and "Stranger Things," but only to reassure people that Netflix won't be shoving new cars where they don't fit in. The GM lineup on display is pretty varied, with the GMC Sierra EV, Hummer EV, Chevy Blazer EV, and Cadillac Lyriq all making appearances. Most interesting is the Chevy Silverado EV Trail Boss in the "Stranger Things" part. Chevy hasn't said much about it beyond a teaser and saying it'll be a late addition to the line. It looks pretty much like the truck in the teaser with the black plastic front fascia and fender flares. But it gets different wheels, Trail Boss badges on the rear pillars, and a gloss black roof like the RST trim. Related video: 2024 Chevy Silverado EV | 2022 Chicago Auto Show