High Top Conversion Van Regency Low Miles 1 Owner 5.3 V on 2040-cars

Lubbock, Texas, United States

Body Type:Minivan/Van

Engine:5.3 Liter Vortec V8

Vehicle Title:Clear

Year: 2004

Make: GMC

Model: Savana

Warranty: Vehicle does NOT have an existing warranty

Mileage: 72,695

Options: Leather Seats

Sub Model: Hi Top Roof

Safety Features: Driver Airbag, Anti-Lock Brakes, Passenger Airbag

Exterior Color: Burgundy

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Interior Color: Tan

Drivetrain: RWD

GMC Savana for Sale

1999 gmc savana 3500 base cutaway van 2-door 5.7l very low miles

1999 gmc savana 3500 base cutaway van 2-door 5.7l very low miles 2005 gmc savanna 3500 w/ 18' box(US $5,900.00)

2005 gmc savanna 3500 w/ 18' box(US $5,900.00) 2002 gmc savana 2500 base extended cargo van 3-door 5.7l(US $2,550.00)

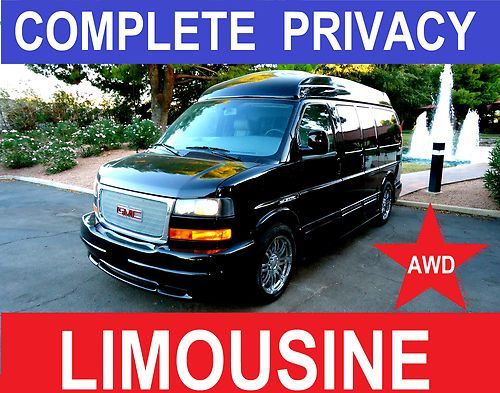

2002 gmc savana 2500 base extended cargo van 3-door 5.7l(US $2,550.00) Presidential limousine, awd, all wheel drive custom conversion van(US $59,900.00)

Presidential limousine, awd, all wheel drive custom conversion van(US $59,900.00) Wheel chair lift / additional seating / just 72k miles / very clean(US $8,850.00)

Wheel chair lift / additional seating / just 72k miles / very clean(US $8,850.00) 2004 gmc savana van wheelchair lift handicap high top conversion van low miles

2004 gmc savana van wheelchair lift handicap high top conversion van low miles

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

There's an impending shortage of new trucks in America's heartland

Thu, May 21 2020URBANDALE, Iowa — Jerry Bill is worried the novel coronavirus could hurt business at the Des Moines auto dealership he runs, but not because of a shortage of buyers for the big Ram pickups on his lot. "Our biggest issue will be if we don't get more inventory," said Bill, general sales manager of Stew Hansen Chrysler Dodge Jeep Ram, which sells around 2,700 new vehicles a year in Urbandale, a suburb of Iowa's capital Des Moines. After a drop in sales in April when consumers stayed home, Bill expects pickup truck sales to end May similar to where they were a year earlier. And if demand remains strong, Bill said he will run out of popular models in June. Fiat Chrysler began slowly restarting Ram truck assembly lines on Monday after a two-month shutdown. The U.S. economy contracted in the first quarter at its sharpest pace since the Great Recession of 2007-2009 because of lockdown measures aimed at slowing the spread of the coronavirus. Economists warn the second quarter will be much worse. Still, far from the lockdowns of states like New York, Michigan or Ohio, dealerships like Stew Hansen have provided FCA and Detroit rivals General Motors and Ford a rare bright spot: strong sales of pickup trucks in America's heartland. Overall U.S. sales of cars and light trucks crashed to the weakest pace in 50 years last month. But sales of big Detroit brand pickups, particularly in southern and western states less affected by the outbreak, significantly outperformed the market, industry executives and analysts said. Pickup trucks are one of the most profitable automotive segments in the world. They account for a huge portion of the Detroit automakers' profits and formed a huge lure for Peugeot, which expects to merge with FCA by early 2021. The pressure is now on to boost pickup truck production and send vehicles to dealers in parts of the country with dwindling supplies. That is particularly true for GM, which is running short of certain truck models after losing 40 days of production to a strike last fall. "If you don't have what someone wants, they can choose to go to another brand," said Cox Automotive analyst Michelle Krebs. 'Easiest swap ever' Detroit automakers in March rolled out large discounts — such as interest-free loans for seven years — to keep vehicles rolling off dealer lots.

2015 GMC Canyon is a Chevy Colorado in Sierra clothing [w/video]

Sun, 12 Jan 2014Ford may not offer the Ranger in America anymore, nor Dodge (or Ram) its Dakota. But General Motors - not unlike Toyota with its Tacoma and Nissan with the Frontier - isn't about to give up on the midsize pickup market. Less than two months ago, it revealed the new Chevrolet Colorado, and now it's following up with its mechanical twin, the 2015 GMC Canyon.

Launched today ahead of its reveal at the Detroit Auto Show, the Canyon slots into the GMC lineup (and differentiates itself from its Chevrolet twin) with styling that closely apes the larger GMC Sierra 1500 and Sierra HD, only a size or two smaller. Oh, there are visual differences, like a subtly different grille treatment and lower fascia, but it still maintains its big brother's square-jawed good looks and rectilinear flared fenders.

Two aluminum-block engines with direct injection and variable valve timing are available: a 2.5-liter inline-four comes standard with 193 horsepower and 184 pound-feet of torque, and a 3.6-liter V6 is available with 302 hp and 270 lb-ft. Buyers will also be able to choose between three bodystyle configurations, three trim levels and either two- or four-wheel drive. A six-speed automatic transmits the power to the road, but a six-speed manual is available on the base model with the 2.5 and 2WD, and there's an All Terrain package available on SLE models. A diesel is expected later.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.033 s, 7928 u