2007 Gmc Yukon Denali Sport Utility 4-door 6.2l Nav, Dvd, Power Steps, Loaded!!! on 2040-cars

O'Fallon, Missouri, United States

|

|

GMC Yukon for Sale

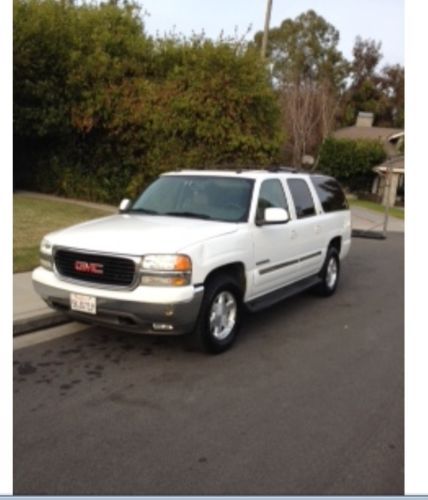

2004 gmc yukon xl 1500 slt sport utility 4-door 5.3l(US $4,900.00)

2004 gmc yukon xl 1500 slt sport utility 4-door 5.3l(US $4,900.00) 2009 sle used 5.3l v8 16v automatic rwd suv premium onstar

2009 sle used 5.3l v8 16v automatic rwd suv premium onstar 2013 gmc yukon 4x4 8-pass htd leather dvd rear cam 24k! texas direct auto(US $36,780.00)

2013 gmc yukon 4x4 8-pass htd leather dvd rear cam 24k! texas direct auto(US $36,780.00) 2013 gmc yukon xl denali sunroof nav dvd pwr steps 14k texas direct auto(US $51,980.00)

2013 gmc yukon xl denali sunroof nav dvd pwr steps 14k texas direct auto(US $51,980.00) 2007 gmc yukon denali all options!!!!(US $25,500.00)

2007 gmc yukon denali all options!!!!(US $25,500.00) 2011 white 4wd cloth auto onstar running boards tow ac cruise!!! we finance!!(US $29,998.00)

2011 white 4wd cloth auto onstar running boards tow ac cruise!!! we finance!!(US $29,998.00)

Auto Services in Missouri

Warehouse Tire & Muffler ★★★★★

Uptown Auto Sales ★★★★★

Toyota Of West Plains ★★★★★

T & B Auto ★★★★★

Springfield Freightliner Sales ★★★★★

Spectrum Glass Inc ★★★★★

Auto blog

GMC reveals updated 2016 Sierra

Wed, Jul 15 2015It was just the other day that Chevy revealed the face of the new 2016 Silverado. And as might have been expected, sister brand GMC has followed up by unveiling its version in the facelifted 2016 Sierra pickup – just two and a half years since the current all-new model was rolled out. Though details released thus far remain few and far between, GMC has revealed more images of the new Sierra – in SLT, Denali and All Terrain trim levels – than Chevy did of the updated Silverado. It's got new headlights, fog lamps, and C-shaped daytime running lights and taillights, all using LED elements. It's arguably a more muscular look than the Chevy version, and with more chrome than the toned-down Silverado. That is, at least, in SLT and Denali trims. The All Terrain version looks more in line with the similarly off-road-focused Silverado Z71 and its color-keyed treatment. The changes ought to help GMC keep up the momentum that has seen its sales rise year-over-year every month over the past twelve. The interior shots indicate that the new Sierra will incorporate Apple CarPlay like GM is installing in so many models across its various brand ranges. But we'll have to wait a little while longer for all the details. Related Video: 2016 GMC Sierra Unveiled 2015-07-15 DETROIT -- GMC's best-selling truck has great momentum coming off its best June since 2006 and 12 consecutive months of year-over-year sales gains. With exterior styling as its top reason for purchase, the new truck adds key design elements: LED "C-shaped" signature daytime running lights and LED headlights; new front fascia and grilles for each trim level; new LED fog lamps; new bumpers; and new "C-shaped" LED taillights. The new Sierra will be available in the fourth quarter of this year, with additional details and information on the new model released in the coming months.

GM's MPG overstatement could affect 2 million vehicles

Tue, May 17 2016Late last week, GM admitted that three of its large SUVs fuel economy window stickers did not match their actual efficiency ratings, and so the vehicles couldn't be sold. The stickers on the 2016 Chevy Traverse, GMC Acadia, and Buick Enclave said their ratings were one to two miles per gallon better than they should have been. Officially, the number of affected vehicles sits at about 60,000. But Consumer Reports makes a good point: what's up with all of the previous model year SUVs that are basically the same vehicle? To wit: the 2016 model year vehicles are not substantially different than the 2015 or the 2014, or even going all the way back to 2007. On the EPA's fuel economy website, all of these older models will "have better stated fuel economy numbers than the new vehicles in GM's dealerships," Consumer Reports noted. CR's best point, and the one that makes the 60,000 number potentially grow to 2 million if all of the vehicles built on this platform are affected, is that "[i]t seems unlikely that the company would change the powertrain on these carryover models so late in their model cycles in a way that would cause a dramatic, negative impact on fuel economy." GM says that earlier model year SUVs are not affected and the EPA did not respond to CR's question about the potential for more discrepancies. We've seen automakers reverse course before, so if GM has to come out with a mea culpa soon, don't be surprised. GM is rushing corrected stickers to dealers so that the SUVs can be sold again, but a fix for the already-sold vehicles could be trickier to solve. Related Video: Related Gallery 2013 GMC Acadia View 16 Photos News Source: Consumer Reports Government/Legal Green Buick Chevrolet GMC Fuel Efficiency mpg gmc acadia chevy traverse

GM will recall 3.5 million pickups and SUVs to fix brake issue

Wed, Sep 11 2019WASHINGTON — General Motors Co is recalling 3.46 million U.S. pickup trucks and SUVs to address a vacuum pump issue that could make braking more difficult and increase the risk of a crash. The recall, which covers 2014-2018 model year vehicles, including some Cadillac Escalade, Chevrolet Silverado, Chevrolet Tahoe, GMC Sierra, Chevrolet Suburban and GMC Yukon vehicles, was triggered because the amount of vacuum created by the vacuum pump may decrease over time, GM told the National Highway Traffic Safety Administration (NHTSA) in documents posted Wednesday. NHTSA opened a preliminary investigation into the issue in November 2018, and said it had reports of 9 crashes and two injuries related to the issue. It provided GM in July with additional field reports that prompted the automaker to open an investigation. The company did not immediately say on Wednesday how many injuries or crashes are linked to the issue but said it could impact braking in "rare circumstances." GM said dealers will reprogram the Electronic Brake Control Module with a new calibration that will improve how the system utilizes the hydraulic brake boost assist function when vacuum assist is depleted. GM said the vacuum assist pump, which is lubricated with engine oil that flows into the pump through a filter screen, can in some cases lose effectiveness over time, as debris such as oil sludge can accumulate on the filter screen. GM told NHTSA that prior model years used a different brake assist system design, and vehicles manufactured after 2018 were not equipped with the affected pump design. Recalls Chevrolet GM GMC