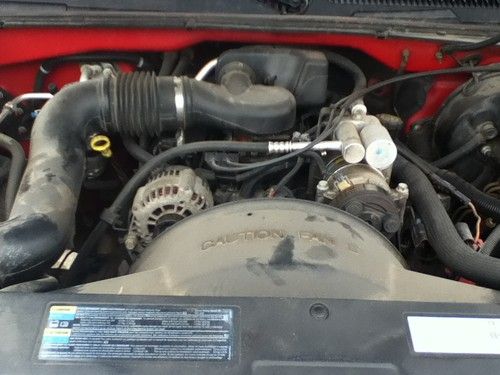

2001 Gmc Sierra Sl 1400 2wd V-6 Vortec $4400 on 2040-cars

Rock Rapids, Iowa, United States

Body Type:Pickup Truck

Vehicle Title:Clear

Engine:4.3 v 6

Fuel Type:Gasoline

For Sale By:Private Seller

Make: GMC

Model: Sierra 1500

Trim: SL Standard Cab Pickup 2-Door

Options: Cassette Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: 2wd

Power Options: Air Conditioning, Cruise Control, Power Locks

Mileage: 156,500

Sub Model: SL

Exterior Color: Red

Disability Equipped: No

Interior Color: Black

Number of Doors: 2

Number of Cylinders: 6

Warranty: Vehicle does NOT have an existing warranty

GMC Sierra 1500 for Sale

Full custom beautiful 1999 gmc sierra. lowered, incredible interior, wilwood(US $35,000.00)

Full custom beautiful 1999 gmc sierra. lowered, incredible interior, wilwood(US $35,000.00) 1993 gmc sierra 1500 s 4.3 v6 4x4 off road blue propane, gas no reserve!

1993 gmc sierra 1500 s 4.3 v6 4x4 off road blue propane, gas no reserve! 94 gmc single cab short wheel base ***great project truck*** or work truck(US $1,900.00)

94 gmc single cab short wheel base ***great project truck*** or work truck(US $1,900.00) Gmc : 1997 sierra 1500 sle shortbed z71 stepside 4x4 35k orig miles 1-owner nice

Gmc : 1997 sierra 1500 sle shortbed z71 stepside 4x4 35k orig miles 1-owner nice 2013 denali crew awd navigation sunroof leather heated rear dvd v8 vortec(US $47,130.00)

2013 denali crew awd navigation sunroof leather heated rear dvd v8 vortec(US $47,130.00) 2003 gmc sierra sle reg cab 4x4 z71 pkg with minute mount fisher plow lo reserve(US $4,988.00)

2003 gmc sierra sle reg cab 4x4 z71 pkg with minute mount fisher plow lo reserve(US $4,988.00)

Auto Services in Iowa

Yaw`s Auto Salvage ★★★★★

Witham Auto Centers ★★★★★

Wheelworks ★★★★★

Virgil`s Repair Service ★★★★★

Super Low Price Auto Glass ★★★★★

Mill Creek Machining ★★★★★

Auto blog

Detroit 3 to implement delayed unified towing standards for 2015

Tue, Feb 11 2014Car buyers have a responsibility to be well-informed consumers. That's not always a very simple task, but some guidelines are self-evident. If you live in a very snowy climate, you generally know a Ford Mustang or Chevrolet Camaro might not be as viable a vehicle choice as an all-wheel drive Explorer or Traverse, for example. If you want a fuel-efficient car, it's generally a good idea to know the difference between a diesel and a hybrid. But what if it's kind of tough to be an informed consumer? What if the information you need is more difficult to come by, or worse, based on different standards for each vehicle? Well, in that case, you might be a truck shopper. For years, customers of light-duty pickups have had to suffer through different ratings of towing capacities for each brand. For 2015 model year trucks, though, that will no longer be a problem. According to Automotive News, General Motors, Ford and Chrysler Group have announced that starting with next year's models, a common standard will be used to measure towing capacity. The Detroit Three will join Toyota, which adopted the Society of Automotive Engineers' so-called SAE J2807 standards way back in 2011. The standard was originally supposed to be in place for MY2013, but concerns that it would lower the overall stated capacity for trucks led Detroit automakers to pass. Ford originally passed, claiming it'd wait until its new F-150 was launched to adopt the new standards, leading GM and Ram to follow suit. Nissan, meanwhile, has said it will adopt the new standards as its vehicles are updated, meaning the company's next-generation Titan should adhere to the same tow ratings as its competitors. While the adoption of SAE J2807 will be helpful for light-duty customers, those interested in bigger trucks will still be left with differing standards. There is no sign of the new tow standards being adopted for the heavy-duty market.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

Mystery man buys fast food worker a new car

Tue, Apr 28 2015A mystery man bought a Tennessee fast food worker a new car. 34-year-old Jeff Smith told WKRN he was approached by an older stranger as he was exiting a grocery store. The two struck up a conversation about Smith's 1991 Geo Storm. The vehicle is falling apart; it has more than 350,000 miles on it, a cracked dashboard, no drivers side window, and a door that is literally being held closed by a small hook. The stranger asked Smith to follow him down the road to James Motors, but then asked the fast food worker to wait outside. Smith told WKRN, "He comes back out and says, 'How do you like that blue pickup?' I said. 'It looks great.' Then he said, 'Well, I bought it and it's yours now.' [...] It's just a blessing. It's the best thing that has ever happened to me." At first, Smith didn't believe this was even real. But the owner of James Motors showed up at the fast food restaurant where he works with the keys and title to the 2001 navy blue GMC Sonoma. The mysterious benefactor didn't want to be identified, but asked smith to do something nice for someone else in the future. Weird Car News GMC geo