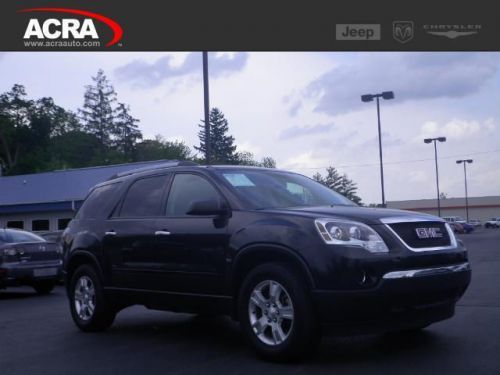

2011 Gmc Acadia Sl on 2040-cars

1200 IN-44, Shelbyville, Indiana, United States

Engine:3.6L V6 24V GDI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1GKKRNED0BJ246300

Stock Num: 14617

Make: GMC

Model: Acadia SL

Year: 2011

Exterior Color: Black

Interior Color: Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 35000

This 2011 GMC Acadia is ready for the road with features like Third Row Seating, an Auxiliary Audio Input, and a Sunroof. As well as an MP3 Player / Dock, Keyless Entry, and Child Locks. It also has a Heated Front Windshield, a Spoiler / Ground Effects, and your favorite talk shows and music styles uninterrupted with Satellite Radio. It also has an Anti-Theft System, Side Airbags for extra safety, and an Auxiliary Power Outlet. This vehicle also includes: Traction Control - Steering Wheel Controls - Tire Pressure Monitoring System - Bucket Seats - Cruise Control - Front Wheel Drive - Power Windows - Rear Head Air Bag - Rear Heat / AC - Disc Brakes - Air Conditioning - Power Locks - Power Mirrors - CD Single-Disc Player - Auto Dimming R/V Mirror - Auto Headlamp - Leather Wrapped Steering Wheel - Cloth Seats - Center Console - Adjustable Head Rests - Daytime Running Lights - Fog Lights - Rear Window Defrost - Tilt Wheel - Vanity Mirrors - Trip Odometer - Digital Clock - Center Arm Rest - Beverage Holder(s) For more photos and info on this vehicle visit our website http://www.acraauto.com >>> 4 LOCATIONS - PLEASE CALL 888-306-0471 FOR VEHICLE AVAILABILITY <<<

GMC Acadia for Sale

2009 gmc acadia slt(US $19,977.00)

2009 gmc acadia slt(US $19,977.00) 2011 gmc acadia denali(US $32,995.00)

2011 gmc acadia denali(US $32,995.00) 2011 gmc acadia slt(US $26,500.00)

2011 gmc acadia slt(US $26,500.00) 2007 gmc acadia slt(US $15,995.00)

2007 gmc acadia slt(US $15,995.00) 2009 gmc acadia sle-1(US $21,995.00)

2009 gmc acadia sle-1(US $21,995.00) 2012 gmc acadia slt-1(US $24,995.00)

2012 gmc acadia slt-1(US $24,995.00)

Auto Services in Indiana

Williams Auto Parts Inc ★★★★★

Wes`s Wheels & Tires ★★★★★

Tsi Auto Repair & Service ★★★★★

Town & Country Ford Inc ★★★★★

Tachyon Performance ★★★★★

Stroud Auto ★★★★★

Auto blog

GMC confirms Hummer EV will be joined by an electric Sierra, or Sierra-like, pickup

Tue, Dec 22 2020GMC will step into the electric vehicle arena for the first time when it begins building the Hummer EV in 2021. While it's not planning on becoming an electric-only brand, it has more battery-powered models in the pipeline. "There will be an all-electric Sierra pickup, but no timeline yet. But, the plan is to make it electric; this whole electric thing is a moving target," Lynn Thompson, the president of a Buick-GMC-Cadillac dealership in Missouri, told the Detroit Free Press. He said executives revealed those plans during a national dealer meeting. What remains to be seen is whether the truck will be an electric variant of the Sierra as Thompson said, or if it will arrive as a standalone electric truck with Sierra-like dimensions and capabilities. Sister company Chevrolet is also planning to launch an electric pickup in the coming years, and it strongly hinted it will take the second route. Its entry into the segment won't look like a Silverado, and nothing seriously suggests it will be badged as one. It will also be interesting to watch how GMC ensures that the truck doesn't overlap with the Hummer EV, which will exclusively be offered as a four-door pickup with a relatively short cargo box when it arrives in stores as a 2022 model. Our crystal ball tells us the Hummer will be marketed as a more expensive model aimed at weekend adventurers who want to make a statement, while the Sierra-like model will be cheaper and primarily aimed at buyers who merely want a truck, whether they're commuters, contractors, or fleet operators. Chevrolet's entry into the segment will slot beneath these two models. General Motors used this strategy nearly 20 years ago to keep the Hummer H2, the GMC Yukon, and the Chevrolet Tahoe in separate corners of the same room. GMC's electric truck could share powertrain and chassis components with the Hummer EV. It might also be built in the same Hamtramck, Michigan, factory that parent company General Motors is funneling $2.2 billion into. Regardless of the path it takes, GMC is not going all-electric. "[GMC boss] Duncan [Aldred] said we're certainly not going to abandon our internal combustion engine vehicles because that's our core business, and that was good to hear. It's to let people know they're not going down the same road as Cadillac," a dealer who asked to remain anonymous said. Cadillac might go EV-only by 2025, starting with a crossover named Lyriq, and many of its dealers have refused to spend $200,000 on upgrades.

GM recalls over 323,000 HD pickups because tailgates can open unexpectedly

Tue, Feb 6 2024General Motors is recalling more than 323,000 heavy-duty pickup trucks in the U.S. because the electronic tailgate release switches can short circuit and open the gates while the vehicles are in park. The recall covers certain Chevrolet Silverado and GMC Sierra 2500 and 3500 trucks from the 2020 through 2024 model years. The National Highway Traffic Safety Administration says in documents posted on its website Tuesday that water can get into the switches and cause the tailgates to open when in park gear. The agency says that can result in unsecured cargo falling out of the beds, creating a road hazard and increasing the risk of a crash. GM is advising owners to check that the tailgate is closed and latched before they drive the trucks. Dealers will replace an exterior touchpad switch. Owners are to be notified by letter starting March 18. GM dealers also have been told to stop selling affected vehicles until repairs are made. The company says in documents that it has 136 complaints about the tailgates opening unexpectedly. GM reported one complaint of a minor injury and three complaints of minor property damage. Recalls Chevrolet GM GMC Truck

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT ó General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.