2008 Gmc Acadia on 2040-cars

3120 Summerhill Rd, Texarkana, Texas, United States

Engine:3.6L V6

Transmission:6 speed automatic

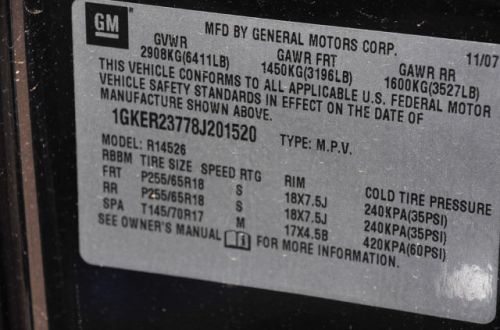

VIN (Vehicle Identification Number): 1GKER23778J201520

Stock Num: KF1611

Make: GMC

Model: Acadia

Year: 2008

Exterior Color: Black

Interior Color: Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 119221

Come check out one of the nicest 2008 models on the market. This ride comes with a smoke free leather interior, automatic, cd, titlt cruise, LOADED!! Call or text me now at 903490249

Jim

GMC Acadia for Sale

2011 gmc acadia slt1(US $24,988.00)

2011 gmc acadia slt1(US $24,988.00) 2011 gmc acadia denali(US $36,988.00)

2011 gmc acadia denali(US $36,988.00) 2011 gmc acadia slt2(US $31,999.00)

2011 gmc acadia slt2(US $31,999.00) 2012 gmc acadia slt1(US $34,995.00)

2012 gmc acadia slt1(US $34,995.00) 2014 gmc acadia sle(US $37,425.00)

2014 gmc acadia sle(US $37,425.00) 2013 gmc acadia slt(US $38,995.00)

2013 gmc acadia slt(US $38,995.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

GM Design shows another early Hummer EV sketch

Sun, Aug 8 2021Like a new mother who's still so excited about her one-year-old baby that she can't stop showing ultrasound photos, General Motors is so excited about its biggest new baby, the battery-electric GMC Hummer, that it can't stop showing off development design sketches. The off-road monster with the 200-kWh Ultium battery pack debuted online on October 21 last year. The next day, the GM Design Instagram page posted some of the Hummer's early "theme sketches" leading to the production version. These had a conceptual flair to them, but were rather restrained. A month later, GM uncovered a series of development renderings showing off a much wilder truck bursting with more angles than a geometry text book. The archives have opened up again with a new "ideation sketch," this one between the first believable sketches and the second truck that Master Chief and Doomguy share on their days off. All three sets of drawings show similar three-box proportions, it's the details that got a ton of love. On this newest sketch, the fenders flare a touch more than on the production truck, but the wheel wells are cut with the kind of clearance found on a Baja 1000 Trophy Truck. Out back, save for the tow hooks, the rear end is totally different than production. The sketch puts illuminated Hummer script across a narrow tailgate flanked by small square, taillights housing six individual elements. Beneath that, a bumper-less rear end puts nothing more than a sloped bash pate between the truck and the rocks it's just scrambled over. To our eyes, this is the best blend of production-ready comfort from the first sketches and zoot suit angles from the second that we've seen so far. First deliveries of the GMC Hummer EV Edition 1 are expected before the year is out. When we get a chance to absorb the truck in its native habitats, we'll know whether there's cause for disappointment at what could have been. If so, with all this hunger among the monied for something different, we feel like restomodders have been given the perfect head starts on custom rebodied Hummers that would make things right. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Chevrolet Silverado reportedly getting the GMC Sierra's MultiPro tailgate

Mon, Aug 17 2020GMC reinvented the pickup tailgate when it added a six-way option named MultiPro to the current-generation Sierra it introduced in 2019. It kept this clever feature to itself as a way to differentiate the Sierra from the Chevrolet Silverado, but a recent report claims it will begin sharing it in the not-too-distant future. Enthusiast website GM Authority learned from anonymous sources familiar with Chevrolet's product plans that the Silverado will soon receive its own version of the MultiPro tailgate. It will be called either MultiFlex or Multi-Flex, a name Chevrolet has already trademarked, and it was initially scheduled to make its debut for the 2021 model year. Its arrival might be delayed until the 2022 model year due to the coronavirus pandemic, however. Chevrolet's Silverado and GMC's Sierra are nearly identical under the sheet metal, so adding the latter's six-way tailgate to the former will be a relatively straightforward and cost-effective process. Interestingly, GM Authority wrote engineers could add a seventh function to the tailgate, though it didn't reveal what they have in store. It's also not sure whether both trucks will get the new feature, or if it will exclusively be offered on the Chevrolet. 2022 will bring major updates to the Silverado and the Sierra, potentially including — as we've previously reported — an independent rear suspension. Interior upgrades will allegedly be part of the mid-cycle changes, too, but we still don't know if the Silverado will receive the tough carbon fiber cargo box available in the Sierra. In the meantime, motorists in the market for a Sierra will temporarily have fewer options to choose from. GMC has asked its dealers to stop taking orders for the regular- and double-cab variants of the truck, according to a separate report from GM Authority. Putting the slower-selling regular- and double-cab trucks on hiatus will allow dealers to build up their inventory of crew-cabs, which sell far better and are in relatively short supply. These restrictions will remain in effect until the 2021 model year, which starts on September 14 for double- and crew-cab models and on September 21 for regular-cab trucks. All three body styles will be available in 2021. Related Video:

Chevrolet Malibu could last until 2024 before joining the dodo

Wed, Jul 31 2019Automotive News pieced together all available intel on the Chevrolet and GMC lineups, trying to ascertain how much life each model might have left. Concerning the Chevrolet Malibu, the answer is not too much, and the historic nameplate's final years don't look like the glory kind. After a major overhaul in 2016 boosted sales for the ninth-generation sedan to 227,881 units, the 2018 sales fell to 144,542, and this year's are down almost 15% through the end of June. The Malibu is one of two Chevrolet sedans still breathing - the other being the Impala for now - but only for about five more years. AN says there'll likely be a refresh in 2022, followed by a visit from the Reaper in 2024. After that, it could be "indirectly replaced" by an electric vehicle, one of the 23 EVs that GM is working on for 2023.   The Impala will meet the ax earlier despite a recent stay of execution. Production is still set to close in January 2020. In the entire GM stable, Cadillac might soon be the only marque with sedans. The Buick LaCrosse has a date with death, and Groupe PSA won't supply Opels-as-Regals forever. The Sonic hatchback should say goodbye at the end of 2020, a year before the seemingly eternal Spark is thought to die. Two years after that, according to one report, the Camaro will go back into cold storage, perhaps forever, and AN says an "expected redesign of the car in 2021 was reportedly canceled." Finally, let's give one final shout-out to the Chevrolet Cruze, a global nameplate, which in the United States alone outsells the Malibu, outsold the Camaro by a factor of three last year, and absolutely trounces the Impala, Sonic, and Spark. Even that couldn't get a stay of execution. In more uplifting news, everything's happening on the crossover and truck side in the next few years. The Chevy Bolt is due for a refresh next year, even though it has "become more important for self-driving ride-hailing fleets that GM Cruise plans to operate than for consumers." In 2021, the Bolt-based crossover should bow, first in China, then here. It's said to look like "a mix of the Bolt and Trax" in spy shots. Still waiting for a green light: a possible subcompact GMC crossover called Granite that might make it to market by 2023. The full-sized SUV triplets Tahoe, Suburban, and Yukon could show their new faces in 2020. The Silverado might get an updated interior in 2020 or 2021, while the Colorado and Canyon mid-sized pickups won't get attention until perhaps 2023.