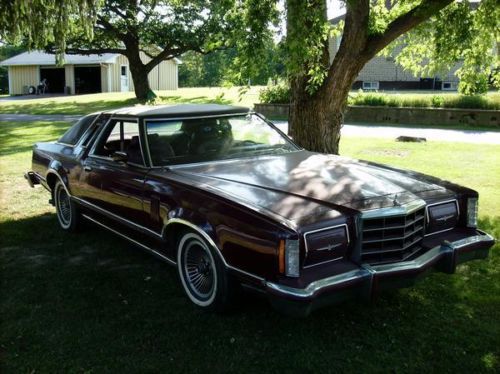

1979 Ford Thunderbird Heritage Hardtop 2-door 5.8l on 2040-cars

Industry, Pennsylvania, United States

|

In storage since the mid 1990's. 73,000 miles. Starts, runs, and drives but needs the brake system gome over from sitting. Needs heater core (leaks). A/C works but needs charged. 351M with FMX trans. Was repainted about 25 years ago but wasn't done nicely and needs it again. Has one small rust spot on front fender and a dent near the gas door. Aside from that, it's a solid car and would make a nice, easy project. Leather interior is pretty nice but needs a good cleaning. 2 sets of wheels included with car...the aluminum turbines (pictured) no longer have tires on them and the car is sitting on steel wheels with random mismatched tires. The tires pictured dry rotted and literally blew out. If you have any questions or want more pictures/details, just ask. I am very motivated to sell this as I need room for another car.

|

Ford Thunderbird for Sale

1966 ford thunderbird landau - original----new reserve

1966 ford thunderbird landau - original----new reserve 1964 ford thunderbird convertible, matching #, original not restored

1964 ford thunderbird convertible, matching #, original not restored 1966 ford thunderbird

1966 ford thunderbird 1987 ford thunderbird turbo coupe(US $2,800.00)

1987 ford thunderbird turbo coupe(US $2,800.00) 1963 ford thunderbird convertible sports roadster

1963 ford thunderbird convertible sports roadster 1962 ford thunderbird base hardtop 2-door 6.4l(US $15,500.00)

1962 ford thunderbird base hardtop 2-door 6.4l(US $15,500.00)

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Van Gorden`s Tire & Lube ★★★★★

Valley Seat Cover Center ★★★★★

Tony`s Transmission ★★★★★

Tire Ranch Auto Service Center ★★★★★

Thomas Automotive ★★★★★

Auto blog

White House clears way for NHTSA to mandate vehicle black boxes

Fri, 07 Dec 2012At present, over 90 percent of all new vehicles sold in the United States today are equipped with event data recorders, more commonly known as black boxes. If the National Highway Traffic Safety Administration gets its way, that already high figure will swell to a full 100 percent in short order.

Such automotive black boxes have been in existence since the 1990s, and all current Ford, General Motors, Mazda and Toyota vehicles are so equipped. NHTSA has been attempting to make these data recorders mandatory for automakers, and according to The Detroit News, the White House Office of Management Budget has just finished reviewing the proposal, clearing the way. Now NHTSA is expected to draft new legislation to make the boxes a requirement.

One problem with current black boxes is that there's no set of standards for automakers to follow when creating what bits of data are recorded, and for how long or in what format it is stored. In other words, one automaker's box is probably not compatible with its competitors.

GM, Ford, Honda winners in 'Car Wars' study as industry growth continues

Wed, May 11 2016General Motors' plans to aggressively refresh its product lineup will pay off in the next four years with strong market share and sales, according to an influential report released Tuesday. Ford, Honda, and FCA are all poised to show similar gains as the auto industry is expected to remain healthy through the rest of the decade. The Bank of America Merrill Lynch study, called Car Wars, analyzes automakers' future product plans for the next four model years. By 2020, 88 percent of GM's sales will come from newly launched products, which puts it slightly ahead of Ford's 86-percent estimate. Honda (85 percent) and FCA (84 percent) follow. The industry average is 81 percent. Toyota checks in just below the industry average at 79 percent, with Nissan trailing at 76 percent. Car Wars' premise is: automakers that continually launch new products are in a better position to grow sales and market share, while companies that roll out lightly updated models are vulnerable to shifting consumer tastes. Though Detroit and Honda grade out well in the study, many major automakers are clumped together, which means large market-share swings are less likely in the coming years. Bank of America Merrill Lynch predicts the industry will top out with 20 million sales in 2018 and then taper off, perhaps as much as 30 percent by 2026. Not surprisingly, trucks, sport utility vehicles and crossovers will be the key battlefield in the next few years, Car Wars says. FCA will launch a critical salvo in 2018 with a new Ram 1500, followed by new generations of the Chevy Silverado and GMC Sierra in 2019, and then Ford's F-150 for 2020, according to the study. Bank of America Merrill Lynch analyst John Murphy said the GM trucks could be pulled ahead even earlier to 2018, prompting Ford to respond. "This focus on crossovers and trucks is a great thing for the industry," Murphy said. Cars Wars looks at Korean (76 percent replacement rate) and European companies more vaguely (70 percent), but argues their slower product cadence and lineups with fewer trucks puts them in weaker positions than their competitors through 2020. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery 2016 Chevrolet Silverado View 11 Photos Image Credit: Chevrolet Earnings/Financials Chrysler Fiat Ford GM Honda Nissan Toyota study FCA

Lucid Air, VW ID.4 AWD and Polestar 2 Single Motor driven | Autoblog Podcast #704

Fri, Nov 12 2021In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Autoblog Green, John Beltz Snyder. Greg's been driving the Volkswagen ID.4 AWD and the Lucid Air, while John has been in the Mini Cooper Hardtop and Polestar 2 Single Motor. They discuss the big Rivian news of the week, its stellar IPO. They take a question from the mailbag about whether to sell a Tesla Model 3, and they help a listener decide whether to buy a Ford Maverick or some other pickup. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #704 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown What we're driving2022 Volkswagen ID.4 AWD Pro 2022 Lucid Air 2022 Mini Cooper Hardtop 2022 Polestar 2 Single Motor Rivian's IPO Mailbag: To sell or not to sell a Tesla Model 3 Spend My Money: Ford Maverick FX4 or something else? Transcript Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.