2008 Ford Mustang Roush on 2040-cars

Raleigh, North Carolina, United States

CONTACT ME AT : mustanggt54ford@hotmail.com This is #8 of 146 made!Stage 3 Roush, comes with 2 additional pulleys 2.8 and 2.57, Sebon carbon fiber hood, Brimbro brakes, Jack Roush signature stitched seats, Saleen Watts link kit on rear end, iboc pro street adjustable coil overs, Roush cold air kit with recalibrated pcm, full Roush exhaust with ceramic headers, brand new Nito tires, touch screen JVC DVD/CD bluetooth deck, upgraded 4 channel amp.EXTREMELY fast, handles even better! Corvettes look great, in my rear view mirror! Garaged its entire life. 475HP with upgrades.

Ford Mustang for Sale

1964.5 ford mustang convertible(US $17,000.00)

1964.5 ford mustang convertible(US $17,000.00) 1965 ford mustang fastback 5-speed(US $23,000.00)

1965 ford mustang fastback 5-speed(US $23,000.00) 1969 ford mustang cobra jet 6-speed(US $24,600.00)

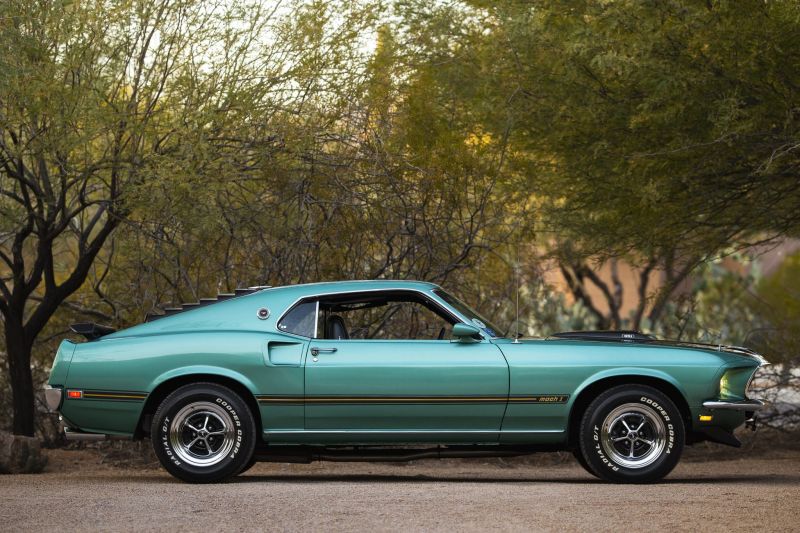

1969 ford mustang cobra jet 6-speed(US $24,600.00) 1969 ford mustang mach 1(US $25,000.00)

1969 ford mustang mach 1(US $25,000.00) 1970 ford mustang boss 302(US $24,000.00)

1970 ford mustang boss 302(US $24,000.00) 1973 ford mustang convertible 4-speed(US $15,000.00)

1973 ford mustang convertible 4-speed(US $15,000.00)

Auto Services in North Carolina

Whitey`s German Automotive ★★★★★

Transmission Center ★★★★★

Tow-N-Go LLC ★★★★★

Terry Labonte Chevrolet ★★★★★

Sun City Automotive ★★★★★

Show & Pro Paint & Body ★★★★★

Auto blog

Ford confirms launch of new Tourneo vans and Ecosport in Europe for Geneva

Sun, 24 Feb 2013We've already seen plenty of what the Geneva Motor Show will have in store for us in less than two weeks, but most of the confirmed debuts that were announced so far have generally been luxury or performance cars. Ford, on the other hand, will be showing off a couple of its new family-friendly models for European buyers to enjoy.

On the larger side of things, the full range of Tourneo vans (shown above) will be on display, including the introduction of the new Tourneo Courier model, but Ford will also be showing off the all-new EcoSport crossover, which is based on the automaker's Global B platform and will be positioned beneath the Kuga, better known here as the Escape. The subcompact EcoSport was originally unveiled at the Beijing Motor Show last April.

Ford recalling 433k cars for engines that don't shut off

Thu, Jul 2 2015Ford Motor Company has announced an enormous recall affecting 433,000 vehicles built between April 2014 and June 2015. There's a problem with the body control module in the affected vehicles that can prevent them from turning off, even if the key is removed from the ignition or stop/start button has been pressed. Individual models include the Focus and C-Max, both built at the Michigan Assembly Plant. The defective Foci were built between June 17, 2014 and June 12, 2015, while the C-Maxes were built between April 22, 2014 and June 12, 2015. Also affected are model year 2015 Escape CUVs, built at the Louisville Assembly Plant in Kentucky, between April 1, 2014 and June 12, 2015. As is usually the case, the overwhelming majority of vehicles – 374,381 – are registered in the United States, while the 52,180 are in Canada and 5,135 are in Mexico. The Blue Oval is not aware of any injuries or accidents due to this defect. Individual consumers, meanwhile, will need to report into dealers to have the body control module's software updated. Scroll down for the brief press release from Ford. Related Video: FORD ISSUES SAFETY COMPLIANCE RECALL IN NORTH AMERICA DEARBORN, Mich., July 2, 2015 – Ford Motor Company is issuing a safety compliance recall for approximately 433,000 vehicles in North America, including certain 2015 Focus, C-MAX and Escape vehicles, for an issue with the body control module. In these vehicles, it could be possible for the engine to continue to run after turning the ignition key to the "off" position and removing the key, or after pressing the Engine Start/Stop button. This is a compliance issue with FMVSS 114 regarding theft protection and rollaway prevention. Ford is not aware of any accidents or injuries associated with this issue. Affected vehicles include certain 2015 Focus vehicles built at Michigan Assembly Plant from June 17, 2014, through June 12, 2015; certain 2015 C-MAX vehicles built at Michigan Assembly Plant from April 22, 2014, through June 12, 2015; and certain 2015 Escape vehicles built at Louisville Assembly Plant from April 1, 2014, through June 12, 2015. There are 432,096 vehicles in North America, including 374,781 in the United States and federalized territories, 52,180 in Canada and 5,135 in Mexico. Dealers will update the body control module software at no cost to the customer.

Daily Driver: 2015 Ford Edge Sport

Thu, May 7 2015Daily Driver videos are micro-reviews of vehicles in the Autoblog press fleet, reviewed by the staffers that drive them every day. Today's Daily Driver features the 2015 Ford Edge Sport, reviewed by Adam Morath. You can watch the video above or read a transcript below. Watch more Autoblog videos at /videos. VIDEO TRANSCRIPT [00:00:00] Hi. I'm Adam Morath for Autoblog and in today's Daily Driver we're with the 2015 Ford Edge. It's been completely redesigned and I really think that it needed it because this was always kind of the last car to come to mind when I was considering all of Ford's lineup. It was sort of forgotten. I don't think that will be the case anymore. It looks great. They revamped the exterior. The first thing I noticed walking up to the car when they first dropped it off was [00:00:30] the great job they've done with the taillights. They've got a very high tech look to them. You have LED accent lighting that surrounds the tail lamps and then a light bar that spans the entire deck lid. It looks pretty cool, very angular, a lot sportier than the previous models. We also have the optional HID headlights so if you combine that with what I've already told you about with the [00:01:00] tail lamps, and also the ambient lighting inside this vehicle ... It just feels like the lighting in general was very well considered on the Edge and gives it a very modern feel. The nice design continues to the interior as well. You've got leather panels with contrast stitching on the sport model. You've got a nice center console that actually has some storage underneath it, so it's sort of a floating center console. The only thing is there is still a little bit of cheap plastic [00:01:30] used on the interior. That's a common complaint of automotive journalists worldwide, but this one I can see already has a few scratches on it. You can also get this vehicle with 20-inch aluminum wheels or 21-inch matte black aluminum wheels. Here we've got them wrapped in Perelli. I haven't been on a track or anything where you could really get a sense of the performance, but again, that just adds to the sporty look of the Edge in the sport trim level. It has the new 2.7 [00:02:00] liter Eco Boost V6 and I have been really happy with this powertrain. It puts out 315 horsepower, 350 pound feet of torque, and that's that twin turbo working for you. It helps with acceleration and passing at highway speed, so it checks both boxes there.