1918 Model T Ford Highboy Coupe on 2040-cars

Crescent, Oklahoma, United States

|

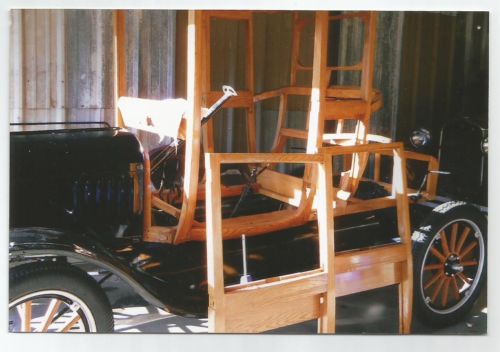

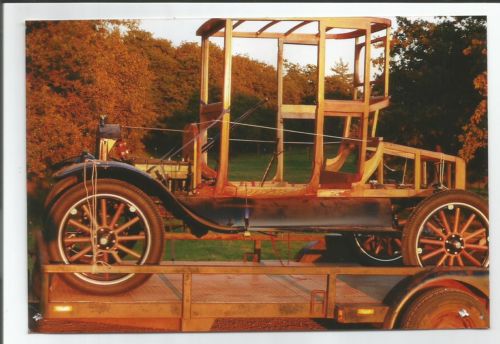

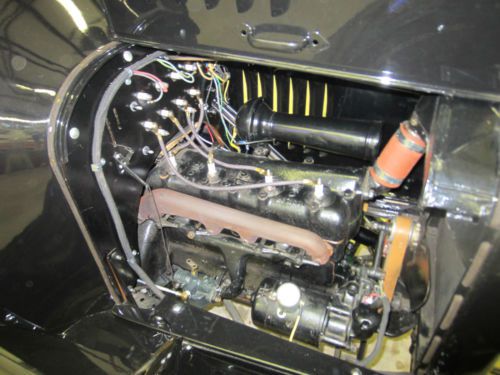

This is a fully restored 1918 Ford Model T Highboy Coupe. It does not have removable posts.

|

Ford Model T for Sale

27 ford model t coupe(US $18,000.00)

27 ford model t coupe(US $18,000.00) Very nice black model five window coupe(US $8,900.00)

Very nice black model five window coupe(US $8,900.00) 1927 ford total performance t(US $32,995.00)

1927 ford total performance t(US $32,995.00) Full custom-built roadster, removable hardtop, 4 wheel disc, 350 ci!!!(US $22,995.00)

Full custom-built roadster, removable hardtop, 4 wheel disc, 350 ci!!!(US $22,995.00) 1923 fiberglass t bucket, old style,350 chev. engine, recently redone

1923 fiberglass t bucket, old style,350 chev. engine, recently redone 1927 ford model t coupe traditional hot rod rat rod street rod flathead

1927 ford model t coupe traditional hot rod rat rod street rod flathead

Auto Services in Oklahoma

Simek`s Auto Supply & Garage ★★★★★

Rogers Auto Upholstery Shop ★★★★★

Pro Auto Glass ★★★★★

Paintmaster Collision & Auto Painting Center ★★★★★

Noble Auto & Truck Service ★★★★★

Midway Automotive ★★★★★

Auto blog

NHTSA releases updated Takata airbag recalled cars list, but it still has errors

Wed, 22 Oct 2014

Unfortunately, the government's list still contains errors.

The National Highway Traffic Safety Administration has issued an updated list of vehicle models that it's urging owners to repair under the mushrooming Takata airbag inflator recall. The latest version adds vehicles from new automakers like Subaru and Ford that are missing from the original announcement, and it also removes erroneous entries from General Motors, leaving only the 2005 Saab 9-2X (a reskinned Subaru WRX), and the 2003-2005 Pontiac Vibe, a joint project with Toyota.

Verizon buys Telogis in connected vehicle market push

Wed, Jun 22 2016(Note/disclaimer: We are owned by Verizon, by way of AOL. This gives us no inside track whatsoever when it comes to news.) With a lot of tech companies and automakers staking their claims in the connected car space, now there are signs that others are looking to move in, too. Today, telecoms giant Verizon announced that it is acquiring Telogis, a California-based company that develops cloud-based solutions for mobile workforces, and specifically telematics, compliance and navigation software used by Ford, Volvo, GM and other car companies, as well as Apple and AT&T. Financial terms of the deal have not been disclosed, although we'll try to find out. Considering that Verizon in 2015 reported full-year revenues of $131.6 billion, the price would have to be very high to be considered "material" and may not be made public for some time, if ever. Telogis in its time as a startup raised a substantial amount of money, just over $126 million in all, including $93 million in 2013, supposedly ahead of an IPO, all from Kleiner Perkins Caufield & Byers. Back in 2013 when KPCB made its investment (which was the first from a VC firm in the company), Telogis told TechCrunch it was profitable and forecasting revenues of $100 million annually for the year. It's not clear what size those revenues are now, but if it was on the same growth trajectory as before the funding, sales would be around $150 million annually, with profitability, at the moment. Other investors include some very notable strategics: the investment arm of General Motors, and Fontinalis Partners, which also invests in Lyft and was co-founded by Bill Ford, the executive chairman of the Ford Motor Company. Before the acquisition, Verizon actually had a business in fleet management and telematics; in fact, the two companies competed against each other for business from the trucking and other industries. Verizon Telematics, as the business is called, is active in 40 countries. But in a way, Verizon buying Telogis is a sign that the latter may have proved to be the more superior, and the one with the key customer deals.

Ford shareholders happy as the Blue Oval stays in the black

Fri, May 15 2015Ford posted slightly falling global sales and revenue in its first-quarter financial announcement, but pre-tax profits and operating margins were up. Apparently, that was plenty to keep shareholders happy, though. The Blue Oval's recent investor meeting in Delaware lasted less than an hour, and a vote on the approval of the board passed by over 93 percent. Ford CEO Mark Fields continued to predict a strong year financially and increasing profits, according to the Detroit Free Press. The growth comes thanks in large part to the company's 24 global vehicle launches last year and 15 more this year. The likelihood of significant profits from the strong-selling 2015 F-150 should be especially lucrative, too. In the Q1 announcement, the Blue Oval forecast pre-tax profits between $8.5 billion and $9.5 billion for 2015. During the meeting, Fields said that the next 15 years of changes in the industry represent the "ultimate opportunity as a company. As big as when Henry Ford put the world on wheels more than 100 years ago," according to the Free Press. Investments like the expanded technology center in Silicon Valley should push that work along. Related Video: