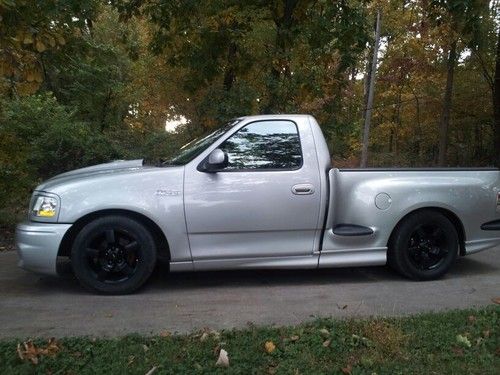

2001 Ford F-150 Lightning Standard Cab Pickup 2-door 5.4l on 2040-cars

Street, Maryland, United States

Fuel Type:GAS

Engine:5.4L 330Cu. In. V8 GAS SOHC Supercharged

Vehicle Title:Clear

Transmission:Automatic

For Sale By:Private Seller

Make: Ford

Model: F-150

Mileage: 164,766

Trim: Lightning Standard Cab Pickup 2-Door

Exterior Color: Silver

Interior Color: Black gray

Drive Type: RWD

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

2001 ford lightning 165,000 miles runs great no problems. Has kenne bell charger, bassani exhaust, long tube headers, diablo sport tuner. Don't know much about truck not the first owner not sure if it was ever rebuilt but It runs like new. Has gauge pillar boost gauge works, fuel/air gauge works when it wants to( loose connection maybe), water temp gauge not hooked up like that when I bought it and never hooked it up. Paint in great condition for being twelve years old, it was a Midwest truck only seen one winter so NO RUST. It's a great truck probably the most reliable I've ever had, sad to see it go.

Ford F-150 for Sale

Lifted silver xlt extended cab 5.4l v8 4x4 leather pro comp fuel we finance(US $17,981.00)

Lifted silver xlt extended cab 5.4l v8 4x4 leather pro comp fuel we finance(US $17,981.00) 04 ford f150 f-150 5.4l triton v8 gas auto 4x4 crew cab short bed xlt 80 pics(US $11,495.00)

04 ford f150 f-150 5.4l triton v8 gas auto 4x4 crew cab short bed xlt 80 pics(US $11,495.00) 1997 ford f-150 new tires multimedia dvd bluetooth stereo(US $2,100.00)

1997 ford f-150 new tires multimedia dvd bluetooth stereo(US $2,100.00) Used ford f 150 extra cab 4x4 automatic pickup trucks 4wd truck we finance autos

Used ford f 150 extra cab 4x4 automatic pickup trucks 4wd truck we finance autos Ford f-150 xlt lariat standard cab pickup 2-door 4x4(US $6,399.00)

Ford f-150 xlt lariat standard cab pickup 2-door 4x4(US $6,399.00) 1976 ford f150 barn find 4x4 4spd a/c

1976 ford f150 barn find 4x4 4spd a/c

Auto Services in Maryland

Wes Greenway`s Waldorf VW ★★★★★

star auto sales ★★★★★

Singer Auto Center ★★★★★

Prestige Hi Tech Auto Service Center ★★★★★

Pallone Chevrolet Inc ★★★★★

On The Spot Mobile Detailing ★★★★★

Auto blog

Recharge Wrap-up: Ford Fusion and Toyota Highlander named Best Hybrids for Families; Funky Prius motorhome

Fri, Mar 13 2015Tesla Model S customers in China will receive a "Universal Mobile Charger" with their vehicle. The charger will allow drivers to charge their Tesla anywhere, without having to search out a Supercharger when out in the wild. It allows Model S drivers a bit more freedom and helps alleviate worries about traveling too far from home. It could also help sway potential customers who suffer from range anxiety. The charger will be free to new and existing customers when it becomes available this summer. Read more at Car News China. US News & World Reports' list of Best Cars for Families includes two hybrids. The 2015 Ford Fusion Hybrid was chosen as the Best Hybrid Car for Families, while the 2015 Toyota Highlander Hybrid was picked as the Best Hybrid SUV for Families. The Fusion hybrid was chosen for its roomy, comfortable cabin, as well as the MyKey system's features for new drivers. The Highlander Hybrid offers eight seats - good for carpooling - as well as good mileage and a quality infotainment system. Read more at US News & World Reports or at Hybrid Cars. Audi plans to give its electric vehicles looks that differentiate them from the rest of the lineup. "In early 2018, we will launch a battery-powered sports activity vehicle in the large premium segment with a range of more than 500 kilometers," says Audi's head of development, Ulrich Hackenberg. "It will have a new, very attractive design, which we are developing especially for the E-Tron range and for battery-electric vehicles." According to analysts, part of the reason the Toyota Prius was so successful was because it was easy to distinguish from other Toyota models with conventional powertrains. Read more at Automotive News Europe. An Australian man turned his Toyota Prius into a miniature motorhome. James Lawler used mostly scraps to build the tiny house – complete with tin roof, chimney, and stained glass window – for just $150 Australian. It took him about a week to finish. Lawler made use of his creation at the Meredith Music Festival so he didn't have to sleep in a tent. He was, however, fined by police for driving the makeshift motorhome. See pictures and read more at the Herald Sun.

Lexus gets top brand marks from Consumer Reports; Ford, Jeep hit hard

Tue, 25 Feb 2014Consumer Reports has released its 2014 Car Brand Report Cards, with Lexus again reigning at the top and doing so with the same industry-topping score of 79 that it registered in last year's Report Cards. This year, the institute credited its lineup for being "usually quiet, comfortable, and fuel-efficient," noting it's the only brand on the list "to achieve an excellent average overall reliability score." The Car Brand Report Cars list is meant to rank the best all-around vehicles based on CR testing and reliability results tallied by subscribers it surveyed. Each brand included must have sufficient test and reliability data for at least three models, a standard which left out 11 marques including Fiat, Jaguar, Land Rover and Porsche.

This 2014 Brand Report Cars edition is the first of a new format in which sub-brands have been broken out from their parent brands, with Acura using this year to move up the leaderboard into second place with a score of 75 for its "reliable, well-finished and somewhat sporty models." The top three was rounded out by Audi, climbing from eighth to third by scoring a 74 for "well-crafted interiors, nice handling and good gas mileage." Audi scored highest in the road-test portion, its improved reliability aiding its rise. The top nine was completed by Subaru, Toyota, Mazda, Honda, Infiniti and Mercedes-Benz.

Ford and Jeep weighed in at the other end of the rankings, Jeep taking the lowest overall score in the road tests and hampered by "a mix of spotty reliability." Ford was sunk by reliability issues with its MyFord Touch infotainment system which consumers found troublesome enough to negate its cars earning "solid test scores" for being "very nice to drive." Perhaps the rumored switch from Microsoft to Blackberry's QNX for the next generation SYNC will help them out. Cadillac's score also took a hit for infotainment reasons after it was the leading US brand last year, the CUE system in the XTS dragging Cadillac to the bottom of all General Motors brands.

Weekly Recap: An '80s encore in the auto world

Sat, Jul 11 2015The '80s returned in a big way this week, as National Lampoon's, Ghostbusters, Miami Vice, and even Tetris were back in the news. While there were far more serious topics (see below), nostalgia mingled with modern marketing to put these Reagan-era favorites back in the spotlight. The '80s were alternately cold and corny at times, but their cultural touchstones can still generate big money. That's why Infiniti recreated an iconic scene from National Lampoon's Vacation (1983) for an advertisement that hawks the QX60 crossover. Actor Ethan Embry, who played Rusty Griswold in a later Lampoon's movie, pilots the Infiniti – which is serving as a modern Family Truckster – for a trip to Walley World. A blonde pulls alongside in a red Lamborghini. They flirt, and she drives on. Christie Brinkley, who played the original girl in the red sports car (she drove a Ferrari in the '83 flick), is riding shotgun and chides Embry with: "A blonde. In a convertible. Seriously?" Okay, it's hardly on the level of "here's looking at you," or even "you can't handle the truth," but it should resonate with '80s babies, many of whom are now having children of their own and moving into three-row SUVs like the QX60. Naturally, Hollywood is going back to the well, too, with a Vacation remake that premiers July 29. Meanwhile, Ghostbusters is returning next year, and director Paul Feig offered a peak at the new Eco-1 in this tweet. In the 1984 classic, the team drove a modified 1959 Cadillac. Now, it will drive a late '80s Cadillac. As expected, the announcement generated support and controversy from movie and car enthusiasts. His tweet had generated several thousand retweets and favorites in the days following the news. Though the '80s Caddy looks, uh, less elegant in comparison to the now-iconic fins and curves of the original Ecto-1, it's about the same time lapse into the past as the '59 Caddy was to viewers in 1984. Speaking of 1984, Miami Vice, which debuted that year on NBC, is seeing one of its hero cars hit the auction block, Mecum Auctions announced this week. The 1986 Ferrari used on the show will be offered for sale Aug. 15 during Monterey classic car week. The white supercar runs a 390-hp flat 12-cylinder engine paired with a five-speed manual transmission and was in storage after the show ended in 1989 until earlier this year. It has 16,124 miles on the odometer and is authenticated by Ferrari North America and Classiche.