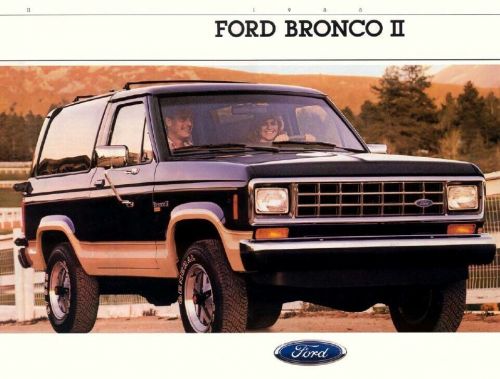

1988 Ford Bronco on 2040-cars

Fort Worth, Texas, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

VIN (Vehicle Identification Number): 1FMCU14T5JUB64460

Mileage: 87419

Make: Ford

Interior Color: Tan

Previously Registered Overseas: No

Number of Seats: 5

Number of Cylinders: 6

Drive Type: 4WD

Service History Available: Yes

Drive Side: Left-Hand Drive

Horse Power: 86 - 110 kW (115.24 - 147.4 hp)

Engine Size: 2.9 L

Model: Bronco

Exterior Color: Black

Car Type: Classic Cars

Number of Doors: 2

Features: Air Conditioning, Alarm, Power Locks, Power Windows

Ford Bronco for Sale

2023 ford bronco t-rock, lifted, 4x4, 22's(US $6,100.00)

2023 ford bronco t-rock, lifted, 4x4, 22's(US $6,100.00) 1971 ford bronco sport(US $30,090.00)

1971 ford bronco sport(US $30,090.00) 1977 ford bronco(US $224,900.00)

1977 ford bronco(US $224,900.00) 1996 ford bronco u100(US $4,600.00)

1996 ford bronco u100(US $4,600.00) 2021 ford bronco(US $17,776.50)

2021 ford bronco(US $17,776.50) 1970 ford bronco sport(US $56,900.00)

1970 ford bronco sport(US $56,900.00)

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

We spy the Ford Mustang King Cobra early at SEMA

Tue, 04 Nov 2014As is the case with most auto shows, waiting for the reveal of hot new models is the worst part. So, while our own Drew Phillips has been wandering the halls here in Las Vegas since they unlocked the doors for SEMA 2014, we didn't expect him to come back with any big reveals until later in the day. Until this happened.

Meandering by the Ford stand, Phillips eagle-eyed a trunk lid that caught his attention. Popping out from an otherwise draped 2015 Mustang, the matte black lid clearly has the name King Cobra embossed on the rear.

That name is interesting for a few reasons: to start, Ford hasn't used the Cobra name (without "Jet" attached) since way back in 2004, so a new snake is certainly something to take note of. Second, the King Cobra name dates all the way back to the ill-remembered Mustang II, meaning there is a clear link to Blue Oval history here.

Why the Detroit Three should merge their engine operations

Tue, Dec 22 2015GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. Fiat-Chrysler CEO Sergio Marchionne would love to see his company merge with General Motors. But GM's board of directors essentially told him to go pound sand. So now what? The boardroom battle started when Mr. Marchionne published a study called Confessions of a Capital Junkie. In it, Sergio detailed the amount of capital the auto industry wastes every year with duplicate investments. And he documented how other industries provide superior returns. He's right, of course. Other industries earn much better returns on their invested capital. And there's a danger that one day the investors will turn their backs on the auto industry and look to other business sectors where they can make more money. But even with powerful arguments Marchionne couldn't convince GM to take over FCA. And while that fight may now be over, GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. No doubt this suggestion will send purists into convulsions, but so be it. The Detroit Three should seriously consider merging their powertrain operations, even though that's a sacrilege in an industry that still considers the engine the "heart" of the car. These automakers have built up considerable brand equity in some of their engines. But the vast majority of American car buyers could not tell you what kind of engine they have under the hood. More importantly, most car buyers really don't care what kind of engine or transmission they have as long as it's reliable, durable, and efficient. Combining that production would give the Detroit Three the kind of scale that no one else could match. There are exceptions, of course. Hardcore enthusiasts care deeply about the powertrains in their cars. So do most diesel, plug-in, and hybrid owners. But all of them account for maybe 15 percent of the car-buying public. So that means about 85 percent of car buyers don't care where their engine and transmission came from, just as they don't know or care who supplied the steel, who made the headlamps, or who delivered the seats on a just-in-time basis. It's immaterial to them. And that presents the automakers with an opportunity to achieve a staggering level of manufacturing scale. In the NAFTA market alone, GM, Ford, and FCA will build nearly nine million engines and nine million transmissions this year.

Ford earnings take a dive on investment, slowing sales; workers get $6,900 in profit sharing

Thu, Jan 29 2015Ford Motor Company's pre-tax profits for 2014 took a beating, falling to $6.3 billion, a $2.3-billion drop from 2013, while overall revenues fell from $139.4 billion to $135.8 billion. Net income for 2014, meanwhile, plunged 56 percent, from $7.18 billion to $3.19 billion. Yeah, those aren't great numbers. While Ford's figures are largely down across the board, some of the weaker numbers aren't too difficult to explain away. The company launched 24 vehicles across the globe in 2014, including some of its biggest and most important volume models, like the 2015 F-150, as well as iconic offerings like the new Mustang. The result of this is both increased investment as well as a drop in total sales – US market numbers were down 164,000 units compared to 2013. Recall claims and high warranty costs also did a number on the Blue Oval. "2014 was a solid yet challenging year for Ford - with our investments and a record number of new products launched around the world positioning us for strong growth this year and beyond," Ford CEO Mark Fields said in a statement. Ford's 50,180 UAW workers in the United States will receive profit-sharing checks of $6,900. In some markets, Ford's fortunes were impacted by outside factors. Europe, for example, recorded more sales (up 70,000 units) and higher revenues (up $2.2 billion), but still reported a $443-million pre-tax loss. Blame was placed on the crumbling Russian economy, which has suffered from sanctions and slumping oil prices. Despite its troubles last year, the company still seems bullish on 2015. Ford's pre-tax outlook remains unchanged, as the company expects to make anywhere from $8.5 to $9.5 billion on the back of higher revenue from the company's automotive operations. We expect strong growth and improved financial performance in 2015 driven by our investments in new products and capacity," Ford CFO Bob Shanks said of the company's future.