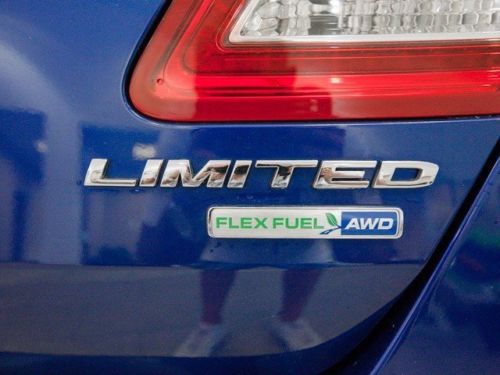

Limited 3.5l Cd Awd 3.5l Ti-vct V6 Ffv Engine (std) Power Steering Abs on 2040-cars

Hilton Head Island, South Carolina, United States

Ford Taurus for Sale

1993 ford taurus sho 3.0 5 speed

1993 ford taurus sho 3.0 5 speed Sho 3.5l cd awd 3.5l v6 ecoboost engine (std) turbocharged power steering abs(US $25,000.00)

Sho 3.5l cd awd 3.5l v6 ecoboost engine (std) turbocharged power steering abs(US $25,000.00) New limited sync leather heated premium wheels sunroof backup camera remotestart

New limited sync leather heated premium wheels sunroof backup camera remotestart Sho 3.5l cd awd 3.5l v6 ecoboost engine (std) turbocharged power steering abs(US $31,500.00)

Sho 3.5l cd awd 3.5l v6 ecoboost engine (std) turbocharged power steering abs(US $31,500.00) Many new parts.good car for little money(US $7,500.00)

Many new parts.good car for little money(US $7,500.00) Ford taurus se sedan 4-door 3.0l,2005

Ford taurus se sedan 4-door 3.0l,2005

Auto Services in South Carolina

Williams Tire & Auto Service ★★★★★

Sully`s Wholesale ★★★★★

Steel City Service ★★★★★

Simmons Auto Collision Inc ★★★★★

Robert Smith`s Repair Shop ★★★★★

Right Choice Automotive ★★★★★

Auto blog

Ford hurt by 2015 F-150 production restraints

Tue, Mar 10 2015The new 2015 Ford F-150 came out of the gate strong for January 2015 with all F-Series sales up 17 percent for the month. However, February tempered those gains a bit with the model line dipping 1.2 percent, and the Ford brand itself dropped 1.7 percent year-over-year. The fall is being blamed in part on tight supply of the latest pickup. A major factor holding back the 2015 F-150 is that they are only currently being made at the Dearborn Truck Plant. The Kansas City factory is still changing over, and full supply from them both is expected by the middle of the year. Ford also just announced plans to hire an extra 1,550 people to build the pickups, including 900 in Kansas City. However, the downtime in the assembly changeover has caused about 90,000 units in lost production since mid-2014, according to The Detroit Free Press. It's not all bad news for the pickup, though. The latest F-150 made up 21 percent of F-Series sales in February, according to The Detroit Free Press, up from 18 percent in the previous month, and they remained on dealer lots an average of 18 days. The lessened supply has also meant lower incentives. Mark LaNeve, Ford's US marketing boss, told the Free Press that average F-150 transaction prices were up $2,000 from last year. He also indicated that retail figures grew seven percent in February, while F-Series fleet numbers were down 18 percent. The constrained supply does come at an inopportune time for Ford, though. This year is expected to be huge for pickups. Also, lower gas prices appear to be pushing people towards SUVs and trucks recently. Related Video:

Gas-electric hybrid vehicles are getting a boost from Ford, others

Wed, Aug 23 2023DETROIT — Hybrid gasoline-electric vehicles may not be dying as fast as some predicted in the auto sectorÂ’s rush to develop all-electric models. Ford Motor is the latest of several top automakers, including Toyota and Stellantis, planning to build and sell hundreds of thousands of hybrid vehicles in the U.S. over the next five years, industry forecasters told Reuters. The companies are pitching hybrids as an alternative for retail and commercial customers who are seeking more sustainable transportation, but may not be ready to make the leap to a full electric vehicle. "Hybrids really serve a lot of America," said Tim Ghriskey, senior portfolio strategist at New York-based investment manager Ingalls & Snyder. "Hybrid is a great alternative to a pure electric vehicle; it's an easier sell to a lot of customers." Interest in hybrids is rebounding as consumer demand for pure electrics has not accelerated as quickly as expected. Surveys cite a variety of reasons for tepid EV demand, from high initial cost and concerns about range to lengthy charging times and a shortage of public charging stations. “With the tightening of emissions requirements, hybrids provide a cleaner fleet without requiring buyers to take the leap into pure electrics,” said Sam Fiorani, vice president at AutoForecast Solutions. S&P Global Mobility estimates hybrids will more than triple over the next five years, accounting for 24% of U.S. new vehicle sales in 2028. Sales of pure electrics will claim about 37%, leaving combustion vehicles — including so-called “mild” hybrids — with a nearly 40% share. S&P estimates hybrids will account for just 7% of U.S. sales this year, and pure electrics 9%, with internal combustion engine (ICE) vehicles taking more than 80%. Historically, hybrids have accounted for less than 10% of total U.S. sales, with ToyotaÂ’s long-running Prius among the most popular models. The Japanese automaker has consistently said hybrids will play a key role in the company's long-range electrification plans as it slowly ramps up investment in pure EVs. Ford is the latest to roll out more aggressive hybrid plans. On its second-quarter earnings call in late July, Chief Executive Jim Farley surprised analysts, saying Ford expects to quadruple its hybrid sales over the next five years after earlier promising an aggressive push into all-electric vehicles. “This transition to EVs will be dynamic,” Farley told analysts.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.