1991 Ford Mustang Lx Hatchback 2-door 5.0l on 2040-cars

Nanuet, New York, United States

Body Type:Hatchback

Engine:5.0L 302Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Make: Ford

Model: Mustang

Trim: LX Hatchback 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Options: Cassette Player

Mileage: 133,000

Power Options: Power Locks, Power Windows

Sub Model: LX

Exterior Color: Gray

Interior Color: Black

YOU ARE BIDDING ON A 1991 MUSTANG LX 5.0. THE VEHICLE HAS NO BODY RUST AND RUNS GREAT. THE ENGINE AND TRANS ARE IN GREAT CONDITION WITH NO LEAKS OR SMOKE.

ADDITIONS:

COLD AIR INTAKE

SHIFT KIT

373 GEARS

WHAT IN NEEDS:

A/C WAS TAKEN OUT BY PREVIOUS OWNER, IT HAS A SMALL DENT ON THE DRIVERS SIDE DOOR, THE DRIVERS SIDE REAR MOLDING IS CRACKED, THE FRONT BUMPER PASS SIDE IS CRACKED (SEE PICS) AND THE HEAT ONLY WORKS ON HIGH.

THE CAR IS VERY DEPENDABLE, IT STARTS RIGHT UP AND GOES. IT HAS VERY GOOD TIRES, BRAKES AND STRUTS WERE DONE ABOUT 5K AGO. THERE ARE NO TEARS IN THE INTERIOR ITS ACTUALLY IN GOOD CONDTION FOR THE AGE. THE HEAD LINER IS IN GREAT CONDTION. I NEVER SKOKED IN IT, NEITHER DID THE PREVIOUS OWNER. I AM AN HONEST PERSON AND WOULD LIKE TO SEE THAT IN RETURN. IF YOU HAVE LESS THAN 10 FEEDBACK PLEASE CONTACT ME FIRST, $500.00 IS REQUIRED WITH IN 24 HOURS OF THE AUCTION ENDING. ANY QUESTIONS PLEASE CONTACT ME.

Ford Mustang for Sale

11 aluminum 19" wheels carbon fiber automatic leather 23k coupe candy red

11 aluminum 19" wheels carbon fiber automatic leather 23k coupe candy red Convertible, black, 17,000 miles, automatic

Convertible, black, 17,000 miles, automatic 1968 ford mustang 302 j-code coupe automatic with disc & powersteering

1968 ford mustang 302 j-code coupe automatic with disc & powersteering 1987 mustang gt convertible 5.0 5spd red on red 36k miles in mint condition(US $21,500.00)

1987 mustang gt convertible 5.0 5spd red on red 36k miles in mint condition(US $21,500.00) Mustang, gt, 2013, low milage, california special, 5.0, red, m

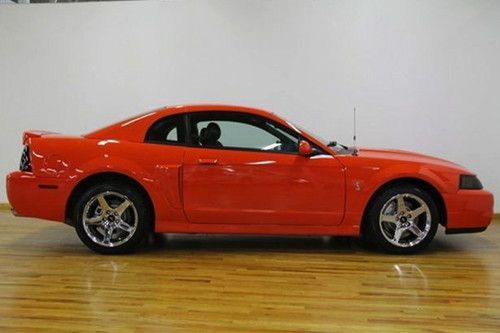

Mustang, gt, 2013, low milage, california special, 5.0, red, m 2004 mustang svt cobra rare comp orange flawless low reserve must see

2004 mustang svt cobra rare comp orange flawless low reserve must see

Auto Services in New York

Tones Tunes ★★★★★

Tmf Transmissions ★★★★★

Sun Chevrolet Inc ★★★★★

Steinway Auto Repairs Inc ★★★★★

Southern Tier Auto Recycling ★★★★★

Solano Mobility ★★★★★

Auto blog

Ford could post best-ever profits in Q1 2013

Tue, 23 Apr 2013Analysts are saying that Ford Motor Company may have earned a record $2.7 billion pretax profit in North America during the first quarter of 2013, a number that represents its highest first quarter profit ever. The impressive earnings are further proof that the American automaker is making a solid comeback as the economy begins to recover.

Morgan Stanley and JP Morgan Chase are estimating that Ford's first quarter North American profit may have topped 12 percent. The firm cited the automaker's fresh lineup, but noted that CEO Alan Mulally needs to uphold the pace as the company works to gain ground in the car and utility segments.

Ford's success has been led by increased demand for its F-Series pickup, the best-selling vehicle in the US for 31 years, and by the Fusion sedan that recently recorded its best-ever quarterly sales in the domestic market. Ford is expected to release its first-quarter revenue on Wednesday, of this week.

Ford defends plan to shareholders: ‘We're simply reinventing the American car’

Fri, May 11 2018Ford's top executives took heat from shareholders over their plan to do away with sedans as we know them in Ford's North American lineup, as the company held its annual meeting Thursday. Critics said the plan to shelve the Fiesta, Focus and Taurus, reduce the Focus to one crossover model, and concentrate on high-margin trucks and SUVs was a shortsighted abandonment of entire market segments of affordable vehicles. "This doesn't mean we intend to lose those customers," Ford CEO Jim Hackett said. "We want to give them what they're telling us they really want. We're simply reinventing the American car." Ford has said SUVs/crossovers and pickups will constitute 90 percent of its North American lineup by 2020. And though only the Mustang and new Focus Active will remain, it plans to add new vehicles going forward that offer better fuel economy and utility, including EVs and hybrids. Hackett characterized the shift not as an abandonment of traditional cars but as a transformation of them. "We don't want anyone to think we're leaving anything," Hackett said. "We're just moving to a modern version. This is an exciting new generation of vehicles coming from Ford." It was Hackett's first annual meeting as CEO, and for the second year it was conducted online rather than in person. The change to Ford's lineup is part of Hackett's overall plan to cut $25.2 billion in costs by the year 2022. Executive Chairman Bill Ford Jr. blamed the negative reaction to the lineup plan on media coverage. "I wish the coverage had been a little different," he said. "If you got beyond the headline, you'll see we're adding to our product lineup and by 2020 we'll have the freshest showroom in the industry. The headlines look like Ford's retreating. In fact, nothing could be further from the truth." While Ford was clear about its plans for the Blue Oval, it has been less clear about the Lincoln brand. Hackett on Thursday said only that the Lincoln Continental, re-introduced just two years ago, would continue "through its life cycle" — but it has been such a slow seller that rumor has Ford killing the Continental again after that, and Hackett made no mention of a new generation. Presumably the MKZ sedan will go away when its twin the Ford Fusion does, but although Ford has outlined end dates for other models, the Fusion's departure is open-ended. The stock price has been a frustration for investors for years and has fallen 12 percent since the first of the year.

Verizon buys Telogis in connected vehicle market push

Wed, Jun 22 2016(Note/disclaimer: We are owned by Verizon, by way of AOL. This gives us no inside track whatsoever when it comes to news.) With a lot of tech companies and automakers staking their claims in the connected car space, now there are signs that others are looking to move in, too. Today, telecoms giant Verizon announced that it is acquiring Telogis, a California-based company that develops cloud-based solutions for mobile workforces, and specifically telematics, compliance and navigation software used by Ford, Volvo, GM and other car companies, as well as Apple and AT&T. Financial terms of the deal have not been disclosed, although we'll try to find out. Considering that Verizon in 2015 reported full-year revenues of $131.6 billion, the price would have to be very high to be considered "material" and may not be made public for some time, if ever. Telogis in its time as a startup raised a substantial amount of money, just over $126 million in all, including $93 million in 2013, supposedly ahead of an IPO, all from Kleiner Perkins Caufield & Byers. Back in 2013 when KPCB made its investment (which was the first from a VC firm in the company), Telogis told TechCrunch it was profitable and forecasting revenues of $100 million annually for the year. It's not clear what size those revenues are now, but if it was on the same growth trajectory as before the funding, sales would be around $150 million annually, with profitability, at the moment. Other investors include some very notable strategics: the investment arm of General Motors, and Fontinalis Partners, which also invests in Lyft and was co-founded by Bill Ford, the executive chairman of the Ford Motor Company. Before the acquisition, Verizon actually had a business in fleet management and telematics; in fact, the two companies competed against each other for business from the trucking and other industries. Verizon Telematics, as the business is called, is active in 40 countries. But in a way, Verizon buying Telogis is a sign that the latter may have proved to be the more superior, and the one with the key customer deals.