1967 Ford Mustang - Great Options, Including Tach, Deluxe Interior + V8 on 2040-cars

Monroe, Washington, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: Ford

Model: Mustang

Mileage: 71,323

Warranty: Vehicle does NOT have an existing warranty

Sub Model: Deluxe

Exterior Color: Gold

Interior Color: Tan

Ford Mustang for Sale

1966 ford mustang. 98,883 orig. miles! deluxe coupe! second owner! pony int.1965

1966 ford mustang. 98,883 orig. miles! deluxe coupe! second owner! pony int.1965 2012 ford mustang 2dr cpe boss 302 1-owner like new(US $43,900.00)

2012 ford mustang 2dr cpe boss 302 1-owner like new(US $43,900.00) 2013 ford mustang v6 automatic leather grabber blue 7k texas direct auto(US $21,980.00)

2013 ford mustang v6 automatic leather grabber blue 7k texas direct auto(US $21,980.00) 1991 mustang lx 5.0 5 speed coupe notch flowmaster systemax k member 302 4.10 gt

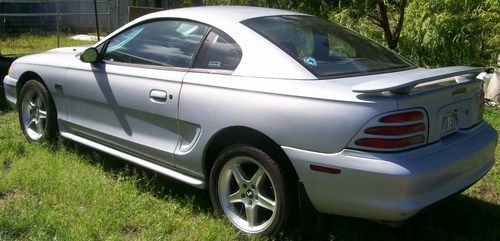

1991 mustang lx 5.0 5 speed coupe notch flowmaster systemax k member 302 4.10 gt 1995 ford mustang gts coupe 2-door 5.0l(US $6,099.00)

1995 ford mustang gts coupe 2-door 5.0l(US $6,099.00) 2008 ford mustang deluxe convertible automatic only 51k texas direct auto(US $15,780.00)

2008 ford mustang deluxe convertible automatic only 51k texas direct auto(US $15,780.00)

Auto Services in Washington

Xtreme Car Audio & Tint ★★★★★

West Seattle Brake Service ★★★★★

United Battery Systems Inc ★★★★★

Skys Auto Repair & Detailing ★★★★★

Setina Manufacturing Co. ★★★★★

Salvage Yard Guru ★★★★★

Auto blog

Ford board OK with Mulally stepping down earlier

Fri, 06 Sep 2013Ford's board is open to CEO Alan Mulally stepping down before his planned departure in 2014, inside sources are telling Reuters. Ford's plan of succession, aside from who would be his actual successor, has been something approaching common knowledge - the 68-year-old former Boeing exec had plans to stay through 2014. This was recently confirmed by Mulally himself on Bloomberg Television and in Automotive News.

Motivation for the about-face comes from what Reuters calls a "growing confidence" in the current crop of Ford execs, led by Mark Fields. Fields, Ford's current chief operating officer, has been tipped as Mulally's ultimate successor, although he's far from the only person with eyes on Ford's top job. Normally, Ford's board saying they're open to an executive, that's done very well for the company, stepping down early would be nearly unremarkable. It's the timing of this announcement, though, that makes this a big piece of news.

Recently, Mulally has been the subject of rumors that he's interested in taking the CEO position at tech giant Microsoft. The Redmond, Washington-based company's CEO, Steve Ballmer, told the media in August that he'd be retiring in a year's time. The fires were stoked when tech website AllThingsD speculated that Mulally would take the top spot, despite denials from the man himself. Could Ford's current boss become the new top dog at Microsoft? Will Mark Fields replace him? Could recently departed Renault exec Carlos Tavares land at Ford in some capacity? Let us know what you think below in Comments.

How did Ford keep the GT a secret before Detroit?

Mon, Feb 2 2015True secrecy is a rarity in the automotive industry. Sure, companies try to keep their future projects under wraps all of the time, but usually a spy shot or blurry development photo leaks out. The complete lack of any hard details before its unveiling likely helped make the Ford GT one of the biggest stars of the 2015 Detroit Auto Show. Not only was it the favorite of Autoblog's editors, but the supercar scored a prestigious EyesOn Design Award, too. Rumors about the vehicle had circulated for weeks before the show, but no one really knew much about the GT until it rolled onto the stage for Ford's press conference in Joe Louis Arena. Amazingly, the Blue Oval kept things mostly a secret during the car's 14- month gestation period prior to its debut. According to Automotive News, the GT project began in late 2013 by a skunk works team, including six designers, that guided the supercar along from birth until the unveiling. Ford kept things clandestine by locking the vehicle in a basement storage room, and only the group members got a key to the lock. Much of the development was also done at night to further keep the secret, but occasionally the prototype was hauled outside on weekends to check it out in natural light. Because of the speed in getting the development done and for even more stealth, the designers didn't get input from the Blue Oval's other styling teams around the world. But that was somewhat of a double-edged sword. "You don't actually get to bounce opinions off people," Ford design boss Moray Callum said to Automotive News. "We were on tenterhooks ourselves until the first people saw it." Even now, there are still mysteries surrounding the GT. There's still no official word on the supercar's power; just that it's over 600 horsepower. There are also the persistent rumors going back months that the Blue Oval plans to take the GT racing to celebrate the 50th anniversary of automaker's Le Mans victory. Although, maybe this time the secrecy wasn't so good because we might have got a glimpse of the racer, recently. Related Video:

1994 McLaren F1 LM-Specification fetches $19.8M at Monterey

Mon, Aug 19 2019The botched sale of that World War II-era 1939 Porsche Type 64 may have somewhat overshadowed the RM Sotheby’s auction last weekend at Monterey, but the event wasnÂ’t without its highlights. Exhibit A: The one-of-two 1994 McLaren F1 LM-Specification supercar that we told you about a month ago netted a whopping $19.8 million at the RM SothebyÂ’s auction last weekend in Monterey, and an almost equally rare 1965 Ford GT40 Roadster Prototype also netted seven figures. The F1 is one of 106 examples ever built and one of just two in LM-Specification (the LM stands for “Le Mans”). McLaren upgraded the standard F1 at the factory post-production, adding a 680-horsepower GTR engine, an extra-high downforce coachwork kit highlighted by the massive rear wing, race-spec dampers, two more radiators and so forth. It also gained a more comfortable interior and creature comforts, with an upgraded air conditioning, radio, new headlights and a different steering wheel. Finally, the exterior was given a coat of silver paint, replacing the factory blue. Four bidders spent four-and-a-half minutes trying to outbid one another for the car, which eventually went to an unidentified American private collector. Also successfully auctioned on Friday: the 1965 Ford GT40 Roadster Prototype for $7.65 million, which fell right in line with expectations of between $7 million and $9 million. It helped pave the way for the Mark IV race cars that won the 24 Hours of Le Mans. As a reminder, it was the first of five GT40 Roadster Prototypes ever built, with seven hardtop versions also built, and it underwent a full restoration in 1983 and a mechanical overhaul in 2003. And it sure is pretty to look at.