Ford F-250 2005 - 5-spd Auto - Cloth Interior - Etr Am/fm Stereo on 2040-cars

Bordentown, New Jersey, United States

Engine:5.4L 3-Valve SOHC EFI Triton V8

Transmission:Automatic

Vehicle Title:Salvage

Make: Ford

Number of Doors: 2

Model: F-250

Airbag: Dual Air Bags

Radio: AM/FM Radio ETR AM/FM Stereo w/Digital Clock

Drive Type: A

Roof: Hard Top

Mileage: 126,653

Interior: Cloth Interior

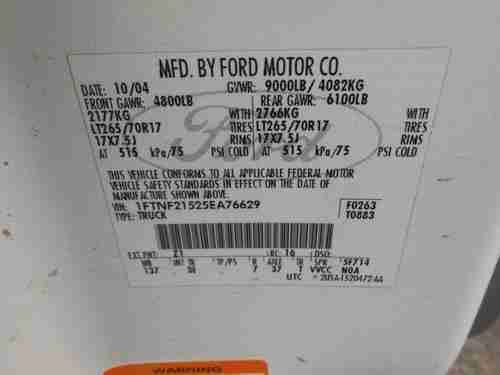

Tires:: LT265/70Rx17E BSW A/T (5)

Warranty: Vehicle has an existing warranty

Wheels: 17" Argent Painted Steel (5)

Trim: ford 2-door

Ford F-250 for Sale

1989 ford f-250 custom standard cab pickup 2-door 5.8l(US $3,000.00)

1989 ford f-250 custom standard cab pickup 2-door 5.8l(US $3,000.00) Crewcab 4dr 4x4 lariat turbo diesel leather loaded!!!!!(US $7,989.00)

Crewcab 4dr 4x4 lariat turbo diesel leather loaded!!!!!(US $7,989.00) 2011 ford f-250 super duty fabtech crew cab 6.7l bmf 22x37 toyo never off road!(US $53,900.00)

2011 ford f-250 super duty fabtech crew cab 6.7l bmf 22x37 toyo never off road!(US $53,900.00) 1978 ford f-250 ranger reg cab 2wd 460 v8 no reserve

1978 ford f-250 ranger reg cab 2wd 460 v8 no reserve 2000 ford f-250 7.3 diesel crew cab pickup 4x4

2000 ford f-250 7.3 diesel crew cab pickup 4x4 Extracab 4dr 4x4 turbo diesel automatic loaded!!!!!!!!!!(US $5,989.00)

Extracab 4dr 4x4 turbo diesel automatic loaded!!!!!!!!!!(US $5,989.00)

Auto Services in New Jersey

World Jeep Chrysler Dodge Ram ★★★★★

VIP HONDA ★★★★★

Vespia`s Goodyear Tire & Svc ★★★★★

Tropic Window Tinting ★★★★★

Tittermary Auto Sales ★★★★★

Sparta Tire Distributors ★★★★★

Auto blog

Cheap gas has Ford investors nervous over 2015 F-150

Wed, Dec 17 2014Gasoline in the US continues its weeks-long descent with prices down about 13 cents a gallon over last week to $2.544, which is lower by around 69 cents/gallon from this time last year, according to the US Energy Information Administration. Many drivers are welcoming the lower bills at the gas station as a fantastic holiday gift, but Ford investors are somewhat spooked over the potential sales implications for the 2015 F-150. Market analyst Rod Lache of Deutsche Bank recently downgraded Ford's stock from a buy to hold, according to TheDetroitBureau.com, and his report to investors may have played a part in a drop in the company's share price. Lache praised the truck's powertrain and lightweight technology, but wrote, "We question whether consumers will pay the price for this content with $2-$3 gas," in his report, according to the website. Whether buyers actually turn away from the F-150 is mostly speculative at this point because it only recently began production. With around 700 pounds of weight loss thanks in parts to its new aluminum parts, the latest Ford pickup offers up to 26 miles per gallon on the highway, plus segment-best payload and towing ratings. Prices are up somewhat in part to pay for additional standard features, though. Still, any further dip in Ford's stock is bad news this year. According to TheDetroitBureau.com, the company's shares are down about 7.5 percent this year. On December 15, the price fell to $14.28, the lowest since November 10. Related Video:

Ford to ramp up Lincoln rollout in China in bid to catch rivals

Thu, Apr 12 2018DETROIT/BEIJING — Ford Motor Co's premium Lincoln brand plans to build as many as five new vehicles in China by 2022, according to two U.S. sources, in a move to expand sales in the world's largest vehicle market that would also blunt the impact of trade U.S.-China trade spats. Ford has said it plans to build an all-new sport utility vehicle in China by the end of 2019, however the company has not detailed future production plans for the Lincoln brand in China beyond that. "Our localization plans to support the China market are on track and will serve to further drive Lincoln's growth in China," Lincoln spokeswoman Angie Kozleski said. "Beyond that, it would be premature to discuss our future product and production plans or timing." Sources familiar with Ford's production plans told Reuters the automaker now expects to begin building the new Lincoln Aviator in China in late 2019 or early 2020, along with replacements for the MKC compact crossover and the MKZ midsize sedan, followed in 2021 by the all-new Nautilus, which replaces the Lincoln MKX crossover. A fifth model, a small coupe-like crossover, is tentatively slated for production in China in 2022, the sources said. Ford has much to lose if the war of words over trade between China and U.S. President Donald Trump escalates into a full-blown tariff war. Last year, it shipped about 80,000 vehicles to China from North America, more than half of them Lincolns to support the brand's growth. All Lincoln vehicles that Ford now sells in China are brought in from North America. Even if China does reduce its 25 percent tariff on imported vehicles - as Chinese President Xi Jinping promised on Tuesday - it is not clear that would mean a big, long-term increase in Fords and Lincolns made in U.S. factories heading to Chinese showrooms. Ford is pursuing long-range plans to build more vehicles in China to serve a market that is now roughly 60 percent larger than the U.S. market, and projected to keep growing. But it is playing catch up to hometown rival General Motors Co and German luxury brands including Audi, BMW and Mercedes-Benz, which have invested heavily in Chinese production in recent years as a form of insurance against trade, political and currency gyrations and to lower price points for their premium cars.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.