2002 Ford Excursion Limited Sport Utility 4-door 7.3l on 2040-cars

Costa Mesa, California, United States

Vehicle Title:Clear

Transmission:Automatic

Body Type:Sport Utility

Fuel Type:Diesel

For Sale By:Dealer

Model: Excursion

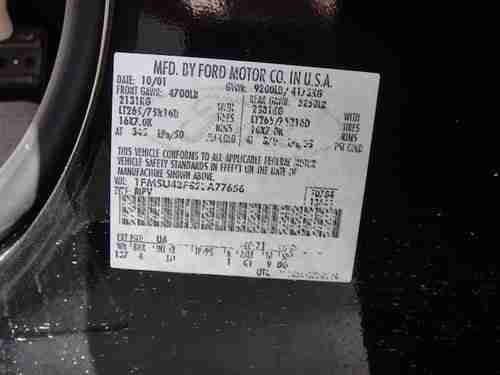

Make: Ford

Mileage: 91,007

Trim: Limited Sport Utility 4-Door

Exterior Color: Black

Interior Color: Tan

Drive Type: 4WD

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

Options: 4-Wheel Drive, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Disability Equipped: No

Ford Excursion for Sale

2005 ford excursion diesel one owner 4x4 clean florida truck must see(US $26,995.00)

2005 ford excursion diesel one owner 4x4 clean florida truck must see(US $26,995.00) 05 excursion 3 rows!! what a clean fla truck!!(US $7,900.00)

05 excursion 3 rows!! what a clean fla truck!!(US $7,900.00) 2001 ford excursion limited sport utility 4-door 7.3l(US $35,999.00)

2001 ford excursion limited sport utility 4-door 7.3l(US $35,999.00) Diesel limited 3rd row tan heated power leather seats black exterior park assist(US $29,777.00)

Diesel limited 3rd row tan heated power leather seats black exterior park assist(US $29,777.00) Ford excursion 2004 eddie bauer 6.0 diesel 4wd super clean low reserve set a+

Ford excursion 2004 eddie bauer 6.0 diesel 4wd super clean low reserve set a+ Excursion 250" dual axle limo limousine, worlds longest seats 28 roman empire !!(US $29,900.00)

Excursion 250" dual axle limo limousine, worlds longest seats 28 roman empire !!(US $29,900.00)

Auto Services in California

Woody`s Auto Body and Paint ★★★★★

Westside Auto Repair ★★★★★

West Coast Auto Body ★★★★★

Webb`s Auto & Truck ★★★★★

VRC Auto Repair ★★★★★

Visions Automotive Glass ★★★★★

Auto blog

How tariffs in China could cause a meltdown in the American South

Sun, Aug 25 2019While BMW is clearly a German company, the crossovers that are exceedingly important to it are actually made in Spartanburg, South Carolina. And more than that, the Spartanburg plant (physically located in the town of Greer) is where the corporate know-how and capability for those vehicles is concentrated. These are the vehicles – specifically, the BMW X3, X4, X5, X6, X7 – that drove record growth for the company in 2018, according to BMW. But whatÂ’s most notable about BMW Group Plant Spartanburg, given current events, is that according to the U.S. Department of Commerce it was the largest automotive exporter by value for the fifth year running in 2018. ThatÂ’s worth emphasizing: largest automotive exporter by value. Not GM. Not Ford. BMW. And where might one assume that more than a few of those X vehicles are shipped to? China. Some 360 miles southwest of Spartanburg is Mercedes-Benz U.S. International, Inc., in in Tuscaloosa County, Alabama. It started building vehicles in 1997. Since then, Daimler AG has invested in excess of $5.5 billion in the facility. It manufactures the crossover now known as the GLE, formerly the ML-Class. It also makes the GLE coupe and GLS. Daimler describes the Tuscaloosa facility as “the traditional home of SUV production” for those vehicles. When it reported its global 2018 sales, Daimler noted that on a global basis SUVs account “for more than a third of all Mercedes-Benz sales.” According to the Chinese finance ministry, on December 15th the Chinese government will impose a 25% tariff on automobiles (and a 5% tariff on auto parts) from the U.S. Certainly this is going to have a direct effect on the sales of vehicles that are manufactured in the U.S. and exported to China. BMW and Mercedes are going to take it on the chin for the vehicles that they make in plants that they invested in so heavily in the U.S. Which could potentially mean that people in places like Greer, South Carolina, and Vance, Alabama, are going to find themselves in the crosshairs of the combatants. Soo too could Lincoln, which produces vehicles in places like Louisville, Kentucky (Navigator), Chicago, Illinois (Aviator) and Flat Rock, Michigan (Continental). Although the Tesla Gigafactory 3 is rapidly nearing completion in Shanghai, it is worth noting that vehicles built in Fremont, California, are being sold in China in numbers that donÂ’t make Musk unhappy.

Ford ditching Microsoft in favor of BlackBerry QNX for next-gen Sync?

Mon, 24 Feb 2014Ask the average consumer - at least, those who follow the goings-on in the automotive industry - which carmaker they'd most closely associate Microsoft, and the answer you'd most likely get would be Ford. The Blue Oval automaker, after all, was at the forefront of bringing Microsoft technology into cars with its pioneering Sync system, and, though reality didn't turn out as such, Ford's CEO was recently touted as a potential future head of the Redmond-based software giant. But that relationship, according to the latest reports, could be coming to an end.

Alan Mullaly kiboshed the idea of leaving Dearborn for Redmond, but more importantly Ford is tipped to be ditching Microsoft in developing its next-generation Sync system. In its place, Ford is expected to partner with BlackBerry's QNX division.

Now, before you go balking "BlackBerry?! But they're finished!" consider that QNX is (or at least was) an independent entity that Research In Motion (as BlackBerry's Ontario-based parent company was then known) just happened to have bought back in 2010. QNX provides control systems to everything from nuclear power plants and UAVs to automakers like Audi, BMW and Porsche.

Verizon buys Telogis in connected vehicle market push

Wed, Jun 22 2016(Note/disclaimer: We are owned by Verizon, by way of AOL. This gives us no inside track whatsoever when it comes to news.) With a lot of tech companies and automakers staking their claims in the connected car space, now there are signs that others are looking to move in, too. Today, telecoms giant Verizon announced that it is acquiring Telogis, a California-based company that develops cloud-based solutions for mobile workforces, and specifically telematics, compliance and navigation software used by Ford, Volvo, GM and other car companies, as well as Apple and AT&T. Financial terms of the deal have not been disclosed, although we'll try to find out. Considering that Verizon in 2015 reported full-year revenues of $131.6 billion, the price would have to be very high to be considered "material" and may not be made public for some time, if ever. Telogis in its time as a startup raised a substantial amount of money, just over $126 million in all, including $93 million in 2013, supposedly ahead of an IPO, all from Kleiner Perkins Caufield & Byers. Back in 2013 when KPCB made its investment (which was the first from a VC firm in the company), Telogis told TechCrunch it was profitable and forecasting revenues of $100 million annually for the year. It's not clear what size those revenues are now, but if it was on the same growth trajectory as before the funding, sales would be around $150 million annually, with profitability, at the moment. Other investors include some very notable strategics: the investment arm of General Motors, and Fontinalis Partners, which also invests in Lyft and was co-founded by Bill Ford, the executive chairman of the Ford Motor Company. Before the acquisition, Verizon actually had a business in fleet management and telematics; in fact, the two companies competed against each other for business from the trucking and other industries. Verizon Telematics, as the business is called, is active in 40 countries. But in a way, Verizon buying Telogis is a sign that the latter may have proved to be the more superior, and the one with the key customer deals.