2017 Fiat 500 Abarth on 2040-cars

Engine:1.4L I4 16V MultiAir Turbocharged

Fuel Type:Gasoline

Body Type:2D Hatchback

Transmission:Manual

For Sale By:Dealer

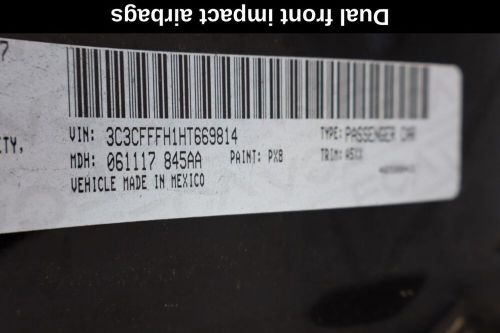

VIN (Vehicle Identification Number): 3C3CFFFH1HT669814

Mileage: 83450

Make: Fiat

Trim: Abarth

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Model: 500

Fiat 500 for Sale

1970 fiat 500 500 coupe - (frame-on restoration)(US $15,998.00)

1970 fiat 500 500 coupe - (frame-on restoration)(US $15,998.00) 2012 fiat 500 pop(US $6,495.00)

2012 fiat 500 pop(US $6,495.00) 1952 fiat 500 topolino(US $21,000.00)

1952 fiat 500 topolino(US $21,000.00) 2017 fiat 500 pop cabrio convertible automatic(US $12,500.00)

2017 fiat 500 pop cabrio convertible automatic(US $12,500.00) 2014 fiat 500l 5dr hatchback trekking 1 owner stickshift turbo fl(US $8,500.00)

2014 fiat 500l 5dr hatchback trekking 1 owner stickshift turbo fl(US $8,500.00) 2016 fiat 500 easy(US $7,999.00)

2016 fiat 500 easy(US $7,999.00)

Auto blog

Ex-Fiat exec: VW diesel scandal will hurt plug-in hybrids

Thu, Apr 7 2016It doesn't sound right at first blush, but former Fiat executive and noted diesel-powertrain expert Rinaldo Rinolfi thinks that plug-in hybrid sales may be more impacted by the VW diesel-emissions scandal than diesel sales. Rinolfi, who worked for Fiat for 40 years, told Automotive News Europe, said that the Euro 6 emissions rules that went into effect in 2015 have already increased diesel-engine production costs enough to raise prices and ultimately flatten demand. By the end of the decade, diesel-vehicle sales will settle in at a 40-percent market share of new European vehicles, and that was going to happen with or without the scandal. "Every carmaker has found ways to achieve fuel consumption and emissions results that have progressively diverged from the real driving conditions." - Rinaldo Rinolfi Makers of plug-in hybrids have more to lose, though, because every PHEV maker has figured out a way to keep emissions figures artificially low, Rinolfi said. Under New European Driving Cycle (NEDC) standards, PHEVs can be tested part of the time with the electric motor in action, meaning emissions get driven down to 30 percent to 40 percent less than real-world figures. With the VW scandal pushing regulators to use real-world figures, those PHEV emissions numbers are expected to rise substantially. To a lesser extent, hybrid emissions figures are also tested as artificially low. "Over the years, even without defeat devices, every carmaker has found ways to achieve fuel consumption and emissions results that have progressively diverged from the real driving conditions the customer experiences," Rinolfi said in the Automotive News Europe interview. Rinolfi is a little sunnier about compressed natural gas (CNG) vehicles, estimating that CNG emissions are as much as 25 percent lower compared to conventional vehicles. As for battery-electrics, he's not so optimistic, estimating that there needs to be at least a tenfold improvement in energy efficiency for EVs to be truly competitive with conventional vehicles. "I've been waiting for a true breakthrough for the past 25 years, but I've not seen it yet," Rinolfi said about EVs in the Automotive News Europe interview. Related Video: News Source: Automotive News Europe-sub.req.Image Credit: Arnd Wiegmann / Reuters Green Fiat Volkswagen Diesel Vehicles Electric Hybrid diesel emissions scandal nedc

2019 Fiat 500X First Drive Review | Anchor's away!

Wed, Aug 14 2019MALIBU, Calif. — We lived with the Fiat 500X for a year and were pleasantly surprised by everything it had to offer but — and this is a big but, a but worthy of Sir Mix-a-LotÂ’s affection — the entire powertrain. ItÂ’s no small feat that the small crossover was able to charm us despite our distaste for the very thing that makes it move. For 2019Â’s mid-cycle facelift, Fiat has addressed that exact issue. Gone is the old, naturally aspirated 2.4-liter inline-four that Fiat called the Tigershark, but we called a boat anchor. It was noisy, unresponsive, and an insult to tiger sharks. We preferred the lower-spec 1.4-liter turbo to the higher-spec 2.4, and suggested that it should be offered on all trims. Now the sole engine on all trim levels is a turbocharged 1.3-liter with stop-start and Multiair III, FiatÂ’s third-generation cam-less variable intake valve system. Fiat also eliminated the front-wheel-drive option for 2019, making all 500Xs all-wheel drive. Though the motor is down three horsepower overall — 177 versus the TigersharkÂ’s 180 — it more than makes up for it in torque. The outgoing engine produced 175 lb-ft at a lofty 3,900 rpm, which wasnÂ’t really useful in real-world driving. The 2019 comes with 210 lb-ft at a mere 2,200 rpm, giving drivers significantly more grunt at the low end. Beyond that, Fiat says the engine is less thirsty than the 2.4-liter — the only engine available in 2018 all-wheel-drive models — returning 24 city and 30 highway mpg. ThatÂ’s 3 mpg better in the city and 1 on the highway, made possible with more efficient technologies like needle roller bearings around the exhaust cam, a variable displacement oil pump, and an integrated charge-air cooler and exhaust manifold. We'll note that the 2018 500X equipped with front-wheel drive, the 1.4-liter turbocharged engine and six-speed manual transmission is still the most efficient of them all, returning 25 city and 33 highway mpg. “The engine is about 80 pounds lighter than the 2.4,” chief engineer Adam Remesz told us, putting total curb weight for the AWD model with 17-inch alloys at 3,305 pounds. Improved efficiency also means reduced CO2 emissions, down from 264 grams per mile to 242. According to Remesz, thatÂ’s “about the amount expelled by an average adult male running a 10k race.” Sure. The new mill mostly addresses our biggest gripe with the 500X. The throttle feels peppier, and rolling acceleration is much improved.

Stellantis and LG announce Canadian EV battery joint venture

Wed, Mar 23 2022SEOUL — South Korean battery giant LG Energy Solution (LGES) said on Wednesday it plans to invest $1.5 billion to set up a joint venture with Stellantis in Canada. LGES owns 51% of the joint venture, tentatively named "LGES-STLA JV" and Stellantis owns 49%, LGES said in a regulatory filing. In October, LGES and Stellantis NV struck an electric vehicle (EV) battery production joint venture, targeting to start production by the first quarter of 2024 and aiming to have an annual production capacity of 40 gigawatt hours of batteries. In a separate regulatory filing, LGES said it plans to acquire a stake worth $542 million in ES America to respond to demand from EV startups in the United States. LGES is considering building a factory in Arizona to meet demand in the United States, two people familiar with the matter told Reuters, adding that the plant is expected to primarily produce cylindrical battery cells. LGES has its own factory in Michigan and two battery joint ventures with General Motors in Ohio and Tennessee. "We are considering a new production site, but nothing has been decided yet," said a spokesperson at LGES. LGES, which counts Tesla, GM and Volkswagen among its customers, currently has battery production sites in the United States, China, Poland, Indonesia and South Korea. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Green Plants/Manufacturing Chrysler Dodge Fiat Jeep RAM Electric