2014 Fiat 500l Easy on 2040-cars

800 N Central Expressway, McKinney, Texas, United States

Engine:1.4L I4 16V MPFI SOHC Turbo

VIN (Vehicle Identification Number): ZFBCFABH8EZ016179

Stock Num: 14F127

Make: Fiat

Model: 500L Easy

Year: 2014

Exterior Color: White

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 16

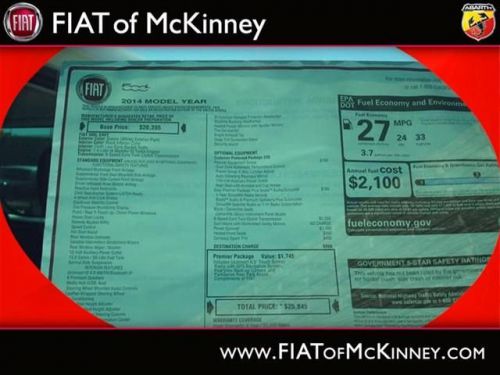

Your lucky day!!! If you've been seeking just the right Vehicle, well stop your search right here... Priced below MSRP!!! Bargain Price!!! Biggest Discounts Anywhere! Special Financing Available: APR AS LOW AS 0% OR REBATES AS HIGH AS $1,500. Your lucky day!!! Great safety equipment to protect you on the road: ABS, Traction control, Passenger Airbag, Curtain airbags, Knee airbags - Driver...Comes equipped with all the standard amenities for your driving pleasure: Bluetooth, Power locks, Power windows, Turbo, Air conditioning...

Fiat 500 for Sale

2014 fiat 500 lounge(US $24,950.00)

2014 fiat 500 lounge(US $24,950.00) 2014 fiat 500l trekking(US $24,995.00)

2014 fiat 500l trekking(US $24,995.00) 2014 fiat 500c abarth(US $29,195.00)

2014 fiat 500c abarth(US $29,195.00) 2014 fiat 500l lounge

2014 fiat 500l lounge 2013 fiat 500 sport turbo

2013 fiat 500 sport turbo 2014 fiat 500 sport turbo

2014 fiat 500 sport turbo

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Fiat Chrysler shares get a boost after revised Stellantis merger deal with PSA

Tue, Sep 15 2020MILAN — Shares in Fiat Chrysler (FCA) rose sharply in Milan on Tuesday after the car maker and French partner PSA revised the terms of their merger deal, with FCA's shareholders getting a smaller cash payout but a stake in another business. FCA and PSA, which last year agreed to merge to give birth to Stellantis, the world's fourth largest car manufacturer, said late on Monday they had amended the accord to conserve cash and better face the COVID-19 challenge to the auto sector. Milan-listed shares in Fiat Chrysler rose almost 8% by 1000 GMT, while PSA gained 1.5%. Under the revised terms, FCA will cut from 5.5 billion euros ($6.5 billion) to 2.9 billion euros the cash portion of a special dividend its shareholders are set to receive on conclusion of the merger. However, PSA will for its part delay the planned spinoff of its 46% stake in car parts maker Faurecia until after the deal is finalized. That means all Stellantis shareholders — and not just the current PSA investors - will get shares in a company which has a market value of 5.8 billion euros. Based on Stellantis' 50-50 ownership structure, FCA and PSA respective shareholders will each receive a 23% stake in Faurecia. Analysts welcomed the 2.6 billion euros in additional liquidity for Stellantis' balance sheet as well as the increase in projected synergies to more than 5 billion euros from 3.7 billion. There was also further reassurance as the two companies confirmed they expected the deal to close by the end of the first quarter of 2021. "All told, the two players emerge as winners," broker ODDO BHF said in a note. "Of the two, FCA might be a bit more of a winner in the short term given the structure of the deal and the numerous payouts to shareholders to come in the quarters ahead (potentially close to 5 billion euros versus the current capitalization of around 16 billion euros)." The special dividend for FCA shareholders had proved contentious after Italy offered state guarantees for a 6.3 billion euro loan to the company's Italian business. "These announcements should, at last, end the debate over the financial terms of the merger, which had become a big topic and was still penalizing the two groups' share performances," ODDO BHF said. PSA and FCA said they would consider paying out 500 million euros to shareholders in each firm before closing or else a 1 billion euro payout to Stellantis shareholders afterwards, depending on market conditions and company performance and outlook.

Fiat set to invest $12B on new models, stop Euro losses in 3 years

Mon, 09 Dec 2013Naturally, you'd expect a massive automaker like Fiat to have an in-depth plan to exit the current European-market doldrums, and you'd expect that plan to include plenty of new vehicles to attract those precious buyers that still remain despite the financial downturn. And you'd be right, though Fiat does seem to have a few unexpected twists up its corporate sleeve.

Perhaps the biggest shocker is a report that Fiat will completely drop the Punto, a car with mass-market appeal aimed at small-car buyers cross-shopping the popular Volkswagen Polo. Its replacement will be a five-door Fiat 500 aimed at upmarket buyers (sounds awfully similar to the 500L) that will be built in Poland. Lower-end customers will reportedly be served by variants of the Fiat Panda.

Borrowing a page from the BMW, Daimler and Volkswagen playbook, reports Automotive News, Fiat is said to have plans to reignite production at its Italian factories by retooling them to build high-end vehicles from Maserati and Alfa Romeo. These will be marketed as premium products, built by skilled Italian workers (who are paid wages that are 75-percent higher than those building Fiats in Poland), and will be sold around the world.

FCA to idle Belvidere Jeep plant again for a week in February

Mon, Feb 3 2020Bloomberg reports that Fiat Chrysler will shut down the Belvidere, Ill., plant that assembles the Jeep Cherokee for a week this month, starting February 17. FCA has been tweaking the plant's headcount and production schedule for a while now, usually downward. The automaker laid off 1,371 workers last February and fired 32 more in May, the same month it eliminated the third production shift. In August, the automaker shut down the plant for one week, then did so again for two weeks last month. As in August and January, FCA explained this month's idling by saying it needs to get production in alignment with demand. Cherokee sales declined 20% in the U.S. last year, helping to account for Jeep's overall 5% domestic drop in 2019. On top of the shutdown, FCA is offering buyouts to certain plant workers among the 3,600 hourly and 300 salaried personnel. The choices are either taking a "separation package" that comes with a $60,000 lump sum payment, or accepting voluntary termination that pays a lump sum based on seniority. Employees that choose a buyout can't return to Chrysler, becoming no longer "eligible for recall, rehire or reemployment." Belvidere personnel have until March 11 to make their decisions. Bloomberg says the aim is to reduce the number of workers with more seniority and higher pay grades; a company spokesperson said the move would "create opportunities for those employees still on layoff," who were lesser-paid. Around 900 of those laid-off workers remain on standby for reassignment to another plant. Analysts predict a soft year for car sales, so FCA might not be the only automaker pruning the rolls. Early estimates have come in below 17 million, and if that comes true, 2020 will be the slowest year since 2014, when 16,531,070 units left lots. The new contract between FCA and the UAW made provisions for Belvidere, which has tempered talk of a total shutdown.The automaker will invest $55 million for "fresh models/features off of the current (KL) platform" that underpins the Cherokee as well as the Chinese-market Jeep Grand Commander (it was previously used for the Dodge Dart and Chrysler 200). Outside of that, some observers think the carmaker could be planning a three-row Chrysler crossover based on the KL platform, akin to the Grand Commander, for the United States. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.