2014 Fiat 500 Lounge on 2040-cars

800 N Central Expressway, McKinney, Texas, United States

Engine:1.4L I4 16V MPFI SOHC

VIN (Vehicle Identification Number): 3C3CFFCRXET267735

Stock Num: 14F198

Make: Fiat

Model: 500 Lounge

Year: 2014

Exterior Color: Green

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 15

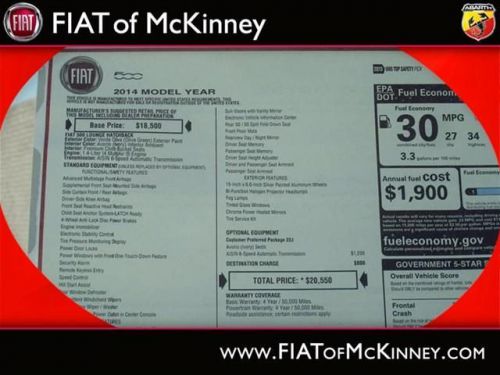

Zoom Zoom Zoom!!! Zoom Zoom Zoom!!! Special Financing Available: APR AS LOW AS 0% OR REBATES AS HIGH AS $1,500. Hold on to your seats!!! FIAT has done it again!!! They have built some superior vehicles and this superior 2014 FIAT 500 Lounge is no exception* Safety equipment includes: ABS, Traction control, Curtain airbags, Passenger Airbag, Front fog/driving lights...NICELY EQUIPPED: wireless phone connectivity - BLUE&ME, Power locks, Power windows, Climate control, Cruise control...

Fiat 500 for Sale

2014 fiat 500l trekking(US $22,787.00)

2014 fiat 500l trekking(US $22,787.00) 2014 fiat 500l trekking(US $24,016.00)

2014 fiat 500l trekking(US $24,016.00) 2013 fiat 500 lounge(US $24,027.00)

2013 fiat 500 lounge(US $24,027.00) 2014 fiat 500l lounge(US $26,295.00)

2014 fiat 500l lounge(US $26,295.00) 2014 fiat 500 lounge(US $25,250.00)

2014 fiat 500 lounge(US $25,250.00) 2014 fiat 500l lounge(US $28,245.00)

2014 fiat 500l lounge(US $28,245.00)

Auto Services in Texas

Xtreme Customs Body and Paint ★★★★★

Woodard Paint & Body ★★★★★

Whitlock Auto Kare & Sale ★★★★★

Wesley Chitty Garage-Body Shop ★★★★★

Weathersbee Electric Co ★★★★★

Wayside Radiator Inc ★★★★★

Auto blog

Ford tops GM in US vehicle sales in May, driven by fleets

Thu, Jun 1 2017DETROIT - Ford, bolstered by heavy sales to fleet customers, surpassed General Motors in US new vehicle sales in May, according to figures reported Thursday. Ford said May sales rose 2.2 percent from a year ago to 241,126 units. GM sales dropped 1.3 percent to 237,364. GM said it had been trimming sales of heavily discounted vehicles to car rental companies. Such fleet sales made up about 19 percent of its total sales in May. Ford's fleet sales rose 8.4 percent, representing more than 34 percent of total sales. The industry average is around 20 percent. Analysts had expected mixed results for the industry, with sales likely propped up by heavy discounts. Fiat Chrysler Automobiles said May sales dipped 0.9 percent to 193,040. Toyota's US sales dropped 0.5 percent to 218,248. Nissan said US sales in May rose 3.0 percent, to 137,471. After demand fell in March and April, analysts estimated May sales at just over 1.5 million. The seasonally adjusted annual rate of sales in May was estimated at 16.8 million to 16.9 million vehicles, about the same as April. A year earlier, sales stood at 17.55 million vehicles. Early reports indicated that sales over the three-day Memorial Day weekend were helped by heavy discounts. "While demand for new vehicles is still relatively strong, it's a bit of smoke and mirrors," said Jessica Caldwell, executive director of industry analysis at Edmunds, the car shopping website. Manufacturers and dealers "really pushed the deals over the holiday weekend to prop up their May numbers," she said. "Incentives were up sharply, and it seems automakers are putting more cash on the hood to nudge car shoppers to buy versus lease." General Motors dealers were offering discounts of up to $12,000 on the full-size Chevrolet Silverado pickup, while some dealer discounts on Ford Motor Co's F-series pickups were more than $10,000 on 2017 models and more than $14,000 on leftover 2016 models. The 2017 model year started eight months ago. Reporting by Paul LienertRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Earnings/Financials Chrysler Fiat Ford GM Nissan Toyota US

UAW may be key to forced FCA merger with GM

Wed, Jul 29 2015Sergio Marchionne doesn't give up on a business deal easily. While outwardly not much has recently been said about FCA's attempted merger with General Motors, Marchionne might be hoping to garner a powerful, new ally that could help break things wide open. The United Auto Workers retiree health care trust is the single largest shareholder of GM with 8.7 percent of the stock, and having its support would certainly improve FCA's position in getting a deal done. "Whatever happens in terms of consolidation, it would never be done without the consent and support of the UAW," Marchionne said when FCA recently began contract talks with the UAW, The Detroit News reports. The boss is also allegedly on good terms with the union president Dennis Williams. Still, using the organization for a hostile takeover could be very difficult because of the way its votes are structured. Other activist investors might already be on board, though. Marchionne believes that consolidation in the industry is vital because automakers are investing to create the same technologies. A GM/FCA merger still has many roadblocks, though, including the fact that Marchionne's company is smaller than GM. From a regulatory perspective, the size of the merged company could raise serious anti-trust concerns among regulators, according to The Detroit News. There's also the concern for lost jobs from redundant work with the two combined businesses. Even if the UAW angle doesn't work out, there are contingency plans afoot for other merger targets. According to The Detroit News speaking to anonymous insiders, FCA bigwigs have a meeting in London on Thursday to take a close look at other options. In addition to GM, they are investigating possible deals with Volkswagen and the Renault-Nissan Alliance. In the past, PSA Peugeot Citroen and multiple Asian automakers have also been brought up as partners, and UBS has reportedly been providing financial advice on what to do.

Interested, then not: Marchionne not 'chasing' a VW merger

Tue, Mar 14 2017Update (March 15, 2017) : Automotive News reports that FCA CEO Sergio Marchionne, regarding the suggested VW and FCA merger, said in a press conference "I have no interest." He also said that he "will not call Matthias," the CEO of VW. He did add that he would be willing to entertain anything VW brings up, but he has "no intention of chasing him." Despite this, Marchionne still took a moment to reinforce his favorable stance concerning mergers and consolidation. Last week, Volkswagen's CEO Matthias Mueller effectively shut down Fiat Chrysler CEO Sergio Marchionne's idea of the two automakers merging. However, it seems Mueller has softened, if only just, to the idea. According to Reuters, the CEO said in a press conference he is "not ruling out a conversation." However, he did say that he would like Marchionne to discuss with him directly the possibility rather than to the media. Though this statement certainly doesn't mean such a merger is happening, it's far more open than when he said outright the company isn't in any talks with anyone at the moment. His new stance also indicates that there may be people (lawyers, accountants, etc.) behind the scenes working out possible ways a merger could work. And even though this new development makes the prospect of a merger between the two companies a bit less bleak, it's still a long way from the "will they, won't they" relationship between GM and FCA. FCA's pursuit of GM involved emailing CEO Mary Barra and the threats of a hostile takeover, the latter of which resulted in some awkward statements about hugs. Only time will tell if VW becomes open enough for Marchionne to talk about hugs again. Related Video: