2013 Fiat 500 Sport Turbo on 2040-cars

800 N Central Expressway, McKinney, Texas, United States

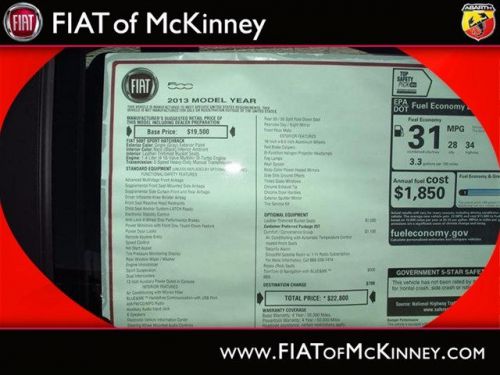

Engine:1.4L I4 16V MPFI SOHC Turbo

Transmission:5-Speed Manual

VIN (Vehicle Identification Number): 3C3CFFHH4DT607220

Stock Num: 13F184

Make: Fiat

Model: 500 Sport Turbo

Year: 2013

Exterior Color: Gray

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 18

All Around stud!! It's ready for anything!!!! Come and get it. Special Internet Pricing on this superb Vehicle!! Incredible price!!! Priced below MSRP! Special Financing Available: APR AS LOW AS 0% OR REBATES AS HIGH AS $2,500! All Around stud!! This gas-saving 2013 500 Turbo will get you where you need to go!!! Great safety equipment to protect you on the road: ABS, Traction control, Passenger Airbag, Curtain airbags, Front fog/driving lights...Oh, and did you notice that it's generously equipped with: wireless phone connectivity - BLUE&ME, Power locks, Power windows, Manual Transmission, Turbo...

Fiat 500 for Sale

2014 fiat 500 lounge(US $22,250.00)

2014 fiat 500 lounge(US $22,250.00) 2014 fiat 500l trekking(US $23,995.00)

2014 fiat 500l trekking(US $23,995.00) 2014 fiat 500l trekking(US $24,945.00)

2014 fiat 500l trekking(US $24,945.00) 2014 fiat 500 pop(US $16,608.00)

2014 fiat 500 pop(US $16,608.00) 2014 fiat 500l trekking(US $23,545.00)

2014 fiat 500l trekking(US $23,545.00) 2014 fiat 500l trekking(US $23,995.00)

2014 fiat 500l trekking(US $23,995.00)

Auto Services in Texas

Z Rated Automotive Sales & Service ★★★★★

Xtreme Tinting & Alarms ★★★★★

Wayne`s World of Cars ★★★★★

Vaughan`s Auto Glass ★★★★★

Vandergriff Honda ★★★★★

Trade Lane Motors ★★★★★

Auto blog

Appeals court delays 'sensible resolution' meeting between GM, Fiat Chrysler CEOs

Tue, Jun 30 2020DETROIT — Three federal appeals judges have delayed a court-ordered meeting between the CEOs of General Motors and Fiat Chrysler to try to settle a lawsuit over corruption by union leaders. U.S. District Court Judge Paul Borman last week ordered GM CEO Mary Barra and FCA CEO Mike Manley to meet before July 1. But GM on Friday asked the federal appeals court in Cincinnati to overturn the order and remove Borman from the case. In an order issued Monday, three appellate judges delayed Borman's order to provide time to consider legal points raised by GM. GM is suing crosstown rival FCA alleging that it got an advantage by paying off United Auto Workers union leaders to reduce labor costs during contract talks. FCAÂ’s former labor chief, Al Iacobelli, is in prison, although the company denies that it directed any prohibited payments. In his order last week, Borman described the lawsuit as a “nuclear option” that would be a “waste of time and resources” for years if he allows the case to move forward. The judge ordered Barra and Manley to sit down without lawyers by July 1 and reach a “sensible resolution of this huge legal distraction.” Borman wants an update from them on a public video conference that same day. Over the weekend he modified the order to allow lawyers to attend the meeting. In a court filing, GM called BormanÂ’s order a “profound abuse” of power. “The court possesses no authority to order the CEOs of GM and FCA to engage in settlement discussions, reach a resolution and then appear alone at a pretrial conference eight days later, without counsel,” GMÂ’s attorneys said. “Second, the court has no business labeling a properly filed federal lawsuit assigned to the court for impartial adjudication ‘a distractionÂ’ or a ‘nuclear option,’” GM said. Borman canÂ’t be viewed as impartial, company lawyers said. The judge declined to comment. In a court filing Monday, Fiat Chrysler lawyers wrote that GM didn't make a good case to remove Borman because judges routinely direct lawsuit parties to talk about settling. The lawyers wrote that GM originally wanted the case assigned to Borman but now apparently is worried that his tough questions mean he will dismiss GM's claims. “GM should not be permitted now to complain that that judge has turned out to be less hospitable to GMÂ’s claims than GM anticipated. Parties are not permitted to engage in such judge shopping," the filing said.

Stellantis reports record margins, $7B profits despite chip shortage

Tue, Aug 3 2021MILAN — Automaker Stellantis on Tuesday said it achieved faster-than-expected progress on synergies and record margins in its first six months as a combined company, despite suffering 700,000 units in lower production due to interruptions in the semiconductor supply chain. The company — formed from French carmaker Peugeot PSAÂ’s takeover of the Italian-American company Fiat Chrysler — reported net profit of 5.9 billion euros ($7 billion) in the first half of 2021, compared with a loss 813 million euros during the same period a year earlier, which was impacted by the coronavirus restrictions around the globe. Shipments rose 44% to 3.2 million units, while revenues rose 46% to 75 billion euros. “We are very pleased with the speed with which the new team has begun to execute as one company, as Stellantis,Â’Â’ Chief Financial Officer Richard Palmer told reporters. Semiconductor shortages accounted for 200,000 units of production losses in the first quarter and 500,000 in the second quarter. Semiconductors are used more than ever before in new vehicles with electronic features such as Bluetooth connectivity and driver assist, navigation and hybrid electric systems. Stellantis achieved 1.3 billion euros in cost savings in the first half, mostly by sharing investments in new technologies and platforms, which Palmer said was a faster rate than initially forecast. It aims to achieve 80% of the targeted 5 billion in cost savings by 2024. “These synergies allow us to continue to invest in the electrification strategy, which we talk about every day,” Palmer said. Stellantis, which lags competitors in rolling out electric vehicles, plans to launch 21 fully electric or plug-in gas electric hybrid vehicles over the next two years. North American posted record profitability on global sales of Ram trucks and the strong launch of the Jeep Wrangler 4xe, which was the best-selling plug-in gas electric vehicle in the United States in the second quarter. Stellantis was the market leader in South America and second in Europe. The results were presented on a pro-forma basis, taking into account the performance of each of the carmakers as separate entities during 2020. Related video: 2021 Jeep Wrangler Rubicon 392 Inside and Out

Autoblog Podcast #380

Tue, May 13 2014Episode #380 of the Autoblog podcast is here, and this week, Dan Roth, Chris Paukert and Seyth Miersma talk about the Fiat-Chrysler five-year plan, the seeming demise of the Nissan Cube, and proposed legislation to require speed limiters with a 68-mph maximum on America's tractor trailers. We start with what's in the garage and finish up with some of your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Check out the new rundown below with times for topics, and you can follow along down below with our Q&A. Thanks for listening! Autoblog Podcast #380: Topics: Fiat-Chrysler five-year plan Nissan Cube on the way out? Big rig speed limiters coming? In the Autoblog Garage: 2015 Mercedes-Benz S63 AMG 2014 Chevrolet Sonic RS Sedan 2014 Honda Odyssey Touring Elite Hosts: Dan Roth, Chris Paukert, Seyth Miersma Runtime: 01:44:17 Rundown: Intro and Garage - 00:00 Fiat Chrysler Plan - 29:40 Nissan Cube - 01:07:33 Semi Speed Limiters - 01:17:33 Q&A - 01:27:35 Get the podcast: [UStream] Listen live on Mondays at 10 PM Eastern at UStream [iTunes] Subscribe to the Autoblog Podcast in iTunes [RSS] Add the Autoblog Podcast feed to your RSS aggregator [MP3] Download the MP3 directly Feedback: Email: Podcast at Autoblog dot com Review the show in iTunes Auto News Earnings/Financials Plants/Manufacturing Podcasts Rumormill Chevrolet Chrysler Dodge Fiat Jeep Nissan nissan cube speed limiters