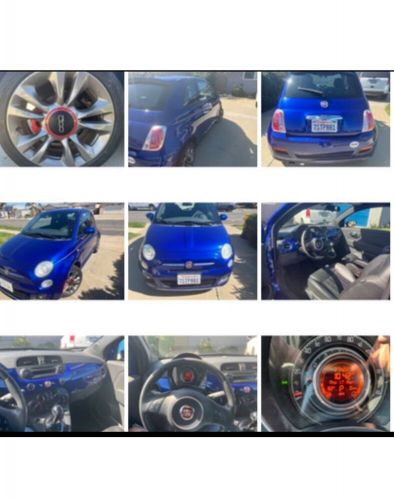

1971 Fiat 500 Coupe - (collector Series) on 2040-cars

Engine:--

Fuel Type:Gasoline

Body Type:--

Transmission:Manual

For Sale By:Dealer

VIN (Vehicle Identification Number): 00000000000000000

Mileage: 111

Make: Fiat

Trim: COUPE - (COLLECTOR SERIES)

Drive Type: --

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Red

Warranty: Unspecified

Model: 500

Fiat 500 for Sale

2014 fiat 500(US $7,900.00)

2014 fiat 500(US $7,900.00) 1970 fiat 500 coupe - (collector series)(US $16,998.00)

1970 fiat 500 coupe - (collector series)(US $16,998.00) 2012 fiat 500 pop cabrio 5-spd(US $11,995.00)

2012 fiat 500 pop cabrio 5-spd(US $11,995.00) 1971 fiat 500 coupe - (collector series)(US $16,998.00)

1971 fiat 500 coupe - (collector series)(US $16,998.00) 2015 fiat 500 sport(US $3,900.00)

2015 fiat 500 sport(US $3,900.00) 2013 fiat 500 lounge(US $1,000.00)

2013 fiat 500 lounge(US $1,000.00)

Auto blog

To grease the skids for Stellantis, PSA offers to boost Toyota's fortunes

Sun, Sep 27 2020BRUSSELS/MILAN — Peugeot maker PSA has offered to boost Japanese rival Toyota to try to address EU antitrust concerns about its plan to create the world's fourth-biggest carmaker, to be called Stellantis, by merging with Fiat Chrysler, people familiar with the matter said on Friday. PSA has offered to increase the production capacity for Toyota in their van joint venture, one of the sources said. Another source said the French company would sell the vans at close to cost. PSA makes vans for Toyota in its Sevelnord plant in northern France. The van collaboration started in 2012. PSA submitted its offer to the European Commission earlier on Friday, three months after the EU enforcer opened a full-scale investigation into the deal with FCA on concerns that it would hurt competition in small vans in 14 EU countries and Britain. "As of now, the transaction has obtained merger clearance in 14 jurisdictions. As previously stated, closing of the transaction is expected to occur in the first quarter of 2021," PSA and FCA said in a joint statement. The Commission, which temporarily halted its investigation into the deal in July while waiting for the companies to provide requested data, did not set a deadline for its decision. "The deadline is still suspended. This procedure in merger investigations is activated if the parties fail to provide, in a timely fashion, an important piece of information that the Commission has requested from them," the EU executive said. It is now expected to seek feedback from customers and rivals before deciding whether to demand more concessions, or either clear or block the deal. Government/Legal Chrysler Fiat Peugeot Stellantis

Order a real color, Fiat says — it's eliminating gray paint

Mon, Jun 26 2023For Fiat aficionados around the world, it’s the dawn of a new dolce vita: The Italians will no longer build gray-colored cars. ItÂ’s a rather bold move, but one you may expect from “the brand of joy, colors and optimism,” declared Olivier Francois, Fiat chief executive officer and global chief marketing officer at Stellantis.“We broke the rules: We decided to stop the production of Fiat gray cars ... Fiat wants to inspire people to live with optimism and positivity, and this will also be one of the missions of the new Fiat 600e, the electric for families and friends." The first Fiat model to delete gray from its palette is the new 600e electric, which is about to debut.  But there remains a colorful antipasto of choices, inspired by “the New Dolce Vita values and the Italian DNA embodied by the Brand.” The current Fiat range — New 500, 500 Hybrid, 500X, Panda and Tipo — will be rendered in Gelato white, Sicilia orange, Paprika orange, Passione red, Blu Dipinto di Blu, Italia blue, Venezia blue, Rugiada green, Foresta green, Rose gold and Cinema black. “All with an evocative name that reminds of Italian beautiful landscapes and dolce vita mood,” says Francois. Gray has historically been a popular shade — Fiat says it's the most popular color for new cars in the UK. It represents more than one in four new cars sold in the UK in 2022, the company says. In the U.S., it's nearly one in every five cars, and automakers have rolled out a new generation of grays that are attempting to be more interesting.Â

FCA earnings improve in first quarter

Thu, Apr 30 2015Following on the recent global financial releases from Ford and from General Motors for the first quarter of 2015, FCA is now putting out its own numbers, and things look quite good for the company. The automaker posted adjusted earnings before taxes and interest of $895 million, a 22-percent jump from Q1 2014, and net profits of $103 million, a $296-million boost from last year. Revenue was also up 19 percent to $30 billion. Despite the favorable figures, actual worldwide shipments fell slightly by 2 percent to 1.1 million vehicles. FCA is giving some credit for these strong Q1 results to the automaker's performance in the NAFTA region. Shipments grew 8 percent to 633,000 vehicles, and net revenue jumped a strong 38 percent to $18.1 billion. Adjusted earnings reached $672 million, compared to $425 million in 2014. The company especially praised the Jeep Renegade, Chrysler 200, and Ram 1500 for helping the bottom line. The numbers could have been even higher, but the corporation admitted that "higher warranty and recall costs" partially drug things down. For the full year in 2015, FCA expects to ship between 4.8 and 5 million vehicles worldwide and post up to $5 billion in adjusted earnings. There should be about $1.3 billion in net profit, as well. FCA CLOSED Q1 WITH NET REVENUES OF ˆ26.4 BILLION, UP 19% AND ADJUSTED EBIT AT ˆ800 MILLION, UP 22% 30/04/15 FCA closed Q1 with net revenues of ˆ26.4 billion, up 19% and adjusted EBIT at ˆ800 million, up 22%. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion. Full year guidance confirmed. Worldwide shipments were 1.1 million units, 2% lower than Q1 2014, reflecting strong performance in NAFTA and weak market conditions in LATAM. Jeep's positive performance continued with worldwide shipments up 11% and sales up 22%. Net revenues were up 19% to ˆ26.4 billion (+4% at constant exchange rates, or CER). Adjusted EBIT was ˆ800 million, up ˆ145 million from Q1 2014, with all segments except LATAM posting positive results. The positive impact of foreign exchange translation was offset by negative impacts at a transactional level. Net profit was ˆ92 million, up ˆ265 million compared to the net loss of ˆ173 million in Q1 2014. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion from year-end mainly due to timing of capital expenditures and working capital seasonality. Liquidity remained strong at ˆ25.2 billion. The Group confirms its full-year guidance.