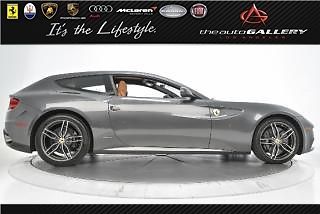

Rare Ff! + Awd + 4 Seats + Low Miles + Nav + Rr Camera + Sport Whls + Red Calip on 2040-cars

Richardson, Texas, United States

Engine:6.3L 6262CC V12 GAS DOHC Naturally Aspirated

Body Type:Hatchback

Fuel Type:GAS

Transmission:Automatic

Year: 2012

Make: Ferrari

Power Options: Air Conditioning, Cruise Control, Power Windows

Model: FF

Doors: 5 or more

Trim: Base Hatchback 2-Door

VIN: ZFF73SKA1C0187049

Cylinders: 12-Cyl.

Drive Type: AWD

Number of Doors: 2

Mileage: 1,332

Exterior Color: Gray

Number of Cylinders: 12

Interior Color: Black

Ferrari FF for Sale

2012 ff 7 year maint ferrari approved cpo warranty msrp $357,800(US $249,900.00)

2012 ff 7 year maint ferrari approved cpo warranty msrp $357,800(US $249,900.00) Coupe 6.3l nav cd 1st row lcd monitors: 1 4 wheel disc brakes abs brakes(US $269,900.00)

Coupe 6.3l nav cd 1st row lcd monitors: 1 4 wheel disc brakes abs brakes(US $269,900.00) Coupe 6.3l nav cd 1st row lcd monitors: 1 4 wheel disc brakes abs brakes(US $289,800.00)

Coupe 6.3l nav cd 1st row lcd monitors: 1 4 wheel disc brakes abs brakes(US $289,800.00) Yellow calipers shields daytona sport exhaust camera rear entertain 20 diamond(US $279,900.00)

Yellow calipers shields daytona sport exhaust camera rear entertain 20 diamond(US $279,900.00) 2012 ferrari ff 2dr hb(US $269,888.00)

2012 ferrari ff 2dr hb(US $269,888.00) 20 inch sport forged diamond wheels- suspension lifter- parking sensors w/ rear

20 inch sport forged diamond wheels- suspension lifter- parking sensors w/ rear

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Ferrari stock falls after new CEO calls Marchionne's goals ‘aspirational’

Thu, Aug 2 2018MILAN — Ferrari's new boss sought to reassure investors that he would execute midterm targets set by his predecessor, Sergio Marchionne, but the stock has fallen by 12.5 percent since Wednesday after he described the goals to 2022 as "aspirational." Louis Camilleri was appointed chief executive of the Italian supercar maker on July 21, succeeding Marchionne, who fell seriously ill and later died after suffering complications following surgery. The sudden change jolted investors who had expected Marchionne, who nearly tripled Ferrari's value since taking it public in 2015, to stay on as CEO and chairman until 2021. It also left Camilleri, 63, to finish scripting a midterm strategy that will be presented in September and is meant to show how the company plans to achieve financial targets unveiled earlier this year, notably a goal to double core earnings to 2 billion euros ($2.33 billion) by 2022. In a post-results conference call with analysts, Camilleri said he and Marchionne, with whom he had interacted for years, shared the same ambitions for the company. The tobacco veteran, chairman and former CEO of Philip Morris International has served on the Ferrari board since 2015, while Marchionne in turn sat on the board of PMI. Asked about how he planned to deliver on the targets set by his predecessor, Camilleri said he would provide details during capital market days to be held on Sept. 17-18 at the company's headquarters in Maranello, Italy. "They are aspirational targets. At the capital markets day, we will tell you how we plan to get there," he said. "We will also have to disclose potential risks to that, but also significant opportunities that we see going forward." Ferrari's Milan-listed shares fell after the comments, and its shares on the New York Stock Exchange fell from a Wednesday high of $134.77 to $117.99 on Thursday morning. Tough act to follow At Ferrari, Camilleri has a tough act to follow. Marchionne orchestrated Ferrari's spinoff from parent Fiat Chrysler, positioned it as a luxury icon rather than a car manufacturer, and managed to do what few thought possible: sail through a self-imposed cap of 7,000 vehicles per year without sacrificing pricing power and exclusive appeal. When its share price hit a record high of 129.90 euros in June, the company that sold just under 8,400 vehicles last year was worth around 24 billion euros, almost as much as Fiat Chrysler, which shipped 4.7 million cars.

Ferrari, not Tesla, might be the stock to buy

Mon, May 8 2017Last week Tesla's earnings – or lack thereof – were one of the big stories in the auto industry. As usual, the electric carmaker didn't make money, but the news sent the market, analysts, and Tesla's devoted fans into a lather. But another company, this plucky upstart called Ferrari, also attracted a positive reaction from the market and actually had the financials to back it up. Ferrari posted net revenues of $898 million (at today's exchange rates) EBITDA of $265 million (a slightly complicated way to snapshot financial performance) and an adjusted net profit of $136 million in the first quarter. The company delivered 2,003 cars, and sales of its V12 models increased 50 percent. It quietly made progress nearly a year and a half into its life as an independent automaker. For 2017, Ferrari expects to deliver 8,400 cars and rake in net revenue of $3.6 billion. No one thought Ferrari would flounder when Fiat Chrysler Automobiles spun it off in fall 2015. With a rich history, expensive products, and its own loyal fan base that's arguably even larger than Tesla's, the company seemed poised for success, though skeptics wondered how it might fare after longtime chief Luca di Montezemolo stepped down before the spinoff. Plus, the company remains within the FCA sphere, as its key stakeholders are largely connected to its former parent in some way, and Chairman Sergio Marchionne also steers FCA. Last week's results showed Ferrari is gaining footing in the evolving automotive world, and analysts responded. UBS analyst Michael Binetti reiterated Ferrari stock (RACE on the NYSE) as buy status and raised his target price from $85 to $92. Morgan Stanley's Adam Jonas was even more bullish, raising projections to $100 in the next 12 months. Shares were trading around $82 Monday morning. Both analysts viewed Ferrari as something different than a conventional automaker stock, with Binetti comparing it to luxury house Hermes, which produces high margins even for a specialty goods maker. Jonas suggested Ferrari's singular reputation and history (16 Formula One Constructors titles, the most ever) could insulate its products when autonomous and electric cars become even more commonplace. "In our view, a Ferrari is not transportation," he wrote in a note to clients. "Ownership is viewed as an exclusive club, and membership requires more than just money.

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.034 s, 7972 u