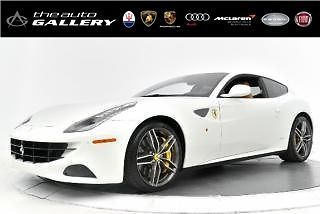

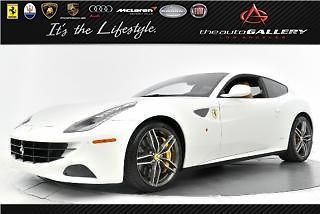

2012 Ferrari Ff Grigio Ferro Metallic With Black Navi Dvd System Only 4600 Miles on 2040-cars

Cleveland, Ohio, United States

Ferrari FF for Sale

2012 ferrari ff 2dr hb(US $265,000.00)

2012 ferrari ff 2dr hb(US $265,000.00) 2012 ferrari ff 2dr hb leather seats traction control security system

2012 ferrari ff 2dr hb leather seats traction control security system Suspension lifter shields parking sensors automatic boot electric leather nero(US $229,900.00)

Suspension lifter shields parking sensors automatic boot electric leather nero(US $229,900.00) 341k msrp! carbon fiber driving zone! panoramic roof! sport exhaust! shields!(US $298,900.00)

341k msrp! carbon fiber driving zone! panoramic roof! sport exhaust! shields!(US $298,900.00) 2012 ferrari ff 2dr hb

2012 ferrari ff 2dr hb 2012 ferrari ff 2dr hb leather seats traction control security system

2012 ferrari ff 2dr hb leather seats traction control security system

Auto Services in Ohio

Weber Road Auto Service ★★★★★

Twinsburg Brake & Tire ★★★★★

Trost`s Service ★★★★★

TransColonial Auto Service ★★★★★

Top Tech Auto ★★★★★

Tire Discounters ★★★★★

Auto blog

For his last act, Marchionne will outline an EV/hybrid roadmap this week

Wed, May 30 2018MILAN/LONDON — Fiat Chrysler (FCA) boss Sergio Marchionne is expected to outline new plans for electric and hybrid cars in a strategy presentation on Friday, aiming to ensure the world's seventh-largest carmaker remains in the race in the absence of a merger. The 65-year-old will present FCA's strategy to 2022, his final contribution to the company he turned around and multiplied in value through 14 years of canny dealmaking. After failing to secure a tie-up he said was necessary to manage the costs of producing cleaner vehicles, Marchionne needs to show the group can keep churning out profits on its own, even as emissions rules tighten, SUV competition intensifies and worries around his succession abound. Marchionne had long refused to jump on the electrification bandwagon, saying he would only do so if selling battery-powered cars could be done at a profit. He even urged customers not to buy FCA's Fiat 500e, its only battery-powered model, because he was losing money on each sold. But Tesla's success and the need to comply with tougher emissions rules have forced Marchionne to commit to what he calls "most painful" spending. "FCA is way behind rivals in terms of hybrid and electric vehicles and they need to hit the accelerator to convince investors they can close that gap," said Andrea Pastorelli, a fund manager at 8a+ Investimenti. Germany's Volkswagen, Daimler, BMW and U.S. rivals GM and Ford have committed to spending billions of euros each in coming years to try produce profitable cars powered by cleaner fuels. FCA needs to present a clear roadmap, just like Volvo Cars, which ditched diesel from its best-selling XC60 SUV, launched a new electric brand and pledged to shift all brands to hybrid by 2019, a banking source close to FCA said, noting: "The tech divide determines winners and losers in the industry." Marchionne has already said half of the wider FCA fleet will incorporate some elements of electrification by 2022, while luxury marque Maserati will spearhead FCA's electrification drive by making all new models due after 2019 electric. But its plans remain vaguer and less advanced than most big rivals and some investors wonder about the capital required to make vehicles compliant, and what share of spending can go to electrification given FCA's numerous demands.

Last Ferrari 275 GTS/4 NART Spider could top $26m at auction

Tue, Apr 19 2016One of the prettiest convertible Ferraris built, the NART Spider is also one of the rarest – only ten cars ever left the factory. This specific car was the last off the line, and has the additional distinction of being the only NART Spider sold new in Europe. It was also the only one painted in the Grigio Scuro shade of medium grey from factory. It has been redone in a tasteful red, which is an interesting change from the usual bright Ferrari color. It is also the third-to-last Ferrari 275 to be built altogether. The NART name stands for North American Racing Team, and the drop-top production run is credited to the U.S. Ferrari distributor Luigi Chinetti, who wanted to boost the 275 model's sales with a limited edition convertible model. Originally, Ferrari planned to build 25 cars, but despite the racing pedigree only ten found owners. The first NART Spider finished second in class at the 1967 12 Hours of Sebring, and the model also has some Steve McQueen cool about it due to a starring role in The Thomas Crown Affair. This car, chassis #11057, was sold new in Madrid to a Spanish Foreign Legion colonel, and spent its first 14 years in Spain. In the early 1980s it was bought by a Swiss collector, who had it restored for the first time, and in the mid-90s it moved to the UK. The current paint scheme dates back to 2001, while the interior's beige leather re-trim is from 2009. Despite a gradual change in appearance, it is a fully numbers-matching car that still retains the 300-horsepower Colombo V12 it received at the Maranello factory. A similar NART Spider was auctioned at RM Auctions' Monterey event in 2013, for a staggering $27.5 million. That specific example, finished in a brighter hue was estimated at 17 million tops, so it will be interesting to see whether this darker car will surpass its estimate at the auction held on May 14th. Related Video: Featured Gallery RM Sotheby's 1968 Ferrari 275 NART Spider View 16 Photos Image Credit: RM Sotheby's Auto News Ferrari Auctions Convertible Classics Steve McQueen RM Sotheby's ferrari 275

What's the smarter investment, Ferrari stock or a Ferrari?

Sun, Jul 26 2015Fiat Chrysler Automobiles is gearing up to spin Ferrari off into its own company, and float some of its shares on the stock market. But buying and trading in Ferrari stock could face a rather unlikely competitor from within. As Bloomberg points out, the values held by classic Ferraris keeps going up, and by no small margin. Even something as relatively humble as the 80s-era Testarossa, for example, has nearly doubled in value over the past year alone. Meanwhile the value of some models – particularly those built in the 1950s, 60s, and 70s – have skyrocketed nearly seven-fold since 2006. Just look at the 250 GTO, one of the most coveted of classic Ferraris among collectors: not taking inflation into account, they were worth thousands in the late 60s, were already selling for hundreds of thousands in the 1980s, and by now are trading hands – on the rare occasion when they do trade hands – for tens of millions. One sold in 2004 for $10 million, and another in 2013 for over $50 million. Those kinds of increases can make a vintage Ferrari seem like a sound investment. That might make it difficult for Ferrari's stock to compete. The company hopes investors will view it as a luxury goods manufacturer along the likes of Prada, Hermes, or Louis Vuitton Moet Hennessy, the stocks of which tend to increase in value at a greater rate than those of most automakers. But even the best of those luxury stocks have merely doubled in value since 2006, compared to the aforementioned seven-fold increase enjoyed by some classic Ferraris over the same period. Add to that the prospect of actually getting to enjoy owning a classic Ferrari – albeit at the risk of damaging it and hindering its value – and the idea of investing in Maranello's products instead of its stock can seem like a much more enticing prospect. Related Video: