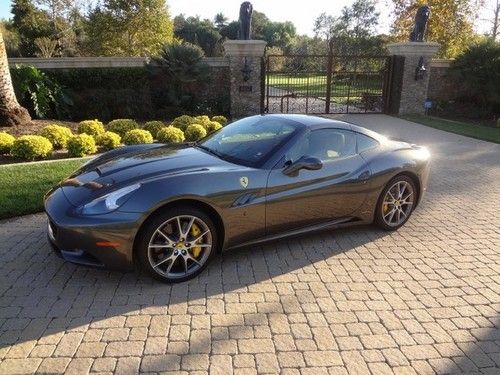

Like New, One Owner, Serviced, Great Color Combo. on 2040-cars

Rancho Santa Fe, California, United States

For Sale By:Dealer

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Transmission:Automatic

Fuel Type:GAS

Warranty: Vehicle does NOT have an existing warranty

Make: Ferrari

Model: California

Trim: Base Convertible 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drive Train: Rear Wheel Drive

Mileage: 4,902

Number of Doors: 2

Exterior Color: Silver

Interior Color: Tan

Number of Cylinders: 8

Cab Type (For Trucks Only): Other

Ferrari California for Sale

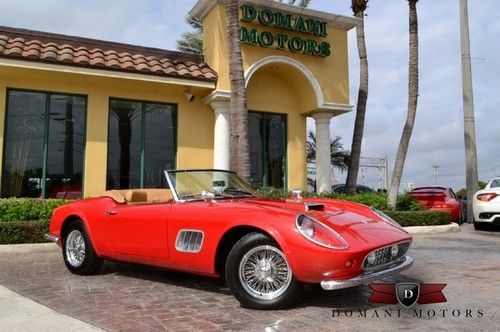

Classic 1961 ferrari california replica, ford 302ci, 5sp tremec, sq. tube chasis(US $79,900.00)

Classic 1961 ferrari california replica, ford 302ci, 5sp tremec, sq. tube chasis(US $79,900.00) 1 owner convertible(US $179,000.00)

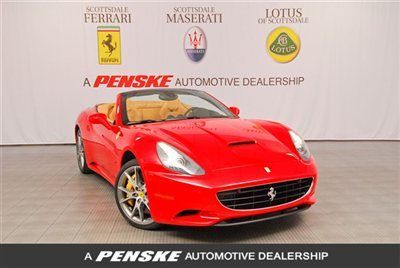

1 owner convertible(US $179,000.00) 2010 ferrari california, 1 owner, loaded, updated services, and only 3,554 miles(US $179,900.00)

2010 ferrari california, 1 owner, loaded, updated services, and only 3,554 miles(US $179,900.00) 2010 ferrari california - 20" wheels-navigation-daytona seats -carbon ceramics!(US $170,500.00)

2010 ferrari california - 20" wheels-navigation-daytona seats -carbon ceramics!(US $170,500.00) 2011 ferrari california with 2300 miles~call today 480-538-4340!(US $212,887.00)

2011 ferrari california with 2300 miles~call today 480-538-4340!(US $212,887.00) 2011 ferrari california cpo ext warranty~magnride~shields~park sensors~like 2012(US $195,000.00)

2011 ferrari california cpo ext warranty~magnride~shields~park sensors~like 2012(US $195,000.00)

Auto Services in California

Woody`s Auto Body and Paint ★★★★★

Westside Auto Repair ★★★★★

West Coast Auto Body ★★★★★

Webb`s Auto & Truck ★★★★★

VRC Auto Repair ★★★★★

Visions Automotive Glass ★★★★★

Auto blog

Ferrari F12 TdF, Tesla Autopilot, Fiat Leadership Change | Autoblog Minute

Sat, Oct 17 2015Ferrari unleashes the F12 TdF, Model S owners get an exciting announcement from Tesla, and Fiat North America undergoes a leadership change. Senior editor Greg Migliore reports on this edition of the Autoblog Minute Weekly Recap. Ferrari Fiat Tesla Autoblog Minute Videos Original Video ferrari f12 tdf

$1.3B worth of classic cars were auctioned in 2014

Sat, Dec 27 2014The collector auto market in the US just continues to expand with the values of vehicles seemingly only growing in the past years, especially if they have a prancing horse on the hood. This year was no different. According to data compiled by classic car insurance agency Hagerty, there were about $1.3 billion worth of vintage rides auctioned in North America in 2014, up just slightly from $1.2 billion crossing the block in 2013. If you want an idea of just how big a role the Monterey Car Week plays in the North American collector hobby, Hagerty's stats illustrate it perfectly. The company recorded $430 million in auction sales during the week – about a third of the entire market for the year. The event also hosted the biggest seller of 2014 when the hammer fell on a 1962 Ferrari 250 GTO (pictured above) for $38.115 million at Bonhams. In fact, vintage Ferraris in general were among the top buys in the classic auto world in 2014. Eight of the ten most expensive vehicles sold at auction were Prancing Horses (the other two were Ford GT40s). Also, the insurance company's price index for these Italian stallions showed a 43-percent gain in value for the year. The market for another Italian supercar is exploding, as well. The Lamborghini Countach showed a staggering 175-percent growth in auction value in 2014. According to Hagerty, the average price when they crossed the block was $736,599. Judging by Hagerty's numbers, there were still some places to look for those hoping to spend a bit less money. The Aston Martin Lagonda showed a strong gain in value with a 32-percent increase in auction price, but they still averaged $47,078. In addition, the company's index for '50s American cars showed only one-percent growth for these classics. These huge leaps in collector car value might be winding down, according to Hagerty. It predicts growth in the market to slow to an estimated five percent gain in 2015. Maybe a few of these classics might actually become a bit more affordable to fans without such deep pockets sometime in the future. Featured Gallery Bonhams Maranello Rosso Collection: Monterey 2014 View 21 Photos News Source: HagertyImage Credit: Copyright 2014 Drew Phillips / AOL Aston Martin Ferrari Lamborghini Auctions Car Buying Performance Classics aston martin lagonda ferrari 250 gto Lamborghini Countach collector cars 1962 ferrari 250 gto auto auction

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.