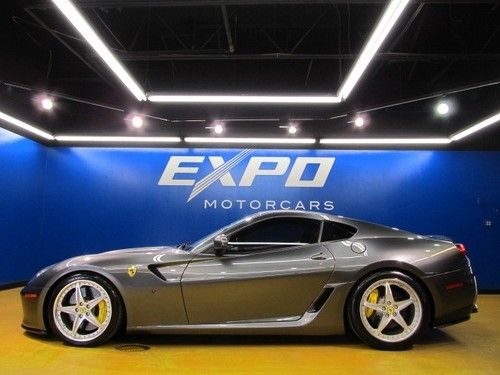

2010 Ferrari 599 Gtb - Extreme Low Mileage - Like New Condition on 2040-cars

Naples, Florida, United States

For Sale By:Dealer

Engine:6.0L 5999CC V12 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Transmission:Automatic

Warranty: Vehicle has an existing warranty

Make: Ferrari

Model: 599 GTB

Options: Leather

Trim: Fiorano Coupe 2-Door

Doors: 2

Drive Type: RWD

Engine Description: 6.0L V12 612HP

Mileage: 1,438

Number of Doors: 2

Sub Model: Fiorano

Exterior Color: Gray

Number of Cylinders: 12

Interior Color: Cuoio

Ferrari 599 for Sale

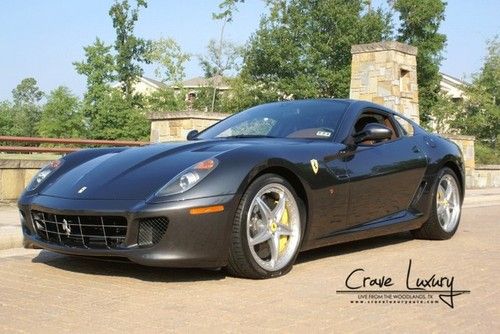

Blk over tan loaded! full hamman , exhaust carbon more!

Blk over tan loaded! full hamman , exhaust carbon more! Ferrari 599 gtb fiorano hgte(US $174,995.00)

Ferrari 599 gtb fiorano hgte(US $174,995.00) 2007 ferrari 599 gtb fiorano f1 black daytona carbon fiber 20 wheels recaro

2007 ferrari 599 gtb fiorano f1 black daytona carbon fiber 20 wheels recaro 2009 ferrari 599 gtb florano! incredible! carbon fiber! custom upgrades! hot!(US $194,900.00)

2009 ferrari 599 gtb florano! incredible! carbon fiber! custom upgrades! hot!(US $194,900.00) 599 gtb hgte loaded msrp was 381,646(US $249,888.00)

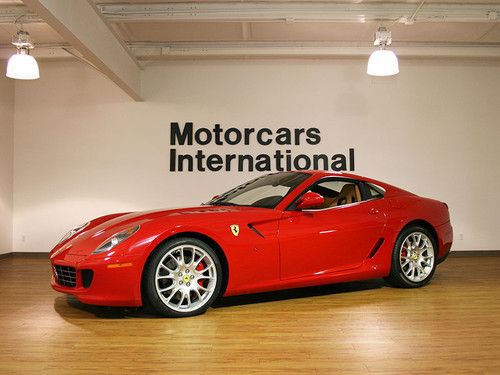

599 gtb hgte loaded msrp was 381,646(US $249,888.00) Extremely low mile 2007 599 with lots of options!

Extremely low mile 2007 599 with lots of options!

Auto Services in Florida

Youngs` Automotive Service ★★★★★

Winner Auto Center Inc ★★★★★

Vehicles Four Sale Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Auto Glass ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

What's the smarter investment, Ferrari stock or a Ferrari?

Sun, Jul 26 2015Fiat Chrysler Automobiles is gearing up to spin Ferrari off into its own company, and float some of its shares on the stock market. But buying and trading in Ferrari stock could face a rather unlikely competitor from within. As Bloomberg points out, the values held by classic Ferraris keeps going up, and by no small margin. Even something as relatively humble as the 80s-era Testarossa, for example, has nearly doubled in value over the past year alone. Meanwhile the value of some models – particularly those built in the 1950s, 60s, and 70s – have skyrocketed nearly seven-fold since 2006. Just look at the 250 GTO, one of the most coveted of classic Ferraris among collectors: not taking inflation into account, they were worth thousands in the late 60s, were already selling for hundreds of thousands in the 1980s, and by now are trading hands – on the rare occasion when they do trade hands – for tens of millions. One sold in 2004 for $10 million, and another in 2013 for over $50 million. Those kinds of increases can make a vintage Ferrari seem like a sound investment. That might make it difficult for Ferrari's stock to compete. The company hopes investors will view it as a luxury goods manufacturer along the likes of Prada, Hermes, or Louis Vuitton Moet Hennessy, the stocks of which tend to increase in value at a greater rate than those of most automakers. But even the best of those luxury stocks have merely doubled in value since 2006, compared to the aforementioned seven-fold increase enjoyed by some classic Ferraris over the same period. Add to that the prospect of actually getting to enjoy owning a classic Ferrari – albeit at the risk of damaging it and hindering its value – and the idea of investing in Maranello's products instead of its stock can seem like a much more enticing prospect. Related Video:

Ferrari to stop supplying Maserati with its engines

Thu, May 9 2019The Ferrari Q1 earnings call was full of information, and perhaps the biggest revelation was that Ferrari is going to stop supplying engines to Maserati. CEO Louis Camilleri broke the news, and The Motley Fool posted a transcript of the whole call online. "Eventually, we will no longer supply engines to Maserati, which actually from our perspective is actually a good thing, both from a margin perspective, but also the fact that we can transfer a lot of the labor that's been focused on the engines to the car side of the business," Camilleri says. Maserati has used Ferrari engines (arguably, one of the most compelling reasons to buy a Maserati) in its vehicles since 2002, a little while after Fiat passed Maserati off to the prancing horse. The partnership continued as both Ferrari and Maserati were under the same house at FCA. Then when Ferrari was spun off from FCA in 2015, they kept the supply steady to Maserati. Those engines include a 3.8-liter twin-turbo V8, 3.0-liter twin-turbo V6 and a 4.7-liter naturally aspirated V8. Camilleri said Ferrari will officially stop in 2021 or 2022, with no intention of supplying anybody with engines beyond that. Of course, this leaves Maserati high and dry with no engines for its growing lineup. Maserati will have to reach into the FCA parts bin, find a new outside supplier or develop its own engines. Battery electric sounds out of the question. As of now, there doesn't appear to be a clear plan going forward. We've reached out to Maserati to see if they have any comment on the situation as it stands.

Ferrari's stock price falls off a cliff

Tue, Feb 2 2016The stock price skidded. The stock price stalled. Use whatever automotive analogy you want. It was a bad day for Ferrari on the New York Stock Exchange. Warning that sales growth would slow because of the economic slump in China, Ferrari NV watched its stock price slump accordingly. Shares of the company were down more than 13 percent in afternoon trading, falling to $34.64. Sprung from the Fiat Chrysler Automobiles less than four months ago, Ferrari's stock has lost a third of its value since its October initial public offering and is nearly half the price of its $62 high set days after the IPO. In a conference call with investors, chairman Sergio Marchionne said the company expected to ship approximately 7,900 vehicles this year. Marchionne said the company would be "fine" over the long term as long as it maintains a decades-long philosophy of maintaining strong demand. That means Ferrari won't follow some of its sports-car competitors who have broadened their vehicle portfolio's with the addition of SUVs. Marchionne bristled at such a suggestion. "You have to shoot me first," he told Bloomberg. But never say never? Previously, Ferrari had restricted its output to 7,000 vehicles per year. The company is already past that number, and Marchionne foresees the possibility that it could rise to approximately 9,000 by 2019. In a regulatory filing, Ferrari said, "we believe we can grow in a controlled manner while preserving the exclusivity of our brand by continuing to explore controlled growth in emerging markets to capitalize on the substantial wealth creation and the growing affluent populations in those markets." For now, those markets won't include China. Shipments there decreased 22 percent in 2015, even as worldwide output increased. Related Video: