2003 Ferrari 575 Maranello Black W/ Black 16,400 Mile F1 Daytonas Modulars on 2040-cars

Cleveland, Ohio, United States

Engine:12

Transmission:Automatic

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gas

Used

Year: 2003

Make: Ferrari

Disability Equipped: No

Model: 575

Doors: 2

Drivetrain: Rear Wheel Drive

Mileage: 16,488

Trim: Base Coupe 2-Door

Exterior Color: Black

Drive Type: RWD

Interior Color: Black

Number of Cylinders: 12

Ferrari 575 for Sale

2004 ferrari 575maranello

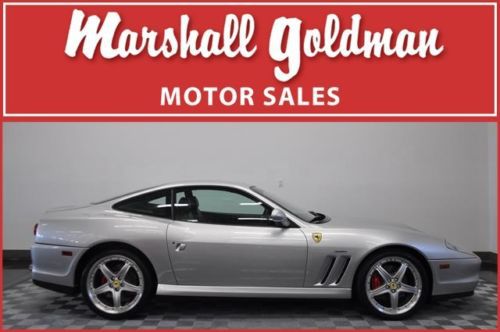

argento nurburgring black leather 4,100 miles serviced(US $119,900.00)

2004 ferrari 575maranello

argento nurburgring black leather 4,100 miles serviced(US $119,900.00) 2005 ferrari superamerica(US $319,900.00)

2005 ferrari superamerica(US $319,900.00) Carbon fiber serviced f1 low miles scud shields v12 fiorano handling pkg(US $90,900.00)

Carbon fiber serviced f1 low miles scud shields v12 fiorano handling pkg(US $90,900.00) 06 e350 3.5 v6 keyless entry moonroof leather harman/kardon audio cruise(US $16,930.00)

06 e350 3.5 v6 keyless entry moonroof leather harman/kardon audio cruise(US $16,930.00) 2011 lexus es350 w/ navigation 8,569 miles lt blue w tan 1 owner mint like new(US $29,375.00)

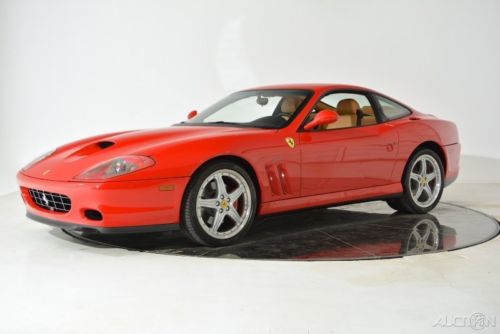

2011 lexus es350 w/ navigation 8,569 miles lt blue w tan 1 owner mint like new(US $29,375.00) Red calipers daytona charger shields modular 19 hifi subwoofer stitching castoro(US $104,900.00)

Red calipers daytona charger shields modular 19 hifi subwoofer stitching castoro(US $104,900.00)

Auto Services in Ohio

Zink`s Body Shop ★★★★★

XTOWN PERFORMANCE ★★★★★

Wooster Auto Service ★★★★★

Walker Toyota Scion Mitsubishi Powersports ★★★★★

V&S Auto Service ★★★★★

True Quality Collision ★★★★★

Auto blog

1962 Ferrari 250 GTO Sells For $38 Million At Auction

Fri, Aug 15 2014A 1962 Ferrari 250 GTO became the most expensive car ever sold during an automotive auction Thursday night when a buyer paid $38 million for the vehicle at a Bonhams event. Only 39 of the racers were ever built, and it is a favorite among collectors. One reportedly sold for $52 million in a private sale. If true, it would be the most expensive car ever purchased. Another Ferrari GTO built for legendary racecar driver Stirling Moss sold for $35 million in 2012. Thursday's sale broke the auction record set at a Goodwood auction last year of a Mercedes W196R that was driven by Juan Manuel Fangio to wins in the 1954 German and Swiss Grand Prix races by $8 million. Pretty good for a car that went to the auction block with no reserve, meaning there was no minimum price set for the sale of the car, though bidding started at $11 million, according to the Los Angeles Times. The Ferrari 250 GTO was the star of the show, but it wasn't the only rare Ferrari on the auction block. Bonhams brought ten of the most collectable Ferraris in the world on stage, including a 1962 250 GT Short-Wheelbase Speciale Aerodinamica that went for $6.875 million, a 1953 250 Mille Miglia Berlinetta driven to racing victory by Phil Hill for $7.26 million and even a 1978 312 T3 Formula One car for $2.31 million. All told, the Ferraris sold for $65.945 million, according to Autoblog.

FCA launches Ferrari IPO

Mon, Oct 12 2015It's been a long time coming, but the moment is finally upon us: Ferrari is hitting the stock market. Its parent company Fiat Chrysler Automobiles has announced the launch of Ferrari's initial public offering – almost exactly a year to the day since FCA launched its IPO (pictured above). And with it, FCA is starting the process of separating the Maranello-based exotic automaker and racing team away from the rest of the Italian-American industrial empire. The plan filed with the US Securities and Exchange Commission (SEC) calls for FCA – which owns 90 percent of Ferrari – to float 17,175,000 common shares on the New York Stock Exchange. That amounts to nine percent of Ferrari's common shares. Another 1,717,150 common shares (equal to 1 percent) will be offered to the underwriters of the IPO. The remaining 80 percent interest in the Prancing Horse company will be separated from the rest of FCA and distributed to the parent company's shareholders – of which Exor, the Agnelli/Elkann family's holding company, is the largest, holding a stake of about 30 percent. Currently registered as New Business Netherlands NV, the company is soon to be renamed Ferrari NV. And while it's nominally based, like its (soon to be former) parent company, in the Netherlands, there's no reason to anticipate at this point that Ferrari will move its operating headquarters away from its current and historic home in Maranello, on the outskirts of Modena in Italy's "supercar valley." The IPO is expected to be priced at or around $50 per share (give or take a couple of bucks), which would value the company at around $10 billion. Trading won't actually commence, however, until all the SEC filings are complete. At that point, the company will be listed on the NYSE under the symbol RACE. And whether you yourself are actually interested in trading in Ferrari shares or not, that could be one of the best parts of the announcement. FCA Announces Launch of Ferrari Initial Public Offering LONDON, October 12, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. (NYSE: FCAU / MI: FCA) ("FCA") and its subsidiary New Business Netherlands N.V. to be renamed Ferrari N.V. ("Ferrari") announce today that Ferrari has launched its initial public offering ("IPO").

Michigan man gets jail time for Ferrari engine sale

Fri, Oct 30 2015Tax evasion is not something to mess about with. Ask Al Capone. For most of us that sell stuff, though, it's not something we really think about. Are you honestly going to pay taxes on that old iPhone 5 you sold? The couch with the questionable stain? No, because paying tax on something you sold for a relative pittance is just a pain in the butt. If you sell one of Aurelio Lampredi's Ferrari engines – used in a range of vintage racers, including the 750 Monza shown above – for over $600,000, you might want to make a point of paying the taxes on your profits. A Michigan man found that out the hard way, Reuters reports, after selling the Lampredi engine in 2009. 71-year-old Terry Myr of Smiths Creek, MI, was convicted in April of tax evasion and four counts of failing to file a tax return and was sentenced to two years in prison and two years of supervised release on Thursday. He was also ordered to pay $738,904 in back taxes, interest, and penalties – he already owed $195,000 in back taxes before his conviction – by a US District Court judge, Reuters reports. Now, this wasn't a simple case of Myr forgetting to set some money aside from the sale. The buyer wire-transferred the $610,000 into a corporate account he made the week prior. Then, Myr promptly withdrew $360,000, which he used to buy silver and gold coins, while the remainder was transferred to other accounts – be they personal or corporate – or simply used for checks to cash. Hence the tax evasion charge. According to Reuters, no explanation was given as to how Uncle Sam uncovered the engine sale in the first place. Related Video:

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.027 s, 7929 u