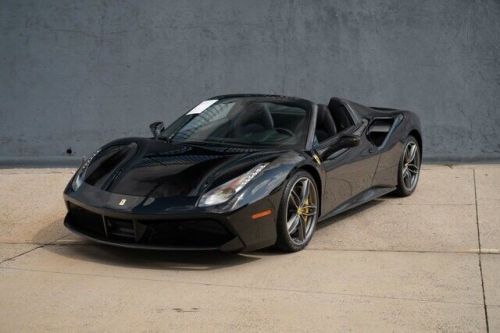

2018 Ferrari 488 on 2040-cars

Engine:3.9L Twin Turbo V8 660hp 561ft. lbs.

Fuel Type:Gasoline

Body Type:2dr Car

Transmission:7-Speed Double Clutch

For Sale By:Dealer

VIN (Vehicle Identification Number): ZFF79ALA4J0232893

Mileage: 27505

Make: Ferrari

Drive Type: Coupe

Features: --

Power Options: --

Exterior Color: Rosso Corsa

Interior Color: Nero

Warranty: Unspecified

Model: 488

Ferrari 488 for Sale

2019 ferrari 488 spider certified cpo(US $299,900.00)

2019 ferrari 488 spider certified cpo(US $299,900.00) 2018 488 spider(US $279,995.00)

2018 488 spider(US $279,995.00) 2018 ferrari 488 2dr conv(US $20,953.00)

2018 ferrari 488 2dr conv(US $20,953.00) 2016 ferrari 488 spider 3.9l v8 twin turbo 660hp.(US $89,900.00)

2016 ferrari 488 spider 3.9l v8 twin turbo 660hp.(US $89,900.00) 2017 ferrari 488(US $219,900.00)

2017 ferrari 488(US $219,900.00) 2018 ferrari 488(US $239,980.00)

2018 ferrari 488(US $239,980.00)

Auto blog

Alfa Romeo considering Ferrari-developed engines for new product lineup

Sun, 06 Apr 2014A report in Bloomberg adds more details to the plans for Alfa Romeo's fourth turnaround plan in Fiat CEO Sergio Marchionne's tenure, and this time Ferrari is apparently going to be part of the show. In December Automotive News Europe reported that a new Maserati-derived rear-drive architecture would be the centerpiece at Alfa Romeo, as well as coming Chrysler and Dodge products. At the time, ANE said the platform would support a new midsize sedan and wagon perhaps to be called Giulia, a fullsize sedan and a midsize crossover, with retail appearance of the product initiative commencing perhaps as soon as next year. It would be part of Fiat's $12.3-billion spend on new models and European recovery.

The Bloomberg report says that particulars haven't been finalized, but the plan is to have six new Alfas appear over the next five years, two of which would be SUVs. The futures of the Mito and Giulietta, two of the three cars Alfa currently sells and 99 percent of sales last year, aren't assured, meaning that the lineup in six years could be seven cars (including the 4C), six of which we haven't any definitive clue of yet. The top-tier versions of those cars, according to the report - perhaps the Quadrifoglio Verde - "will be equipped with motors developed by Ferrari."

Marchionne wants to get sales up to 300,000 units per year when the lineup is complete, pairing Alfa sales with Jeep's global dealer network to open up the retail channel. That kind of volume would get Fiat's Italian plants back in business properly, even though Marchionne's stance on Italy-only Alfa production would mean the end of the anticipated roadster that was to be twinned with the coming Mazda MX-5 Miata. Alfa's direction will be laid out in Detroit in May as part of the overall strategy presentation for Fiat Chrysler Automobiles NV.

US Customs takes break from crushing Skylines, returns stolen Ferrari [UPDATE]

Mon, Apr 18 2016Update: A spokesperson from US Customs and Border Protection told Autoblog more details about the case. The thieves "completely removed the '81 VIN, and changed it to the '82 VIN," the spokesperson said. "The true VIN was identified through secondary numbers." US Customs and Border Protection often gets a bad rap among auto enthusiasts for the agency's propensity to crush fun cars, including Minis, Land Rovers, and Skyline GT-Rs. However, the group also sometimes finds stolen classic vehicles just before they leave the country. For example, officers recently recovered a stolen Ferrari nearly 30 years after the owner reported it stolen. The 308 GTSi was on its way to Poland from the Los Angeles/Long Beach Seaport on April 8th, but the officers found something fishy. This Ferrari was supposed to be a 1982 308 GTS, but running a check indicated that the coupe with that VIN left the US for Norway in 2005. "This VIN discrepancy is what 'raised a red flag' and prompted further scrutiny," CBP LA/LB Seaport Port Director Carlos Martel said in a statement. The CBP contacted the California Highway Patrol and the National Insurance Crime Bureau. A Ferrari expert eventually identified the car as a 1981 308 GTSi. Once the authorities obtained the correct VIN, the system listed the Ferrari as stolen from a consignment lot in Orange County, CA, on July 19, 1987. Unfortunately, the original owner doesn't get to enjoy having the Ferrari back. The Prancing Horse now belongs to the insurance company because it paid off the claim on the car decades ago. It might be worth trying to buy the Ferrari again, though. The red 308 GTSi still looks like a beauty in CBP's photo, and coupe has only covered 45,000 miles since 1981. Stolen 28 Years Ago, CBP Seizes Classic Red Hot Ferrari Release Date: April 14, 2016 "Red Flag" Prompts FEAR Team Scrutiny LOS ANGELES — U.S. Customs and Border Protection (CBP) officers at Los Angeles/Long Beach (LA/LB) Seaport complex intercepted and seized a red 1981 Ferrari 308 GTSi, destined to Poland, on April 8. It was stolen 28 years ago, has 45K miles and an estimated value of $50K. red 1981 Ferrari 308 GTSi seized by CBP CBP officers at LA/LB seaport seized this 1981 Ferrari 308 GTSi, destined to Poland. It was stolen 28 years ago. Falsely manifested as a "1982 Ferrari", analysis of its purported vehicle identification number (VIN) revealed that the VIN was previously used for a 1982 Ferrari 308 GTS exported in 2005, from the U.S.

That aluminum-bodied '69 Ferrari Daytona barn find sold for $2.2M

Mon, Sep 11 2017Barn finds are a strange thing. The idea that some beautiful or rare car can simply be locked away and forgotten about seems unthinkable to many enthusiasts. Still, there's entire communities and several television shows dedicated to unearthing these vehicles. One of the most notable finds in recent memory was the sole road-going aluminum-bodied 1969 Ferrari 365 GTB/4 Daytona in existence. The car just sold for about $2.2 million at an RM Sotheby's auction this past weekend. According to the auction house, this is the 30th of just over 1,200 Ferrari Daytonas ever built. This particular car was found stowed away in Japan, having sat collecting dust and dirt for nearly 40 years. While five aluminum-bodied Daytonas were built for racing, this is the only known street car with aluminum body panels. According to an evaluator, the engine and transaxle are both numbers matching. The odometer reads 36,390 kilometers, or about 22,611 miles. That number is believed to be accurate. All the aluminum body panels wear the correct Scaglietti markings. This car has Rosso Chiaro paint over Nero leather (red over black). Other options include Plexiglas headlamps and power windows. The interior is said to be in surprisingly good shape. The car sold for just more than its initial estimate. Let's hope the new owner gets it back into running condition. Related Video: Featured Gallery 1969 Ferrari 365 GTB/4 Daytona Berlinetta Alloy View 25 Photos News Source: RM Sotheby's Ferrari Auctions Coupe Classics