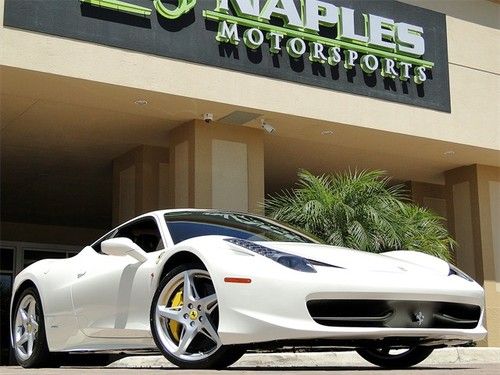

One Owner; Original Msrp $297,068; Corsa Red/beige on 2040-cars

Jericho, New York, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: Ferrari

Model: 458

Mileage: 4,319

Warranty: Unspecified

Sub Model: Italia

Exterior Color: Red

Interior Color: Tan

Ferrari 458 for Sale

2010 ferrari 458 italia coupe rosso corsa 3,059 miles huge msrp great condition(US $262,999.00)

2010 ferrari 458 italia coupe rosso corsa 3,059 miles huge msrp great condition(US $262,999.00) 2012 ferrari 458 italia, black on black, navigation

2012 ferrari 458 italia, black on black, navigation 2011 ferrari 458 perfect condition clear bra all over 2300 miles(US $270,000.00)

2011 ferrari 458 perfect condition clear bra all over 2300 miles(US $270,000.00) 2010 ferrari 458 italia coupe tdf blu tour de france blue / huge msrp / loaded(US $264,999.00)

2010 ferrari 458 italia coupe tdf blu tour de france blue / huge msrp / loaded(US $264,999.00) 458 italia - bianco avus / black - lots of carbon fiber - under 800 miles(US $314,995.00)

458 italia - bianco avus / black - lots of carbon fiber - under 800 miles(US $314,995.00) 10 ferrari 458 italia f1 coupe rosso corsa 34k jbl daytona-seats shields(US $209,000.00)

10 ferrari 458 italia f1 coupe rosso corsa 34k jbl daytona-seats shields(US $209,000.00)

Auto Services in New York

Tones Tunes ★★★★★

Tmf Transmissions ★★★★★

Sun Chevrolet Inc ★★★★★

Steinway Auto Repairs Inc ★★★★★

Southern Tier Auto Recycling ★★★★★

Solano Mobility ★★★★★

Auto blog

Ferrari 212 Barchetta highlights RM auction at Villa d'Este

Tue, May 26 2015While show-goers sip champagne and basque in the glow of some of the most beautiful classics and most notable concept cars at the Concorso d'Eleganza Villa d'Este, at the Villa Erba just down the shore, collectors bid on some of the most tempting automotive creations. And this year was no exception. Highlighting RM Sotheby's auction this year was a rare classic 1952 Ferrari 212 Export Barchetta. The Touring-bodied competition roadster from Ferrari's early days fetched an incredible ˆ6,720,000 – nearly $7.4 million at current exchange rates – to set a new record for that model. According to Sports Car Market, the previous record was held by a 212 Export coupe that sold for $3.2 million early last year. A Barchetta failed to sell for a high bid of $1.97 million in 2008, which just goes to show how far this auction raised the bar for the 212. Though it was by far the top lot of the day, it wasn't the only million-dollar sale of the day. Heck, it wasn't even the only million-dollar Ferrari sold. A quartet of Ferrari supercars – including a 288 GTO, F40, F50 and Enzo – each fetched seven figures, as did a 250 GT Berlinetta Lusso and a 250 GT Cabriolet. So did a Lamborghini Miura, a '73 Porsche 911 Carrera RS 2.7 and a '53 Fiat 8V Cabriolet, if you can believe it. Other notable lots included a 1949 Alfa Romeo 6C 2500 SS Villa d'Este Coupe, a '74 Lancia Stratos and a rare stick-shift Ferrari 599 HGTE. All told, RM Sotheby's racked up nearly $30 million in sales at its first European auction since merging and rebranding, selling 34 out of the 39 lots consigned, but that stunning 250 California Spider did not appear to be among them.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Stellantis wants to outfit cars with AI software to drive revenue

Tue, Dec 7 2021MILAN — Carmaker Stellantis announced a strategy Tuesday to embed AI-enabled software in 34 million vehicles across its 14 brands, hoping the tech upgrade will help it bring in 20 billion euros ($22.6 billion) in annual revenue by 2030. CEO Carlos Tavares heralded the move as part of a strategy that would transform the car company into a “sustainable mobility tech company,” with business growth coming from features and services tied to the internet. That includes using voice commands to activate navigation, make payments and order products online. The company is expanding existing partnerships with BMW on partially automated driving, iPhone manufacturer Foxconn on customized cockpits and Waymo to push their autonomous driving work into light commercial vehicle delivery fleets. StellantisÂ’ embrace of artificial intelligence and expansion of software-enabled vehicles is part of a broad transformation in the auto industry, with a race toward more fully electric and hybrid propulsion systems, more autonomous driving features and increased connectivity in automobiles. Ford and General Motors also are banking on dramatically increased revenue from similar online subscription services. But the automakers face immense competition for monthly consumer spending from movie and music streaming services, news outlets, Amazon Prime and others. Stellantis, which was formed from the combination of PSA Peugeot and FCA Fiat Chrysler, said the software would seamlessly integrate into customers' lives, with the capability of live updates providing upgraded services over time. New products will include the possibility to subscribe to automated driving features, purchase usage-based car insurance or even increase the power of the vehicle with a tune-up to add horsepower. As a baseline, Stellantis generates 400 million euros in revenue on software-generated services installed in 12 million vehicles. To meet the targets, Stellantis will expand its software engineering team of 1,000 to 4,500 in North America, Asia and Europe. More than 1,000 of the expanded team will be retrained in house. Stellantis also announced a new partnership with Foxconn to develop semiconductors to cover 80% of the companyÂ’s needs and simplify the supply chain. The first microchips from the partnership are targeted to be installed in vehicles in 2024.