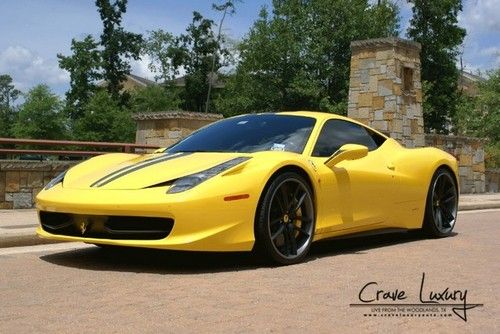

458 Italia Wheels Carbon Fiber Nav Diamond Stitching Loaded on 2040-cars

Spring, Texas, United States

For Sale By:Dealer

Engine:4.5L 4499CC V8 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Transmission:Automatic

Make: Ferrari

Model: 458 Italia

Disability Equipped: No

Trim: Base Coupe 2-Door

Doors: 2

Drivetrain: Rear Wheel Drive

Drive Type: RWD

Number of Doors: 2

Mileage: 1,712

Exterior Color: Yellow

Number of Cylinders: 8

Interior Color: Black

Ferrari 458 for Sale

Tons of carbon diamond sport wheels navigation reverse cam loaded only 700 miles(US $369,980.00)

Tons of carbon diamond sport wheels navigation reverse cam loaded only 700 miles(US $369,980.00) 2010 ferrari 458 italia, 3,975 miles,hre performance wheels!! only $244,888.00!!(US $244,888.00)

2010 ferrari 458 italia, 3,975 miles,hre performance wheels!! only $244,888.00!!(US $244,888.00) 2010 ferrari 458 italia - only 1,200 miles!(US $258,000.00)

2010 ferrari 458 italia - only 1,200 miles!(US $258,000.00) 2012 ferrari 458 italia - certified!!(US $275,000.00)

2012 ferrari 458 italia - certified!!(US $275,000.00) Race carbon fiber forged wheels light weight polycarbonate air jack exhaust tire(US $245,000.00)

Race carbon fiber forged wheels light weight polycarbonate air jack exhaust tire(US $245,000.00) 458 italia bianco avus white over white clean carfax

458 italia bianco avus white over white clean carfax

Auto Services in Texas

World Tech Automotive ★★★★★

Western Auto ★★★★★

Victor`s Auto Sales ★★★★★

Tune`s & Tint ★★★★★

Truman Motors ★★★★★

True Image Productions ★★★★★

Auto blog

FCA launches Ferrari IPO

Mon, Oct 12 2015It's been a long time coming, but the moment is finally upon us: Ferrari is hitting the stock market. Its parent company Fiat Chrysler Automobiles has announced the launch of Ferrari's initial public offering – almost exactly a year to the day since FCA launched its IPO (pictured above). And with it, FCA is starting the process of separating the Maranello-based exotic automaker and racing team away from the rest of the Italian-American industrial empire. The plan filed with the US Securities and Exchange Commission (SEC) calls for FCA – which owns 90 percent of Ferrari – to float 17,175,000 common shares on the New York Stock Exchange. That amounts to nine percent of Ferrari's common shares. Another 1,717,150 common shares (equal to 1 percent) will be offered to the underwriters of the IPO. The remaining 80 percent interest in the Prancing Horse company will be separated from the rest of FCA and distributed to the parent company's shareholders – of which Exor, the Agnelli/Elkann family's holding company, is the largest, holding a stake of about 30 percent. Currently registered as New Business Netherlands NV, the company is soon to be renamed Ferrari NV. And while it's nominally based, like its (soon to be former) parent company, in the Netherlands, there's no reason to anticipate at this point that Ferrari will move its operating headquarters away from its current and historic home in Maranello, on the outskirts of Modena in Italy's "supercar valley." The IPO is expected to be priced at or around $50 per share (give or take a couple of bucks), which would value the company at around $10 billion. Trading won't actually commence, however, until all the SEC filings are complete. At that point, the company will be listed on the NYSE under the symbol RACE. And whether you yourself are actually interested in trading in Ferrari shares or not, that could be one of the best parts of the announcement. FCA Announces Launch of Ferrari Initial Public Offering LONDON, October 12, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. (NYSE: FCAU / MI: FCA) ("FCA") and its subsidiary New Business Netherlands N.V. to be renamed Ferrari N.V. ("Ferrari") announce today that Ferrari has launched its initial public offering ("IPO").

Ferrari worth over $11 billion, says Marchionne ahead of IPO

Mon, Jul 6 2015We all know that cars from Ferrari sell for hundreds of thousands, if not millions of dollars. But how much is Ferrari worth as a company? At least ten billion, according to its chairman. Speaking at the launch of the revised Fiat 500 in Turin on Friday, Fiat Chrysler CEO and Ferrari chairman Sergio Marchionne said he expected the vaunted Maranello-based supercar manufacturer and racing team to be valued at over 10 billion euros, or about $11 billion at current exchange rates. As Bloomberg points out, that would make Ferrari alone account for some 60 percent of the value of its parent company Fiat Chrysler Automobiles, which is currently valued at over 16 billion euros. That may seem like an aggressive estimate, but we won't have to take Marchionne at his word for long. After having floated an Initial Public Offering on the New York Stock Exchange last year, Fiat Chrysler is preparing to do the same with its Ferrari unit as soon as October. FCA will not, of course, be selling off all of its shares. The projected scheme would have ten percent (worth about one billion by Marchionne's estimates) of Ferrari's shares floated on the NYSE. Another 10 percent is expected to remain in the hands of founder Enzo's son (and company vice chairman) Piero Ferrari's hands. The remaining 80 percent is slated to be distributed among Fiat Chrysler's existing stakeholders.

Ferrari patents a fancy and fascinating electric turbocharger

Fri, Jul 20 2018While turbocharging has improved vastly over the years, and it has enabled cars to become both more powerful and more efficient, there's always room for improvement. Turbochargers scavenge exhaust gas pressure and use it to turn a compressor that forces intake air into the cylinders. However, as the patent points out, this means the intake compressor and the exhaust turbine are physically coupled, and have to spin at the same rate. Ferrari's design divorces the two, and it's a happy breakup. The key is hooking up the two components of the turbo to their own individual electric motors, with an energy storage device in between. It's different than the electric supercharger systems you have seen on certain Audi products, for example. Those systems recover energy like a hybrid, store it, and then use it to drive an intake compressor. It supplements conventional turbochargers that harvest energy from the exhaust. In systems like Audi's, the electric supercharger is supplementing the sequential conventional turbochargers when they're not operating efficiently, at very low RPM in particular. It works well, but it's complicated, and it is a workaround for the limitations of a conventional turbocharger. See below for an animation of the Audi system. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Usually, optimizing a turbo is a compromise between figuring out what RPM is ideal for each side to spin at to generate power. A smaller compressor generates boost more quickly, but loses efficiency at higher RPM. But there's way more energy in high-RPM exhaust gasses. By hooking up the turbine to an electric motor instead, you can harvest energy from the exhaust throughout the rev range, and particularly when the engine is pushing lots of gasses through. And you can store that energy in a battery if it's not needed at that moment. The intake-side compressor also has a reversible electric motor attached. It is not physically connected to the turbine, so it can operate at any time the computers decide it's beneficial. As engine RPM increases, the compressor doesn't have to increase its speed beyond its optimal range, so there's less energy wasted. And at low RPM situations, when a conventional turbocharger wouldn't have enough exhaust gas passing through its turbine side to generate useful boost in the compressor side, the electric motor can spin up Ferrari's divorced compressor to provide some boost.