2011 Ferrari 458 Italia Yellow/black Huge Msrp Carbon Fiber Loaded 1 Owner on 2040-cars

Calabasas, California, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:4.5L 4499CC V8 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Make: Ferrari

Warranty: Vehicle has an existing warranty

Model: 458 Italia

Trim: Base Coupe 2-Door

Number of Doors: 2

Drive Type: RWD

Mileage: 3,740

Number of Cylinders: 8

Exterior Color: Yellow

Interior Color: Black

Ferrari 458 for Sale

2012 ferrari 458 italia coupe white/cuoio

2012 ferrari 458 italia coupe white/cuoio 300k+ msrp+afs system+navi+front lift+carbon fiber+leds+alcantara interior(US $281,999.00)

300k+ msrp+afs system+navi+front lift+carbon fiber+leds+alcantara interior(US $281,999.00) 2010 ferrari 458 italia grigio ferro/cuoio front lifter navigation alcantara

2010 ferrari 458 italia grigio ferro/cuoio front lifter navigation alcantara 11 ferrari 458 italia f1 grigio titanio metallic cuoio carbon wheel 2k(US $268,995.00)

11 ferrari 458 italia f1 grigio titanio metallic cuoio carbon wheel 2k(US $268,995.00) 2010 ferrari 458 italia 2dr cpe

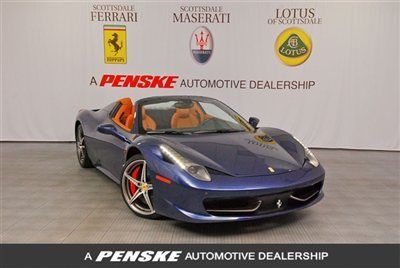

2010 ferrari 458 italia 2dr cpe 2012 ferrari 458 italia spider-carbon interior-afs system-nav-diamond stitch(US $360,000.00)

2012 ferrari 458 italia spider-carbon interior-afs system-nav-diamond stitch(US $360,000.00)

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

Ferrari California T gets sharper edge with Handling Speciale package

Fri, Jan 22 2016It's been about two years since Ferrari updated the California to T-spec with a 3.9-liter, flat-plane crank, twin-turbocharged engine, and we found it to be a suitable change – rewarding to drive, and compelling to experience. Now Ferrari has introduced a new handling option, which will debut at the upcoming Geneva Motor Show in March, which should add a sharper edge to the roadster. Like most handling packages, the springs and dampers get the most attention. The magnetorheological dampers fitted to the conventional California T get changes that increase their response time to changing road conditions. As before, damper settings are controlled via the steering wheel manettino, and the most aggressive change is to be found in the Sport setting. The front springs are stiffer – 16 percent up front, 19 percent in the rear – which will aid body control in all axes. Ferrari claims that, overall, the setup only marginally reduces the ride comfort. It'll take driving a Handling Speciale-equipped car to find out. The changes go beyond just handling hardware. Shifts are faster in Sport mode, both in automatic and manual modes, thanks to recalibrated transmission logic. Ferrari's engineers also found some additional corner exit speed by tweaking the F1-Trac stability control system's programming. The company claims this tweak also helps with acceleration on bumpy surfaces. Cosmetically, the California Ts with the Handling Speciale package will feature a matte grille, a rear diffuser with matte-painted fences, and matte black tailpipes. A special-edition plaque, located in the cabin, is also standard, Finally, in a very Italian move, the exhaust note has been recalibrated "to underline the performance gains." That is to say, if you don't happen to have a skidpad handy to do a direct measurement of the increase in cornering capability – which, it should be noted, Ferrari doesn't quantify – the sportier sound will serve as a psychological reminder. There's no claim that the new exhaust system changes the engine's output – cars so equipped make the same 553 hp at 7500 RPM as the model we tested back in 2014. Look for the Handling Speciale package to debut at the Geneva Motor Show.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Ferrari and FCA are officially separated

Mon, Jan 4 2016It's been a long time in the making, but it's officially happened: Ferrari is no longer part of Fiat Chrysler Automobiles. Following the Italian automaker's initial public offering, it has officially split off from its former parent company. As part of the spin-off, FCA's stakeholders will each receive one common share in Ferrari for every ten they hold in Fiat Chrysler. Special voting shares will be distributed in the same proportions to certain shareholders as well. Those shares being distributed will account for 80 percent of the company's ownership. Another ten percent was floated as part of the company's IPO, while the remaining 10 percent is held by Enzo's son Piero Ferrari (pictured above at center), who serves as vice chairman of the company. The shares will continue to be traded under the ticker symbol RACE on the New York Stock Exchange, and will begin trading this week as well under the same symbol on the Mercato Telematico Azionario, part of the Borsa Italiana in Milan. Since the extended Agnelli family headed by chairman John Elkann (above, right) holds the largest stake in FCA, expect it to continue controlling the largest portion of Ferrari shares as well. Between them, nearly half of the shares in the supercar manufacturer – and we suspect a little more than half of the voting rights – will be controlled by the Agnelli and Ferrari families, who are expected to cooperate to ensure the remaining shareholders don't attempt a takeover of the company. Similar to its former parent company, which operates out of Turin and Detroit, the Ferrari NV holding company is nominally incorporated in the Netherlands, but the automaker will continue to base its operations in Maranello, Italy. That's where it's always been headquartered, on the outskirts of Modena. For the time being, Sergio Marchionne (above, left) remains both chairman of Ferrari and chief executive of FCA – a position to which he is not unaccustomed, having previously headed both Fiat and Chrysler before the two officially merged. Related Video: Separation of Ferrari from FCA Completed LONDON, January 3, 2016 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") (NYSE: FCAU / MTA: FCA) and Ferrari N.V. ("Ferrari") (NYSE/MTA: RACE) announced today that the separation of the Ferrari business from the FCA group was completed on January 3, 2016. FCA shareholders are entitled to receive one common share of Ferrari for every 10 FCA common shares held.