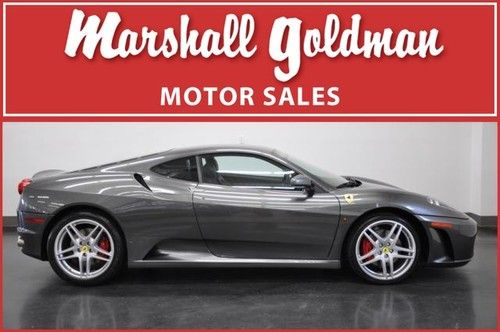

2008 Ferrari F430 430 Scuderia, 11,800 Miles **no Reserve* on 2040-cars

Vista, California, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:V8

Fuel Type:Gasoline

For Sale By:Private Seller

Make: FERRARI

Model: 430

Trim: Scuderia

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Power Locks, Power Windows

Drive Type: Rear Wheel Drive

Mileage: 11,800

Exterior Color: Yellow

Disability Equipped: No

Interior Color: Black

Number of Doors: 2

Number of Cylinders: 8

Warranty: Vehicle does NOT have an existing warranty

This Ferrari 430 Scuderia is a two owner car with all service done at Ferrari of Newport Beach. The car has been in California since new.

Ferrari 430 for Sale

2009 ferrari 430 scuderia, black metallic with stripe. red calipers

2009 ferrari 430 scuderia, black metallic with stripe. red calipers 2007 ferrari 430 2dr convertible spider

2007 ferrari 430 2dr convertible spider 2006 ferrari f430 coupe low miles fresh service!

2006 ferrari f430 coupe low miles fresh service! 2006 ferrari f430 spider fresh service

2006 ferrari f430 spider fresh service 2007 ferrari f430 f1 hre wheels tubi exhaust brembo gt brake system(US $154,900.00)

2007 ferrari f430 f1 hre wheels tubi exhaust brembo gt brake system(US $154,900.00) 2007 ferrari f430 f1 silverstone black leather daytonas shields nav 5800 miles(US $135,800.00)

2007 ferrari f430 f1 silverstone black leather daytonas shields nav 5800 miles(US $135,800.00)

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

Ferrari LaFerrari Spider reportedly debuts privately

Mon, Mar 7 2016If the Porsche 918 Spyder didn't fulfill your dream of open top motoring in a hybrid hypercar, look for Ferrari to publicly debut a topless version of the LaFerrari (standard version above) in the near future. The Facebook page for Automotive Passion (D. Benoit) asserts the LaFerrari Spider is finally on the way and backs up the claim with a photo of a carbon-fiber box that bears the vehicle's sharp silhouette (below). Motor1 claims that Ferrari plans to build 150 to 200 examples of the LaFerrari Spider, which is less than half of the 499 coupes, and customers already snapped them all up. The Prancing Horse is reportedly charging a hefty premium over the hardtop's $1.4-million price tag for the droptop. Given the coupe's sales success, we are surprised Ferrari didn't take the LaFerrari's roof off even sooner, and rumors about the Spider go back to at least 2014. The removable top might add a few pounds, but the 949-horsepower 6.3-liter hybrid V12 should still be plenty to hustle the hypercar around. Ferrari debuted the LaFerrari Spider at a private event, according to Motor1. Showing the hypercar suggests development in nearing completion, so expect a public debut and official info sometime this year. Ferrari is bringing out LaFerrari Spider!© Private #laferrari #spider #laferrarispider #ferrari Posted by Automotive Passion (D. Benoit) on Friday, March 4, 2016 Related Video:

1957 Ferrari 335 S could set auction record at $30+ million

Fri, Jan 22 2016This car that could set the record for the highest price to be paid for an automobile at auction in 2016 – by the second month of the year, no less. It's a 1957 Ferrari 335 S Spider, and it's going up for sale at Artcurial in Paris next month, with an estimate topping $30 million. Though it may look a lot like the iconic 250 Testa Rossa that came out the same year, chassis number 0674 actually started out its life as a 315 S and fitted with coachwork by Scaglietti. After finishing sixth at Sebring and second in the Mille Miglia, it returned to Maranello and was upgraded to 335 S spec. The 3.8-liter V12 was enlarged to 4.1 liters, and its output swelled from 360 horsepower to nearly 400. Mike Hawthorn drove it at Le Mans that year, leading the race and setting a lap record before dropping down to fifth with mechanical troubles. It went on to compete in several more events as part of the factory Scuderia, helping it secure the title in 1957. It was then sold to famed US importer Luigi Chinetti who campaigned it for another couple of years, winning (among others) the 1958 Cuba Grand Prix with Stirling Moss and Masten Gregory behind the wheel. The 335 S was ultimately sold to noted collector Pierre Bardinon. Asked once why he didn't have a factory collection, Enzo Ferrari once said he had "no need" because "Bardinon has done it for me." That's high praise indeed, and the car remained one of the highlights of the Bardinon collection for over 40 years. Having liquidated the Baillon barnfind collection last year, the auction house estimates that this 335 S will sell for $30-34 million. That would not only set the bar very high for the year ahead, but could make it one of the highest price ever paid for a car at auction. 2014 saw a Ferrari 250 Testa Rossa sell for nearly $40 million, and a 250 GTO for $38 million. Behind them is Fangio's Mercedes W196 Silver Arrow that sold for nearly $30 million in 2013. The auction is set to take place during the Salon Retromobile in the French capital on February 5th. Among the other Prancing Horses that Artcurial has corralled for the event include a 1963 Ferrari 250 GT SWB Berlinetta (estimated at $10–13.2m), Gianni Agnelli's unique 1986 Ferrari Testrossa Spider ($750k-1m), and a 1962 Ferrari 250 GT Cabriolet Series 2 that belonged to the King of Morocco ($1.5-1.9m). So if it's a multi-million-dollar Ferrari you're after, Paris will be the place to be in a couple of weeks.

Ferrari Lusso ownership will add some time to your morning commute

Fri, 19 Apr 2013If you've ever driven a vintage vehicle on a regular basis, you know the process from getting from point A to point B is a bit more convoluted than simply hopping in and going. There are rituals to observe, checklists to run through and processes to address before ever touching the ignition. Neglect any one of a number of small tasks and you're likely to find yourself on the side of the road. James Chen, the owner of Axis Wheels, knows all about that. You see, he owns a gorgeous Ferrari Lusso, and coaxing the V12 under the hood to life requires a certain amount of procedure.

Once it's rolling, of course, all that premeditation seems entirely worth the effort. Chen does his best to keep the machine out of traffic, but refuses to keep the coupe sealed away in a museum, so he gets up early and takes to the canyon roads around LA before anyone else is awake. Atta boy.

Check out the latest video from Petrolicious below.