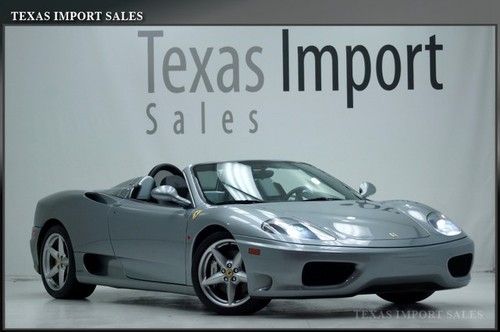

2002 Ferrari 360 Spider Convertible 2-door 3.6l on 2040-cars

Oyster Bay, New York, United States

Body Type:Convertible

Engine:3.6L 3586CC V8 GAS DOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Year: 2002

Number of Cylinders: 8

Make: Ferrari

Model: 360

Trim: Spider Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Mileage: 13,274

Exterior Color: Red

Number of Doors: 2

Interior Color: Black

|

This 2002 Ferrari 360 Spider Convertible 2-Door 3.6L is in great condition! Call or email for details. (516) 922-5656 |

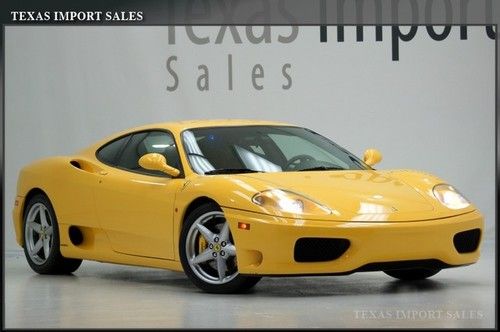

Ferrari 360 for Sale

2001 ferrari 360 spider convertible 2-door 3.6l(US $67,900.00)

2001 ferrari 360 spider convertible 2-door 3.6l(US $67,900.00) Ferrari red leather 360 10k miles low reserve

Ferrari red leather 360 10k miles low reserve Extra clean!! one owner!! clean autocheck!! super low miles!!(US $85,000.00)

Extra clean!! one owner!! clean autocheck!! super low miles!!(US $85,000.00) 2001 ferrari 360 spider f1

2001 ferrari 360 spider f1 2003 modena 360 f1 coupe 13k miles,daytonas,challenge grilles,we finance(US $85,950.00)

2003 modena 360 f1 coupe 13k miles,daytonas,challenge grilles,we finance(US $85,950.00) 2002 360 f1 spider convertible,daytona seats,challenge grille,we finance(US $75,950.00)

2002 360 f1 spider convertible,daytona seats,challenge grille,we finance(US $75,950.00)

Auto Services in New York

Wheeler`s Collision Service ★★★★★

Vogel`s Collision Svc ★★★★★

Village Automotive Center ★★★★★

Vail Automotive Inc ★★★★★

Turbine Tech Torque Converters ★★★★★

Top Line Auto Glass ★★★★★

Auto blog

Ferrari, not Tesla, might be the stock to buy

Mon, May 8 2017Last week Tesla's earnings – or lack thereof – were one of the big stories in the auto industry. As usual, the electric carmaker didn't make money, but the news sent the market, analysts, and Tesla's devoted fans into a lather. But another company, this plucky upstart called Ferrari, also attracted a positive reaction from the market and actually had the financials to back it up. Ferrari posted net revenues of $898 million (at today's exchange rates) EBITDA of $265 million (a slightly complicated way to snapshot financial performance) and an adjusted net profit of $136 million in the first quarter. The company delivered 2,003 cars, and sales of its V12 models increased 50 percent. It quietly made progress nearly a year and a half into its life as an independent automaker. For 2017, Ferrari expects to deliver 8,400 cars and rake in net revenue of $3.6 billion. No one thought Ferrari would flounder when Fiat Chrysler Automobiles spun it off in fall 2015. With a rich history, expensive products, and its own loyal fan base that's arguably even larger than Tesla's, the company seemed poised for success, though skeptics wondered how it might fare after longtime chief Luca di Montezemolo stepped down before the spinoff. Plus, the company remains within the FCA sphere, as its key stakeholders are largely connected to its former parent in some way, and Chairman Sergio Marchionne also steers FCA. Last week's results showed Ferrari is gaining footing in the evolving automotive world, and analysts responded. UBS analyst Michael Binetti reiterated Ferrari stock (RACE on the NYSE) as buy status and raised his target price from $85 to $92. Morgan Stanley's Adam Jonas was even more bullish, raising projections to $100 in the next 12 months. Shares were trading around $82 Monday morning. Both analysts viewed Ferrari as something different than a conventional automaker stock, with Binetti comparing it to luxury house Hermes, which produces high margins even for a specialty goods maker. Jonas suggested Ferrari's singular reputation and history (16 Formula One Constructors titles, the most ever) could insulate its products when autonomous and electric cars become even more commonplace. "In our view, a Ferrari is not transportation," he wrote in a note to clients. "Ownership is viewed as an exclusive club, and membership requires more than just money.

Infographic: Comparing the Veneno, LaFerrari and P1 supercars

Sat, 16 Mar 2013This year's Geneva Motor Show served as the launch platform for three of the world's latest and greatest supercars. The Italians brought us the Lamborghini Veneno and the Ferrari LaFerrari, while the British unveiled the production version of the McLaren P1.

To put the three in better perspective - as if any of us will ever fully comprehend trio of million dollar coupes - the Aussies at Motoring.com built an infographic (click above to enlarge) that outlines what makes each of these cars so spectacular. Using unique colors to represent each of the vehicles, the team put together a variety of charts that focus on vital statistics, pricing, total production run and other parameters all designed to ease the process of digesting an overabundance of exotic goodness. We have uploaded the graphic full size in this link.

Fiat Chrysler begins Magneti Marelli spinoff

Thu, Jul 19 2018MILAN — Fiat Chrysler has kicked off its planned spinoff of parts maker Magneti Marelli, which will be registered in the Netherlands and listed on the Milan stock exchange, a document outlining initial plans and seen by Reuters showed. The spinoff is part of a plan by FCA Chief Executive Sergio Marchionne to "purify" the Italian-American carmaker's portfolio and to unlock value at Magneti Marelli similar to his earlier spinoff of Ferrari. Analysts say Magneti Marelli could be worth between 3.6 billion and 5 billion euros ($4.2 billion to $5.8 billion). It sits within FCA's components unit alongside robotics specialist Comau and castings firm Teksid. FCA has created a separate entity called MM Srl, the document showed, into which it will fold Magneti Marelli's electronics and electro-mechanical operations related to racing motorbikes and racing cars, as well as 14 other holdings in various companies around the world, including Germany, Slovakia, Mexico and South Africa. MM will be incorporated into a Dutch holding company via a cross-border merger, it added. FCA declined to comment. The move follows a similar procedure adopted by FCA for the spinoff and listing of Ferrari as well as of trucks and tractor maker CNH Industrial, both registered in the Netherlands and listed in Milan. The Dutch holding company would allow Marchionne, known for his success in extracting shareholder value through this strategy, to introduce a loyalty share scheme to reward long-term investors through multiple voting rights, as was the case with CNH and Ferrari. That would tighten the grip of FCA's controlling shareholder Exor, the Agnelli family's investment holding company, on the parts maker. Magneti Marelli, which employs around 43,000 people and operates in 19 countries, is a diversified components supplier specialized in lighting, powertrain and electronics. The Magneti Marelli separation is expected to be completed by the end of this year or early 2019, FCA has said. FCA's advisers initially looked at a possible initial public offering for the business to raise cash to cut FCA's debt, but the Agnelli family — FCA's main shareholder — was put off by low industry valuations and did not want its stake in Magneti Marelli to be diluted, three sources close to the matter told Reuters in March. Magneti Marelli has often been touted as a takeover target, and FCA has fielded interest from various rivals and private equity firms over the years.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.034 s, 7967 u