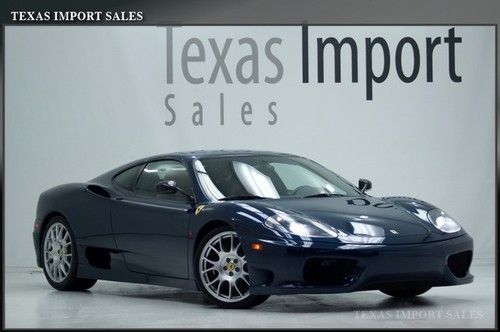

01 Ferrari 360 Spider F1 Convertible 18k Daytona Seats Xenon 18k on 2040-cars

Stafford, Texas, United States

Vehicle Title:Clear

Fuel Type:Gas

Engine:8

For Sale By:Dealer

Transmission:Automatic

Year: 2001

Make: Ferrari

Model: 360

Mileage: 18,897

Disability Equipped: No

Sub Model: Spider F1

Doors: 2

Exterior Color: Silver

Cab Type: Other

Interior Color: Red

Drivetrain: Rear Wheel Drive

Ferrari 360 for Sale

2003 ferrari 360 coupe f1, new clutch, fresh major service, 19k miles, pristine!(US $82,999.00)

2003 ferrari 360 coupe f1, new clutch, fresh major service, 19k miles, pristine!(US $82,999.00) 2004 ferrari 360 spider black/black, 9,959 miles, 6-spd, freshservice! $109,888!(US $109,888.00)

2004 ferrari 360 spider black/black, 9,959 miles, 6-spd, freshservice! $109,888!(US $109,888.00) 04' 360 spider f1 - red/tan - just fully serviced - only 12k miles -modular whls(US $114,995.00)

04' 360 spider f1 - red/tan - just fully serviced - only 12k miles -modular whls(US $114,995.00) 2004 ferrari 360 6spd - carbon racing seats, full service records, crazy clean(US $104,980.00)

2004 ferrari 360 6spd - carbon racing seats, full service records, crazy clean(US $104,980.00) 2005 ferrari 360 f1 spider yellow black daytonas shields only 12000 miles(US $99,900.00)

2005 ferrari 360 f1 spider yellow black daytonas shields only 12000 miles(US $99,900.00) 2004 360 challenge stradale 11k miles,navigation,carbon,we finance(US $135,950.00)

2004 360 challenge stradale 11k miles,navigation,carbon,we finance(US $135,950.00)

Auto Services in Texas

XL Parts ★★★★★

XL Parts ★★★★★

Wyatt`s Towing ★★★★★

vehiclebrakework ★★★★★

V G Motors ★★★★★

Twin City Honda-Nissan ★★★★★

Auto blog

Ferrari wants more hybrids to lift volume to 10,000 cars a year

Tue, Nov 8 2016Ferrari CEO Sergio Marchionne is looking towards hybridization as the way of bumping the Italian automaker's production figures to 10,000 vehicles per year by 2025, reports Automotive News. To do this, Marchionne plans to hybridize every vehicle with a Ferrari badge starting in 2019. As Automotive News points out, Ferrari is dedicated to delivering roughly 8,000 vehicles this year. The automaker has plans in place to raise that figure to 9,000 cars by 2019. Raising its volume numbers to 10,000 vehicles a year, though, would require Ferrari to meet certain fuel economy and emissions requirements, which it currently does not have to do, reports Automotive News. According to Automotive News, in addition to producing more hybrids, Marchionne is also interested in producing Ferraris that appeal to a larger demographic, helping to increase sales. As Automotive News points out, the recent biturbo V8 GTC4Lusso T is an example of this trend, being both more useable and less expensive than its V12 counterpart. Performance will still be a priority. The CEO believes hybrid powertrains are a way to "yield additional performance," reports Automotive News. This isn't the first time Marchionne has spoken about increasing Ferrari's production as the CEO hinted at upping the automaker's output to 10,000 vehicles annually back in 2014. At that time, Marchionne also revealed that Ferrari would come out with a new car every year between 2014 and 2018. More recently, Ferrari announced plans to increase production to approximately 9,000 cars per year by 2019. Related Video:

Petrolicious documents the motorsport-changing Ferrari 512M

Wed, 15 Oct 2014Petrolicious has had plenty of beautiful cars and big-time personalities in its videos, but today's interview is sees one of the series' most well known subjects - US Formula 1 commentator David Hobbs.

Hobbs is an accomplished racer, capturing a number of podiums and a pair of class wins at the 24 Hours of Le Mans, in addition to short stints in F1 and at the Indianapolis 500. One of his Le Mans runs was behind the wheel of this, the Ferrari 512M, a car that's notable for two things - running a 1971 season that included the 24 Hours of Daytona, 24 Hours of Le Mans, 12 Hours of Sebring and Watkins Glen 6 Hour races. The other thing it's known for? Failing to win a single one of those enduros.

Still, the Ferrari 512 is one of the Italian marques most iconic 1970s racers and Hobbs' example is a proud member of that breed, delivering a delicious 5.0-liter V12 exhaust note that makes this an easy video to sit through.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.039 s, 7967 u