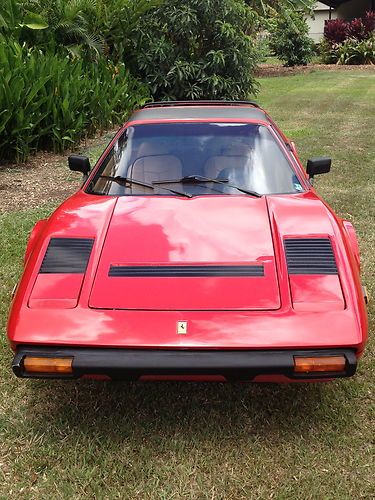

1985 Ferrari 308 Gts Quattrovalve Coupe 2-door 3.0l on 2040-cars

Kailua, Hawaii, United States

Body Type:Coupe

Engine:V8

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Interior Color: Tan

Make: Ferrari

Number of Cylinders: 8

Model: 308

Trim: coupe 2-Door

Drive Type: Manual

Mileage: 67,299

Exterior Color: Red

This is a beautiful 1985 Ferrari 308 GTSI Quattrovalve with 67,3XX miles. It is in great condition with new tires. 1985 is the second year Ferrari made their cars out of galvanized steel, so it has no rust. It has a V8 with 4 valves per cylinder that puts out 235 horsepower. Must sell!

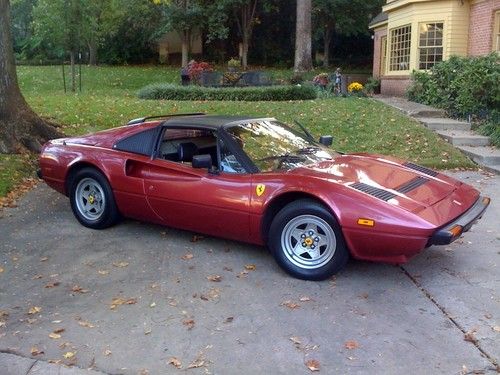

Ferrari 308 for Sale

1984 ferrari 308 gts quattrovalvole coupe 2-door 3.0l

1984 ferrari 308 gts quattrovalvole coupe 2-door 3.0l Pre-production 83 ferrari 308qv(US $26,000.00)

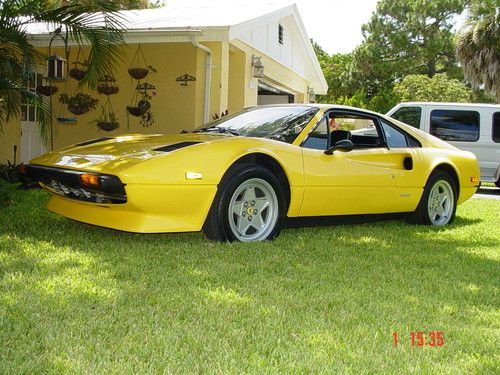

Pre-production 83 ferrari 308qv(US $26,000.00) 1977 - ferrari 308 gtb - 1977 amarelha - 308 gtb - most wanted -

1977 - ferrari 308 gtb - 1977 amarelha - 308 gtb - most wanted - 1980 ferrari 308 gtsi for sale from private collection(US $31,999.00)

1980 ferrari 308 gtsi for sale from private collection(US $31,999.00) 77 ferrari 308 gtb 20k miles 4 webers free usa shipping(US $44,900.00)

77 ferrari 308 gtb 20k miles 4 webers free usa shipping(US $44,900.00) 1985 ferrari 308 gtb quattrovalvole coupe 2-door 3.0l(US $30,000.00)

1985 ferrari 308 gtb quattrovalvole coupe 2-door 3.0l(US $30,000.00)

Auto Services in Hawaii

Streamline Performance - Automotive & Tire Service ★★★★★

S S Auto Repair ★★★★★

Napa Auto Parts - Larry`S Auto Parts ★★★★★

Mobile Mechanic ★★★★★

Maui Glass Tinting Specialists ★★★★★

Japanese Auto Works & Svc ★★★★★

Auto blog

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

$1.3B worth of classic cars were auctioned in 2014

Sat, Dec 27 2014The collector auto market in the US just continues to expand with the values of vehicles seemingly only growing in the past years, especially if they have a prancing horse on the hood. This year was no different. According to data compiled by classic car insurance agency Hagerty, there were about $1.3 billion worth of vintage rides auctioned in North America in 2014, up just slightly from $1.2 billion crossing the block in 2013. If you want an idea of just how big a role the Monterey Car Week plays in the North American collector hobby, Hagerty's stats illustrate it perfectly. The company recorded $430 million in auction sales during the week – about a third of the entire market for the year. The event also hosted the biggest seller of 2014 when the hammer fell on a 1962 Ferrari 250 GTO (pictured above) for $38.115 million at Bonhams. In fact, vintage Ferraris in general were among the top buys in the classic auto world in 2014. Eight of the ten most expensive vehicles sold at auction were Prancing Horses (the other two were Ford GT40s). Also, the insurance company's price index for these Italian stallions showed a 43-percent gain in value for the year. The market for another Italian supercar is exploding, as well. The Lamborghini Countach showed a staggering 175-percent growth in auction value in 2014. According to Hagerty, the average price when they crossed the block was $736,599. Judging by Hagerty's numbers, there were still some places to look for those hoping to spend a bit less money. The Aston Martin Lagonda showed a strong gain in value with a 32-percent increase in auction price, but they still averaged $47,078. In addition, the company's index for '50s American cars showed only one-percent growth for these classics. These huge leaps in collector car value might be winding down, according to Hagerty. It predicts growth in the market to slow to an estimated five percent gain in 2015. Maybe a few of these classics might actually become a bit more affordable to fans without such deep pockets sometime in the future. Featured Gallery Bonhams Maranello Rosso Collection: Monterey 2014 View 21 Photos News Source: HagertyImage Credit: Copyright 2014 Drew Phillips / AOL Aston Martin Ferrari Lamborghini Auctions Car Buying Performance Classics aston martin lagonda ferrari 250 gto Lamborghini Countach collector cars 1962 ferrari 250 gto auto auction

Jeep and Ram could be spun off from FCA, says Marchionne

Thu, Apr 27 2017Jeep is surely the biggest single feather left in the cap of the Fiat Chrysler Automobiles portfolio. Under Sergio Marchionne's leadership, Jeep went from fewer than 500,000 annual sales in 2008 to 1.4 million in 2016, and is on track for 2 million by 2018. Add in the brand's legacy, status as one of the most recognizable nameplates in the world, and rabid fan base, and Jeep has extraordinary monetary value to its parent company. Investors and analysts have certainly noticed Jeep's inherent value. According to The Detroit Free Press, Morgan Stanley's Adam Jonas asked FCA chief Sergio Marchionne if he would ever consider spinning Jeep and Ram, FCA's dedicated truck brand, into a separate corporate entity, and he responded with a simple "Yes." Jonas estimated Jeep's worth in January of this year at $22 billion. Ram was valued at $11.2 billion. Marchionne has a history of spinning off brands while keeping them part of FCA's corporate umbrella. The most noteworthy example of this value maximization was with Ferrari, which now trades on the New York Stock Exchange and rakes in $3.4 billion in annual revenue and close to $435 million in net income, reports the Free Press. Marchionne still serves as chairman and CEO of Ferrari, and Fiat heir John Elkann owns 22 percent of the Italian marque's shares. Even if the offloading of Jeep and Ram into a separate entity would amount to little more than a profit-driven ownership change on paper, it would be huge news to the brands' loyal fanbases. In any case, such a move would likely take years to actually happen and probably wouldn't mean much at all to the products that Jeep and Ram produce. In other words, Jeep fans can keep the pitchforks in the shed ... for now. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.