2008 Dodge Viper Srt-10 Convertible 2-door 8.4l on 2040-cars

Lake Orion, Michigan, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:8.4L 8448CC 515Cu. In. V10 GAS OHV Naturally Aspirated

Fuel Type:GAS

Number of Cylinders: 10

Make: Dodge

Model: Viper

Trim: SRT-10 Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 5,400

Power Options: Air Conditioning, Cruise Control, Power Windows

Sub Model: Hurst 50th Anniversary Viper

Exterior Color: Black with Gold

Number of Doors: 2

Interior Color: Black

Dodge Viper for Sale

2004 dodge viper srt10 black on black 6,185 miles polished alum wheels 500hp(US $46,900.00)

2004 dodge viper srt10 black on black 6,185 miles polished alum wheels 500hp(US $46,900.00) Rt/10 manual convertible alloy wheels cassette player leather seat tachometer

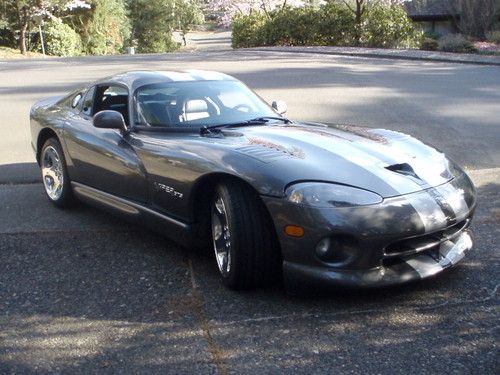

Rt/10 manual convertible alloy wheels cassette player leather seat tachometer 2000 dodge viper gts race car(US $40,000.00)

2000 dodge viper gts race car(US $40,000.00) 2008 dodge viper srt-10! 1ownr! rare viper snakeskin green! only 5k miles!(US $67,900.00)

2008 dodge viper srt-10! 1ownr! rare viper snakeskin green! only 5k miles!(US $67,900.00) 2002 dodge viper r/t-10 convertible 2-door 8.0l(US $34,500.00)

2002 dodge viper r/t-10 convertible 2-door 8.0l(US $34,500.00) 2002 dodge viper gts

2002 dodge viper gts

Auto Services in Michigan

Zaharion Automotive ★★★★★

Woodland-Kawkawlin Trailers ★★★★★

W L Frazier Trucking ★★★★★

Valvoline Instant Oil Change ★★★★★

Urka Auto Center ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

The Dodge Demon is leaked in Fast 8 video with Vin Diesel

Thu, Jan 19 2017It's only week two of the twelve-part Dodge Demon teaser roll out, and it already appears the metaphorical Hellcat is out of the bag. A YouTube video featuring Vin Diesel discussing The Fate of the Furious ( Fast 8) has what are almost certainly two Dodge Challenger Demons parked right in the background. So much for three months worth of build up and mystique. The two cars in the video appear to have the new logo affixed to the fender, right where the current Hellcat logo resides. In addition, the wheels and the massive hood scoop both appear to be the same relative shape as the ones briefly flashed in the latest teaser video. While we can't be 100 percent certain this is really a Demon, all the evidence points to yes. Even if this spoiled Dodge's plans, actually seeing the car here makes us even more excited for the full reveal. We still don't know all the final specs, save that it'll be 200 lbs lighter, so there is still some mystery to be had. The Challenger and Charger Hellcat twins, some of the most brazen and brutish machines currently on the road, were already cranked up to 11. The Demon, with its wide fender flares and comically large hood scoop looks makes the standard car look tame by comparison. We can't wait. Related Video: News Source: YouTube Design/Style Dodge Coupe Performance dodge demon Vin Diesel dodge hellcat dodge challenger hellcat

China-FCA merger could be a win-win for everyone but politicians

Tue, Aug 15 2017NEW YORK — Fiat Chrysler boss Sergio Marchionne has said the car industry needs to come together, cut costs and stop incinerating capital. So far, his words have mostly fallen on deaf ears among competitors in Europe and North America. But it appears Marchionne has finally found a receptive audience — in China. FCA shares soared Monday after trade publication Automotive News reported the $18 billion Italian-American conglomerate controlled by the Agnelli family rebuffed a takeover from an unidentified carmaker from the Chinese mainland. As ugly as the politics of such a combination may appear at first blush, a transaction could stack up industrially, and perhaps even financially. A Sino-U.S.-European merger would create the first truly global auto group. That could push consolidation to the next level elsewhere. Moreover, China is the world's top market for the SUVs that Jeep effectively invented, so it might benefit FCA financially. A combo would certainly help upgrade the domestic manufacturer; Chinese carmakers have gotten better at making cars, but struggle to build global brands, and they need to develop export markets. Though frivolous overseas shopping excursions by Chinese enterprises are being reined in by Beijing, acquisitions that support the modernization and transformation of strategic industries still receive support, and the government considers the automotive industry to be strategic. A purchase of FCA by Guangzhou Automobile, Great Wall or Dongfeng Motors would probably get the same stamp of approval ChemChina was given for its $43 billion takeover of Syngenta. What's standing in the way? Apart from price (Automotive News said FCA's board deemed the offer insufficient) there's the not-insignificant matter of politics. Even as FCA shares soared, President Donald Trump interrupted his vacation to instruct the U.S. Trade Representative to look into whether to investigate China's trade policies on intellectual property. Seeing storied Detroit brands like Jeep, Chrysler, Ram and Dodge handed off to a Chinese company would provoke howls among Trump's economic-nationalist supporters. It might not play well in Italy, either, to see Alfa Romeo and Maserati answering to Wuhan instead of Turin — though Automotive News said they might be spun off separately. Yet, as Morgan Stanley observes, "cars don't ship across oceans easily," and political considerations increasingly demand local manufacture of valuable products.

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.