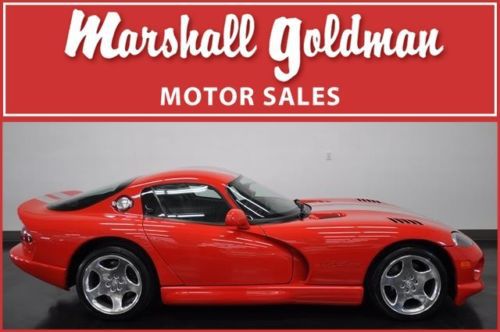

2002 Dodge Viper Gts Coupe In Viper Red 12,900 Miles Chrome Wheels on 2040-cars

Cleveland, Ohio, United States

Dodge Viper for Sale

2006 dodge viper srt-10 coupe 2-door 8.3l(US $76,000.00)

2006 dodge viper srt-10 coupe 2-door 8.3l(US $76,000.00) Final edition #008 of 350 very rare only 63k miles(US $43,999.00)

Final edition #008 of 350 very rare only 63k miles(US $43,999.00) 2000 dodge viper road race car (track car)(US $33,000.00)

2000 dodge viper road race car (track car)(US $33,000.00) Gts new manual coupe 8.4l nav 12 speakers v-10 640hp open mso dodge viper(US $136,990.00)

Gts new manual coupe 8.4l nav 12 speakers v-10 640hp open mso dodge viper(US $136,990.00) 2013 dodge viper srt gts new! loaded dodge dealer laguna interior!(US $105,412.00)

2013 dodge viper srt gts new! loaded dodge dealer laguna interior!(US $105,412.00) 2005 srt10 used 8.3l v10 20v manual rwd convertible premium(US $54,980.00)

2005 srt10 used 8.3l v10 20v manual rwd convertible premium(US $54,980.00)

Auto Services in Ohio

Zerolift ★★★★★

Worthington Towing & Auto Care Inc ★★★★★

Why Pay More Motors ★★★★★

Wayne`s Auto Repair ★★★★★

Walt`s Auto Inc ★★★★★

Voss Collision Centre ★★★★★

Auto blog

Autoblog Podcast #394

Tue, Aug 26 2014Episode #394 of the Autoblog Podcast is here, and this week, Dan Roth, Steven Ewing, and Michael Harley talk about the possibility of a supercharged Dodge Viper, the Chevrolet Silverado Rally Edition, the newly released supercharger kit for the Honda CR-Z, and rumblings of an Alfa Romeo 6C. We start with what's in the garage and finish up with some of your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Check out the rundown below with times for topics, and you can follow along down below with our Q&A. Thanks for listening! Autoblog Podcast #394: The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics: Supercharged Viper Chevrolet Silverado Rally Edition Honda CR-Z Supercharged Alfa Romeo 6C In The Autoblog Garage: 2014 Ford Fiesta SE 2015 Cadillac Escalade 2015 Toyota Tundra TRD Pro 2015 Audi A8 L TDI Hosts: Dan Roth, Steven Ewing, Michael Harley Runtime: 01:32:30 Rundown: Intro and Garage - 00:00 Supercharged Viper - 44:25 Chevrolet Silverado Rally Edition - 55:19 Supercharged Honda CR-Z - 01:00:52 Alfa Romeo 6C - 01:07:29 Q&A - 01:13:41 Get the podcast: [UStream] Listen live on Mondays at 10 PM Eastern at UStream [iTunes] Subscribe to the Autoblog Podcast in iTunes [RSS] Add the Autoblog Podcast feed to your RSS aggregator [MP3] Download the MP3 directly Feedback: Email: Podcast at Autoblog dot com Review the show in iTunes

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN ó Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 ¬ó possibly by the end of June ¬ó and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Fiat Chrysler dumped 40,000 unordered vehicles on dealers

Thu, Nov 14 2019In a move that echoes recent history, Fiat Chrysler has been making more cars and trucks than dealers in the U.S. are willing to accept, with Bloomberg reporting that at one point the automaker had built up a glut of around 40,000 unordered vehicles. Thatís led some dealers to accuse FCA of reviving the dreaded ¬ďsales bank¬Ē accounting practice of obscuring inventory to improve the balance sheet. The company reportedly began building up its inventory of unordered cars this summer despite an industrywide slowdown in sales and an eagerness by some dealers to thin their inventories because rising interest rates are making it more expensive to hold unsold cars. The inventory build-up also coincided with Fiat Chrysler¬ís efforts to find a merger partner, first with Renault, which fell through, then last month¬ís announcement that it will merge with France¬ís PSA Group. FCA denies any such scheme and tells Bloomberg the rising inventory is down to a new predictive analytics system designed to better square supply with demand from dealers that is helping the company save money and narrow the numbers of unsold vehicles. The company recently agreed to pay a $40 million civil penalty to the U.S. Securities and Exchange Commission to settle a complaint that it paid dealers to report fake sales figures over a span of five years. While no one is suggesting that FCA is in dire financial straits ¬ó the company saw higher than expected earnings in the third quarter and record profits in North America ¬ó the practice has strong historical precedent by Chrysler, which built up bloated inventories in the run-up to its two federal bailouts, in 1980 and 2009. It was also common at GM and Ford during the 2000s, when all three Detroit automakers struggled with excess manufacturing capacity and plummeting sales in the lead-up to the Great Recession. Back in 2012, CFO Magazine wrote about a report that explained automakers¬í rationale for the practice and how it works: Say fixed costs for a given factory are $100, and that the factory can make 50 cars. Consumers, however, demand only 10. Under absorption costing, if the company makes all 50 cars, its cost-per-car is $2. If it makes only up to demand, or 10 cars, the cost-per-car is $10. Although each car adds variable costs for steel and other parts, if those costs are low, the company still has an incentive to make more cars to keep the cost-per-car down.