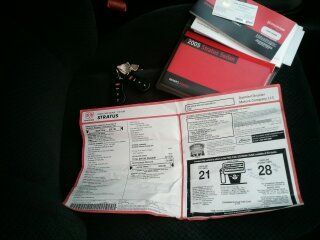

2005 Dodge Stratus Sxt One Owner- State Of Delaware Surplus 20kmiles on 2040-cars

Springfield, Pennsylvania, United States

Body Type:Sedan

Engine:2.7L 2700CC 167Cu. In. V6 GAS DOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:reseller

Interior Color: Black

Make: Dodge

Number of Cylinders: 6

Model: Stratus

Trim: SXT Sedan 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Mileage: 20,500

Sub Model: sxt

Exterior Color: White

Number of Doors: 4

Dodge Stratus for Sale

2005 dodge stratus sdn no reserve auction !!!

2005 dodge stratus sdn no reserve auction !!! 2003 dodge stratus r/t v6 5 speed all custom/race $10,000 (grand rapids mi)(US $10,000.00)

2003 dodge stratus r/t v6 5 speed all custom/race $10,000 (grand rapids mi)(US $10,000.00) 2002 blue se!

2002 blue se! Dodge stratus r/t coupe southern owned local trade leather seats no reserve only

Dodge stratus r/t coupe southern owned local trade leather seats no reserve only 2001 dodge stratus r/t cpe cloth stick

2001 dodge stratus r/t cpe cloth stick 2001 dodge stratus r/t coupe 2-door 3.0l rare v6 rt eclipse almost no reserve

2001 dodge stratus r/t coupe 2-door 3.0l rare v6 rt eclipse almost no reserve

Auto Services in Pennsylvania

Wayne Carl Garage ★★★★★

Union Fuel Co ★★★★★

Tint It Is Incorporated ★★★★★

Terry`s Auto Glass ★★★★★

Terry`s Auto Glass ★★★★★

Syrena International Ltd ★★★★★

Auto blog

FCA's U.S. sales chief sues company for wrongful retaliation

Thu, Jun 6 2019Some fresh controversy is brewing at Fiat Chrysler Automobiles as The Detroit News reports that the head of U.S. sales has filed a federal whistleblower lawsuit against the company.. Reid Bigland, who's also in charge of the Ram truck brand, alleges that FCA made him a scapegoat for wrongful sales inflation practices and fixing vehicle sales statistics, which are currently under investigation by federal agents. Bigland claims that FCA executives punished him for cooperating with the federal investigators in the case by cutting his pay by more than 90 percent, according to the lawsuit he filed. The plan apparently was to use the money saved to pay for fines following any settlements made with the Securities and Exchange Commission. So far, the lawsuit alleges that FCA cost Bigland over $1.8 million in income. "They had the largest growth in retail sales in 17 years last year and refuses to pay him," Deborah Gordon, Bigland's lawyer in the case, said to The Detroit News. "Why is that? Because he participated in the SEC investigation and they don't like what he said." Bigland claims he just cooperated with the SEC investigation by testifying about FCA's sales reporting, from the time he took the position to the period prior to being appointed the company's U.S. sales chief. "In late 2018, presumably as a way to wrap up their investigation with some result, the SEC suggested to plaintiff that he admit to some wrongdoing as to defendants' monthly sales reporting," Gordon further said in a statement as part of the lawsuit. "The SEC also suggested a resolution involving some penalty to FCA. Because (Bigland) had not engaged in any wrongdoing, and there was no wrongdoing, he declined to do so." However, exacerbating the issue is the fact that Bigland reportedly sold his shares in the company last year, prompting FCA to act against him even more. FCA came under fire recently by federal agents in at least two separate investigations, potentially exposing conspiracy and corruption between company executives and private entities. The investigations are being led independently by the U.S. Attorney's Office and the FBI. So far, eight convictions were reportedly secured, with one including former Fiat Chrysler Automobiles Vice President Alphons Iacobelli, as one of the defendants. Iacobelli was one of the former top labor-relations executives for the automaker.

Stellantis mega-merger gets approval from FCA, PSA shareholders

Mon, Jan 4 2021MILAN — Shareholders of Fiat Chrysler and PSA Peugeot decisively voted Monday to merge the U.S.-Italian and French carmakers to create worldÂ’s 4th-largest auto company. Addressing separate meetings, both PSA Peugeot CEO Carlos Tavares and Fiat Chrysler Chairman John Elkann spoke of the “historic” importance of the vote, which combines legacy car companies that helped write the industrial histories of the United States, France and Italy. Before the merger is finalized, shares in the new company, to be called Stellantis, must the launched. It will be traded in Milan, New York and Paris. The marriage of PSA Peugeot and Fiat Chrysler Automobiles is built on the promise of cost-savings in the capital-hungry industry, but what remains to be seen is if it will be able to preserve jobs and heritage brands in a global market still suffering from the pandemic. The deal will create the worldÂ’s fourth-largest carmaker, with the capacity to produce 8.7 million cars a year, behind Volkswagen, Toyota and Renault-Nissan, and create 5 billion euros in annual synergies. “We are fully aware of the fact that together we will be stronger than individually,'' PSA CEO Carlos Tavares told a virtual gathering of eligible shareholders. “The two companies are in good health. These two companies have strong positions in their markets.” The new company will put together under one roof French mass-market carmakers Peugeot and Citroen, top-selling Jeep and Italian luxury and sports brands Maserati and Alfa Romeo - pooling companies that have helped define the industry in the United States, France and Italy. While the tie-up is billed as a merger of equals, the power advantage goes to PSA, with Tavares running Stellantis and holding the tie-breaking vote on the 11-seat board. Tavares is set to take full control of the company early this year, possibly by the end of January. Fiat Chrysler chairman John Elkann, heir to the Fiat-founding Agnelli family and Fiat ChryslerÂ’s biggest shareholder, will be the Stellantis chairman. Fiat Chrysler CEO Mike Manley will head North American operations, which is key to Tavares' long-time goal of getting a U.S. foothold for the French carmaker he has run since 2014, and the clear money-maker for Fiat Chrysler. Such a deal was long wanted by Fiat ChryslerÂ’s long-time CEO Sergio Marchionne, who had predicted the necessity of consolidation in the industry. He was unable to find a deal before his sudden death in July 2018.

Fiat Chrysler and Peugeot boards meet to finalize merger

Tue, Dec 17 2019MILAN/PARIS — The boards of Fiat Chrysler Automobiles and Peugeot will meet separately on Tuesday to discuss finalizing an initial agreement for a $50 billion merger to create the world's number four carmaker, sources said. A source close to FCA said the two companies could announce the signing of a binding memorandum early on Wednesday, followed by a conference call to explain further details later in the day. The two mid-sized carmakers announced plans six weeks ago for a tie-up to help them deal with big challenges in the industry, including a global demand downturn and the need to develop costly cleaner cars to meet looming anti-pollution rules. Ahead of the meetings, entities representing the Peugeot family, Etablissements Peugeot Freres (EPF) and FFP, unanimously approved a proposed memorandum of understanding for the planned merger, a source familiar with the situation said. FCA and PSA have said they would seek to finalize a deal by year-end to create a group with 8.7 million in annual vehicle sales. That would put it fourth globally behind Volkswagen, Toyota and the Renault-Nissan alliance. PSA's Carlos Tavares will be chief executive and FCA's John Elkann — the scion of Italy's Agnelli family, which controls FCA through their holding company Exor — chairman of the combined company. The group will include the Fiat, Jeep, Dodge, Ram, Chrysler, Alfa Romeo, Maserati, Peugeot, DS, Opel and Vauxhall brands, allowing it to serve mass and premium passenger car markets as well as those for trucks and light commercial vehicles. Related Video:    Chrysler Dodge Fiat Jeep RAM Citroen Peugeot