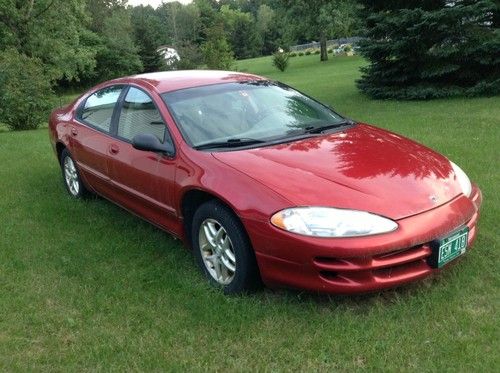

2003 Red Body In Good Condition on 2040-cars

Milton, Vermont, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:2.7L 2700CC 167Cu. In. V6 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Dodge

Model: Intrepid

Trim: SE Sedan 4-Door

Options: CD Player

Drive Type: 2WD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 106,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Red

Interior Color: Gray

Solid car needs timing chain/water pump. Body in great shape. Put the work in motor or buy for parts. Trans in good condition $500.00

jlfstbl@hotmail.com 802-310-8894. John

Dodge Intrepid for Sale

2004 dodge intrepid es sedan 4-door 3.5l less than 74k miles!(US $4,500.00)

2004 dodge intrepid es sedan 4-door 3.5l less than 74k miles!(US $4,500.00) 2001 dodge intrepid se sedan 4-door 2.7l newer engine(US $1,000.00)

2001 dodge intrepid se sedan 4-door 2.7l newer engine(US $1,000.00) 2002 dodge intrepid se sedan 4-door 2.7l(US $2,350.00)

2002 dodge intrepid se sedan 4-door 2.7l(US $2,350.00) 2001 dodge intrepid es sedan 4-door 2.7l - loaded, moonroof, great first car(US $3,300.00)

2001 dodge intrepid es sedan 4-door 2.7l - loaded, moonroof, great first car(US $3,300.00) 2004 dodge intrepid se sedan 4-door 2.7l(US $2,700.00)

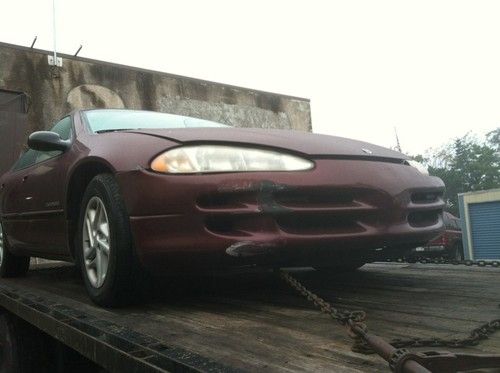

2004 dodge intrepid se sedan 4-door 2.7l(US $2,700.00) 2001 dodge intrepid for engine and parts only - body bent in crash not driveable

2001 dodge intrepid for engine and parts only - body bent in crash not driveable

Auto Services in Vermont

Mark`s Auto ★★★★★

Yipes Auto Accessories and Graphics ★★★★

Tire Warehouse ★★★★

Lyons Gary Garage ★★★★

Houle`s Used Auto & Repairs ★★★★

Paya`s Auto ★

Auto blog

Dodge hoping Fast & Furious appearance gives Dart a sales jolt [w/video]

Tue, 28 May 2013According to Automotive News, Chrysler is hoping Fast & Furious 6 will be kind to the Dodge Dart. While the compact sedan doesn't actually show up in the film, Dodge has partnered up with the movie franchise for a new ad featuring the Dart.

Chrysler hasn't exactly seen the high sales numbers it was originally hoping for with the new sedan, thanks in part to a couple of missteps. For starters, most early-production vehicles were only offered with a manual transmission. Analysts believe Chrysler squandered around 95 percent of potential Dart sales because automatic transmission options weren't immediately available.

Right now, the Dodge Dart rakes 19th among compact cars, pulling down 31,064 sales through April. Last month was the company's strongest, with 8,099 units moving off of dealer lots. Unfortunately, the model has also been handicapped by its older sister, the Avenger. With Chrysler throwing heavy incentives at the aging sedan, many consumers have taken advantage of a better deal with the slightly larger, more powerful Avenger.

Autoblog's guilty pleasure cars

Tue, Mar 10 2015Guilty pleasures are part of life – don't even try to pretend like you don't have one (or two, or six). In the non-automotive space, this could come down to that secret playlist in your iPhone of songs you'll only listen to when you're alone; or think of that one TV show you really do love, but won't admit to your friends. I've got plenty, and so do you. Going back to cars, here's a particularly juicy one for me: several years ago, I had a mad crush on the very last iteration of the Cadillac DTS. Oh yes, the front-wheel-drive, Northstar V8-powered sofa-on-wheels that was the last remaining shred of the elderly-swooning days of Cadillac's past. Every time I had the chance to drive one, I was secretly giddy. Don't hate me, okay? These days, the DTS is gone, but I've still got a mess of other cars that hold a special place in my heart. And in the spirit of camaraderie, I've asked my other Autoblog editors to tell me some of their guilty pleasure cars, as well – Seyth Miersma, as you can see above, has a few choice emotions to share about the Mitsubishi Lancer Evolution. Read on to find out what cars make us secretly happy. Mercedes-Benz SL65 AMG This decadent convertible is the epitome of the guilty pleasure. It's big, powerful, fairly heavy and it's richly appointed inside and out. It's a chocolate eclair with the three-pointed star on the hood. Given my druthers, I'd take the SL65 AMG, which delivers 621 horsepower and 738 pound-feet of torque. That output is borderline absurd for this laid-back convertible. I don't care. You don't need dessert. Sometimes you just crave it. The SL line is about the feel you get on the road. The roof is open. The air, sun and engine sounds all embrace you. It's the same dynamic you could have experienced in a Mercedes a century ago, yet the SL gives you the most modern of luxuries. An Airscarf feature that warms my neck and shoulders through a vent embedded in the seat? Yes, please. Sure, it's an old-guy car. Mr. Burns and Lord Grantham are probably too young and hip for an SL65. I don't care. This is my guilty pleasure. Release the hounds. – Greg Migliore Senior Editor Ford Flex I drove my first Flex in 2009 when my mother let me borrow hers for the summer while I was away at college. The incredibly spacious interior made moving twice that summer a breeze, and the 200-mile trips up north were quite comfortable.

Police officer fired for sexually harassing a young woman

Wed, Aug 24 2016A police officer in Jackson, Mississippi was fired after a video surfaced on Tuesday of him sexually harassing a young woman from his patrol car. According to WAPT, Officer Darryl Stasher of the Jackson Mississippi Police Department rolled up to two young women walking down the street and began talking to them through the driver's side window of his patrol car. During his discourse, his language because coarser and more suggestive. He gave one young woman his number and told her that he was "going to take care of her" and that he wanted to "do more than talk". He also suggested that the two should "get a room" together. The whole exchange was caught on video, and soon after the incident the young woman uploaded the footage to Facebook where it quickly went viral. It didn't take long for the Jackson Police Department to get wind of the video. "The Jackson Police Department does have possession of the video that was posted to Facebook by the young lady," said JPD Commander Tyree Jones. "Chief (Lee) Vance found the video to be very disturbing. He is very disappointed due to the content that's in the video." Upon learning of the video, JPD put Officer Stasher on desk duty pending the results of an internal affairs investigation. Stasher, who worked for at least eight years for JPD in the second precinct, was fired soon after the investigation finished. Related Video: