2011 Dodge Durango Crew on 2040-cars

13500 Veterans Memorial Pky, Wentzville, Missouri, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

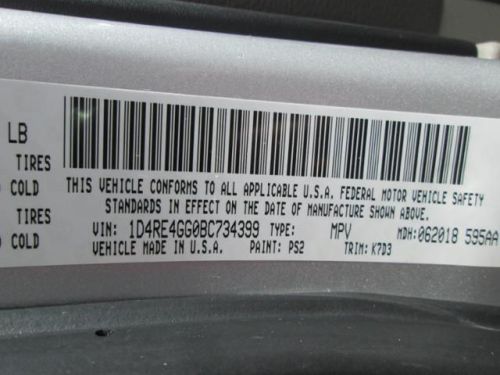

VIN (Vehicle Identification Number): 1D4RE4GG0BC734399

Stock Num: 58330

Make: Dodge

Model: Durango Crew

Year: 2011

Exterior Color: Bright Silver Metallic

Interior Color: Dark Graystone / Medium Graystone

Options: Drive Type: AWD

Number of Doors: 4 Doors

Mileage: 41695

Drop by to see us and you will quickly see how Century's spirit of providing our customers with the highest level of service and product in the automobile industry will make YOU BELIEVE too!

Dodge Durango for Sale

2014 dodge durango limited(US $41,793.00)

2014 dodge durango limited(US $41,793.00) 2014 dodge durango sxt(US $35,997.00)

2014 dodge durango sxt(US $35,997.00) 2014 dodge durango limited(US $42,877.00)

2014 dodge durango limited(US $42,877.00) 2014 dodge durango citadel(US $46,522.00)

2014 dodge durango citadel(US $46,522.00) 2014 dodge durango sxt(US $35,923.00)

2014 dodge durango sxt(US $35,923.00) 2006 dodge durango slt(US $7,995.00)

2006 dodge durango slt(US $7,995.00)

Auto Services in Missouri

Wrench Tech ★★★★★

Valvoline Instant Oil Change ★★★★★

Tint Crafters Central ★★★★★

Riteway Foreign Car Repair ★★★★★

Pevely Plaza Auto Parts Inc ★★★★★

Performance By Joe ★★★★★

Auto blog

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.

Dodge Charger Hellcat makes 1,032 hp with Hennessey help

Fri, Feb 26 2016Sometimes you just want four doors. Earlier this week we brought you Hennessey's riff on the Dodge Challenger Hellcat. Now comes the Charger. Much like its two-door sibling, the Charger gets boosted to as much as 1,032 hp and 987 lb-ft of torque (at the crank) thanks to the addition of a twin-turbocharging setup that works with the factory supercharger. The turbo headers and downpipes are stainless steel, and there is a high-flow air-to-water intercooler and dual-turbo waste gates. Hennessey also beefs up the fuel injectors, fuel pump, and the rest of the fuel system. The engine management system and chassis are recalibrated to accommodate all of this. You also get numbered plaques signed by John Hennessey, the boss of the Texas tuning outfit, and the technician who does your build. Hennessey's additions result in zero-to-60 mph sprints in 2.7 seconds, and the big sedan can run the quarter mile in 9.9 seconds at 142 mph. Like the Challenger, the Charger has the same disclaimer: the lofty horsepower figure comes from an engine dyno, and it will be a 15-to 20-percent lower at the rear wheels. Related Video: Image Credit: Hennessey Performance Dodge Performance Sedan Hennessey dodge charger hellcat

Dodge performance could be electrified, new hybrid transmissions coming

Mon, Jul 8 2019Dodge is arguably the last company around specializing in old-school muscle cars. Outside of a few models like the Chrysler Pacifica Hybrid and the new e-Torque offerings in the Ram 1500 and Jeep Wrangler, FCA as a whole seems behind the ball when it comes to green or electrified powertrains. That might change over the next few years, as Tim Kuniskis, head of passenger cars at FCA, told Automotive News that he sees the future of performance to be electrified. At the reveal of the Dodge Charger Hellcat Widebody a few weeks back, Kuniskis said "the absolute future is electrification of these cars." What form this takes or how soon this all might happen is unclear, but changes are likely coming. Kuniskis said the electrified models could be anything from pure battery-electric vehicles to plug-in hybrids to e-axles. FCA’s e-torque system already works with the companyÂ’s Hemi V8 in the Ram 1500, so, if thereÂ’s room in the engine bay, we imagine it would be pretty easy to adapt the mild-hybrid system for other V8-powered vehicles. One thing to note is that FCA just inked a new deal with ZF. The latter will supply a new 8-speed automatic transmission for longitudinal front-engine cars that will work with both rear and all-wheel drive vehicles. FCA already uses a version of the ZF 8HP automatic, but the big thing to note is that the new transmission has a small electric drive unit built in. If this new transmission is as ubiquitous as the current one, you might find electrified versions of Alfa Romeo and Maserati products as well as those from Dodge, Jeep and Ram. This seems in line with what was announced in last yearÂ’s five-year plan.