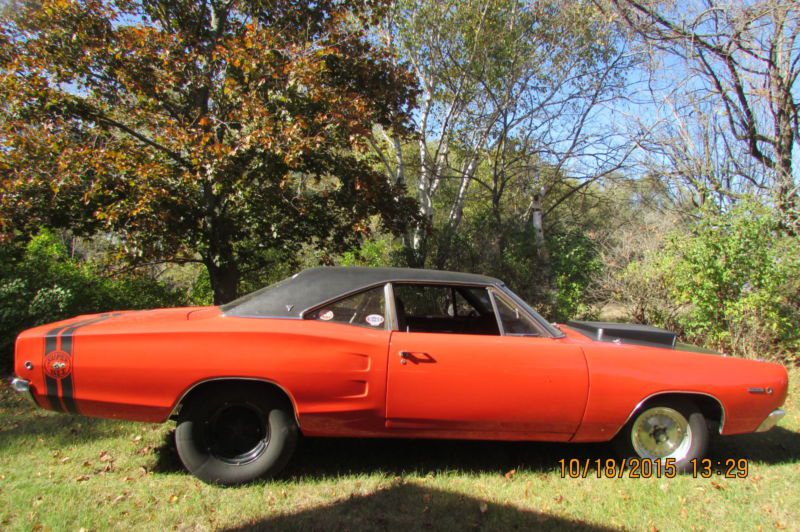

1969 Dodge Coronet Scat Trac on 2040-cars

Gowen, Michigan, United States

Please email me with any questions or requests for additional pics or something specific at: florencefmmogg@oxfordfans.com .

Equipment:

Scat Trac Package

Power Steering

Power Brakes

Original AM Radio

N96 air grabber hood (RT hood on Car, Found correct n96 hood will be installed and rt hood taken off, update will come w correct n96 hood)

Black Dash

Bucket Seats two tone green

Drivetrain:

383 Hi performance spring special motor ( #1 4 barrel carb)

Manual 4 speed

Options/Accessories:

4 speed

Bench seats

Front Disc Brakes

Power steering

Magnum Wheels

Black super bee side stripes (will be installed this week)

rallye dash

two tone paint

2 speed wiper

hood pins tie downs

Clean Frame, under body, floors,body etc. Restored original w no rust issues before restoration.

Has all original floors, quarters, trunk floor etc. Bright work all nice, handles, cranks, exterior bumpers and trim.

New exhaust, new brakes, new gas tank w sender all repainted underside very clean no rust issues.

Engine bay and motor restored and repainted. Transmission/4 speed restored and rebuilt w fresh clutch.

Dodge Coronet for Sale

Dodge: coronet(US $4,000.00)

Dodge: coronet(US $4,000.00) 1968 dodge coronet super bee 2dr post sedan(US $27,500.00)

1968 dodge coronet super bee 2dr post sedan(US $27,500.00) 1968 dodge coronet(US $20,900.00)

1968 dodge coronet(US $20,900.00) 1970 dodge coronet super drag pack(US $24,700.00)

1970 dodge coronet super drag pack(US $24,700.00) 1970 dodge coronet superbee - pure bad ass(US $24,800.00)

1970 dodge coronet superbee - pure bad ass(US $24,800.00) 1969 dodge coronet(US $24,700.00)

1969 dodge coronet(US $24,700.00)

Auto Services in Michigan

Westside Transmission Service ★★★★★

Venom Motorsports Inc ★★★★★

Vanderhoof`s Small Eng Repair ★★★★★

Valvoline Instant Oil Change ★★★★★

U S Auto Supply ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Happy Halloween, cats and kittens!

Tue, Oct 31 2017Happy Halloween, everybody. There's no real Hellcat news in this post. No growl of the second-scariest Dodge Challenger SRT's 707-horsepower engine, no shriek of its supercharger. Just a Hellcat on a photo shoot. A little eye candy on Halloween. In a graveyard. With a black cat. (No cats were doomed to hell in the making of this feature.) But a Hellcat is a good kind of scary, so here are some of our previous galleries. And may a Hellcat cross your path soon. View 18 Photos View 17 Photos View 80 Photos Related Video:

Stellantis expects to hit emissions target without Tesla's help

Tue, May 4 2021Franco-Italian carmaker Stellantis expects to achieve its European carbon dioxide (CO2) emissions targets this year without environmental credits bought from Tesla, its CEO said in an interview published on Tuesday. Stellantis was formed through the merger of France's PSA and Italy's FCA, which spent about 2 billion euros ($2.40 billion) to buy European and U.S. CO2 credits from electric vehicle maker Tesla over the 2019-2021 period. "With the electrical technology that PSA brought to Stellantis, we will autonomously meet carbon dioxide emission regulations as early as this year," Stellantis boss Carlos Tavares said in the interview with French weekly Le Point. "Thus, we will not need to call on European CO2 credits and FCA will no longer have to pool with Tesla or anyone." California-based Tesla earns credits for exceeding emissions and fuel economy standards and sells them to other automakers that fall short. European regulations require all car manufacturers to reduce CO2 emissions for private vehicles to an average of 95 grams per kilometer this year. A Stellantis spokesman said the company is in discussions with Tesla about the financial implications of the decision to stop the pooling agreement. "As a result of the combination of Groupe PSA and FCA, Stellantis will be in a position to achieve CO2 targets in Europe for 2021 without open passenger car pooling arrangements with other automakers," he added. Tesla's sales of environmental credits to rival automakers helped it to announce slightly better than expected first-quarter revenue this week. The next tightening of European regulations will soon be the subject of proposals from the European Commission. The 2030 target could be lowered to less than 43 grams/km. Related Video: Government/Legal Green Alfa Romeo Chrysler Dodge Fiat Jeep Maserati RAM Tesla Citroen Peugeot Emissions Stellantis

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.